BlackRock: Masters of the Universe

Despite what you may have heard, it is about much more than “money.” It always has been.

The recent cultural transformation of corporate America — think Bud Light, Target, and Disney as some of the more recent examples — has shocked traditional Americans to the core. Suddenly, it seems that every major company in the nation has gone “woke,” promoting everything from man-made global-warming alarmism and “transgender” mutilation of children’s genitals to godless globalism and vicious race-mongering. It is all happening under the guise of improving “Environmental, Social, Governance” (ESG) scores and “Diversity, Equity, and Inclusion” (DEI) metrics.

Customers hate it, of course, as many companies facing boycotts and steep financial penalties have learned the hard way. So do shareholders, managers, and employees. Yet, despite being a money loser and despite the endless “Go Woke, Go Broke” chorus chanted by conservatives, more and more companies and brands are jumping on the “woke” bandwagon, apparently oblivious to the catastrophic damage they are doing to their brands. But there is more to the story; a simple explanation to the madness is lurking just beneath the surface.

Behind the scenes, quietly, there is a vast power responsible for pushing all this “woke” corporate fanaticism. It has a name: BlackRock. The world’s largest asset manager, the corporate giant has an estimated $10 trillion under management. For perspective, that is more than the gross domestic product (GDP) of every country on the planet except the United States and Communist China. When the overlord of it all orders lesser mortals running Fortune 500 companies to jump in his annual “letter to CEOs,” business leaders around the world stand at attention and ask, “How high, sir?”

Journalist Matt Taibbi famously referred to Goldman Sachs in a 2010 Rolling Stone article as a “great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.” But as the largest stakeholder in the great vampire squid from hell, BlackRock, while less well known than its diabolical cephalopod minion, is now orders of magnitude more important in both business and politics. It is the Grand Poohbah of all the vampire squids, to borrow Taibbi’s language.

The power of this corporate leviathan is unfathomable. It owns more than five percent of most S&P 500 companies, according to CNBC. And its tentacles extend to every corner of the global economy. In fact, along with State Street and Vanguard, BlackRock is among the largest stakeholders in most of the major companies you can name. It frequently is the largest stakeholder in companies that compete against each other, too.

Base of operations: BlackRock headquarters in Manhattan is the nerve center of the asset manager weaponizing trillions of dollars of Americans’ money to turn corporations “woke” on the path to a New World Order. (AP Images)

In a three-part exposé of the financial monolith, independent journalist James Corbett of the Corbett Report begins with a thought experiment. In his scenario, you start by shopping at Walmart, where BlackRock is one of the top stakeholders. Then you buy some Coke, another company in which BlackRock dominates. Then you get your Moderna shot — again BlackRock is there with about a seven-percent stake. Next you fill up at Exxon, and again, BlackRock is there. Finally, frustrated, you decide to lock yourself in your house and do your shopping on Amazon, and again, BlackRock owns one of the largest stakes.

Once it buys these huge positions, BlackRock makes clear that the firm will go woke. Worst of all, perhaps, this evil imposed on companies is being advanced with your money. Despite the protests of investors, political leaders, and even institutions with massive amounts of money invested with BlackRock, the firm dutifully votes the shares that its clients technically own to promote the “woke” agenda. Indeed, the threat to board members who resist that they will be ousted from their lucrative posts looms large over corporate board meetings everywhere.

BlackRock Chairman and CEO Larry Fink has bragged repeatedly about what he is doing with your money. “Behaviors are going to have to change, and this is one thing that we are asking companies,” Fink declared during a 2017 discussion hosted by The New York Times. “You have to force behaviors, and at BlackRock, we are forcing behaviors.” It is true; BlackRock is, in fact, forcing behaviors on companies, as well as on the people who work in those companies and even consumers.

But the almost $10 trillion it manages for clients like you (via your retirement funds) and your local and state governments is only part of the picture. While State Street and Vanguard are major players in investment management, both of those corporate giants, among many others, now rely on BlackRock’s Artificial Intelligence platform known as Aladdin (Asset, Liability, Debt and Derivative Investment Network). The system now dominates the global economy, with lesser vampire squids everywhere taking their cues from the Dracula of cephalopods.

Cronies ‘R’ Us: Fink & BlackRock’s Political Influence

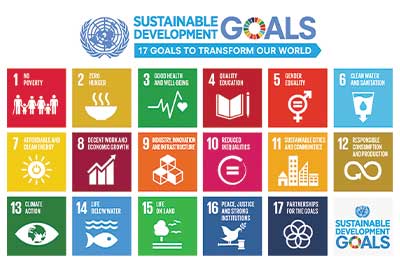

Aside from his company’s unimaginable economic power, the man who created and continues to lead BlackRock, self-proclaimed globalist Fink, is also one of the most powerful global corporatists in the public eye in his own right. Among other roles, he sits on the board of trustees of Klaus Schwab’s World Economic Forum (WEF), the organization bringing together leaders of government and business to advance the “Great Reset.” In addition to being a top champion of ESG, the Switzerland-based WEF is also a “strategic partner” of the United Nations in radically transforming the world through the 17 “Sustainable Development Goals” known as UN Agenda 2030.

Fink also sits on the board of the globalist Council on Foreign Relations, which basically serves as Deep State headquarters in the United States. Then-Secretary of State Hillary Clinton admitted that the CFR tells globalists like her “what we should be doing and how we should think about the future.” Former Vice President Dick Cheney, a Republican, boasted of his longtime association with the group, though he admitted that he never told his constituents in Wyoming. Joe Biden once joked on stage that CFR President Richard Haass was his boss. And U.S. Navy Admiral Chester Ward, who spent 16 years as a CFR member before defecting, said the group and its members were dedicated to the destruction of American sovereignty and the creation of a one-world government.

Big boss: BlackRock CEO Larry Fink, who recently distanced himself from the toxic term ESG, is a leading Deep State globalist helping lead the World Economic Forum and the Council on Foreign Relations. (AP Images)

Aside from the CFR, Fink is also a member of the even more exclusive elitist group known as the Trilateral Commission. The outfit was founded by the late billionaire David Rockefeller, who boasted in his autobiography Memoirs of “conspiring” with a “secret cabal” of “internationalists,” working “against the best interests” of America, to form a global political and economic order. The organization has been dedicated since its inception to advancing what it calls a “New International Economic Order” that is, in essence, warmed-over technocracy, a sort of fascistic and socialistic utopia in which technocrats and engineers run society and your life, supposedly in the name of efficiency and sustainability.

All of these organizations play a crucial role in the global transformation toward planet-wide, liberty-destroying technocratic governance. In other words, Fink sits at the apex of the Deep State. And he is using the unfathomable power of $10 trillion under management to completely reshape every business and the global economy.

It is not just money and secretive organizations, though. In fact, Fink’s ties to government are so pervasive that it’s difficult to tell where the Biden administration ends and BlackRock begins. This has been acknowledged even by establishment voices. Bloomberg, the propaganda megaphone of autocratic billionaire Michael Bloomberg, famously referred to BlackRock as the “fourth branch of government.” And that is no hyperbole.

Fink, a longtime Democrat, told Biden, “I’m here to help” in the 2020 election, according to establishment mouthpiece The Atlantic. And the relationship has only grown since then. BlackRock has also become a major power player in political contributions, handing out huge sums through its employees, its officers, and its own PAC, and setting a new record for spending in the 2022 midterm elections. Moreover, there is a seemingly never-ending list of individuals in the “revolving door” who move effortlessly from BlackRock to senior government posts and vice versa.

For instance, Brian Deese, then global head of sustainable investing at BlackRock, was chosen by Biden to lead his powerful National Economic Council. Before going to BlackRock, Deese served as senior advisor to Barack Obama and Hillary Clinton. Former BlackRock global chief investment strategist and former Obama official Michael Pyle, meanwhile, was selected as chief economic advisor to Kamala Harris. Another top Biden administration pick, Deputy Treasury Secretary Adewale Adeyemo of Nigeria, previously served as chief of staff for Fink.

The revolving door also sees many former government insiders serving in BlackRock. CFR member Thomas Donilon (CFR), chairman of BlackRock Investment Institute, previously served as national security advisor to Obama. His brother, Mike, is known as the “Biden whisperer” and was chief strategist to Biden’s campaign. Former SEC bigwig Dalia Osman Blass now serves as BlackRock chief of external affairs. When it seemed almost certain that Hillary Clinton would become president, Fink named former Clinton Chief of Staff Cheryl Mills to the BlackRock board.

In short, BlackRock operatives are running the very government that, in theory at least, would be in charge of protecting the public from a weaponized, hostile force like BlackRock being used to hijack the government and loot the public. The vampire fox is guarding the henhouse.

Across Europe as well, Fink and BlackRock have been buying up politicians like baseball cards. The list is nearly endless. Analyst William Engdahl pointed out that among those helping BlackRock secure “lucrative contracts” with their former associates was former German Parliamentary bigwig Friederich Merz of then-Chancellor Angela Merkel’s “Christian” Democratic Party, who was widely reported to be Merkel’s possible successor. He was appointed chief of BlackRock Germany. Former British Chancellor of the Exchequer George Osborne, meanwhile, was hired as a “political consultant” for BlackRock.

Fink has also been scooping up leading central bankers, helping BlackRock win huge contracts with some of the most powerful institutions in the world. Former Swiss National Bank President Philipp Hildebrand, for instance, was hired as vice chairman of BlackRock. Former Deputy Governor of the Bank of Canada Jean Boivin was appointed as “global head of research” at the BlackRock Investment Institute. And Stanley Fisher, who served as vice chairman of the Federal Reserve and head of the Bank of Israel, was appointed “senior advisor” to BlackRock. Former Fed senior regulatory official Coryann Stefansson joined BlackRock’s Financial Markets Advisory unit in 2016. This is just the tip of the iceberg.

ESG Mania

To hear Fink and his fellow globalists tell it, sustainability and “sustainable development” are the overarching goals — the ideology underpinning the ongoing transformation of political and economic systems around the world. The UN’s Agenda 21 scheme for sustainable development in the 21st century, long exposed in these pages, is being broken up into more manageable units, too. The current one is known as the UN Agenda 2030 “Sustainable Development Goals” (SDGs).

This Agenda 2030, embraced by every national government on Earth including the Obama administration, includes 17 goals and 169 targets that impact every area of life, from healthcare and education to law and agriculture. Then-UN General Assembly chief Peter Thomson called it the “master plan for humanity,” while then-UN Secretary-General Ban Ki-moon called it the global “declaration of interdependence” approved by the “Parliament of Humanity.”

Lofty goals: BlackRock is key in forcing businesses to align with the draconian UN “Sustainable Development Goals” (SDGs), also known as Agenda 2030 and dubbed the “masterplan for humanity” by UN leaders.

Governments have virtually all jumped on board, with the Chinese Communist Party boasting it played a “crucial role” in developing the global roadmap to technocratic totalitarianism. On the religious front, the Vatican and religious leaders around the world have joined forces to commit their followers to global development based on the SDGs.

On the business side, the World Economic Forum, where Fink serves on the board of trustees, is working with the UN through a “strategic partnership” to bring businesses worldwide into the global system. Fink is leading that charge by imposing ESG standards on companies. (For a much more in-depth treatment of ESG, read William F. Jasper’s cover story in our April 24 issue, “Biden’s ESG Agenda.”)

Touting “stakeholder capitalism,” a concept popularized by Klaus Schwab and the World Economic Forum with roots in fascism and technocracy, Fink made clear that BlackRock would be allocating capital based not merely on profitability, but also on new politicized goals decided by the planet’s would-be overlords. “As stewards of our clients’ capital, we ask businesses to demonstrate how they’re going to deliver on their responsibility to shareholders, including through sound environmental, social, and governance practices and policies,” he explained in last year’s letter to CEOs.

While painting the transition as inevitable and writing as if he were merely a passive observer of these trends, Fink makes clear that companies refusing to get on the sustainable bandwagon will have investment and credit dry up. “Sustainable investments have now reached $4 trillion. Actions and ambitions towards decarbonization have also increased,” Fink wrote in his widely followed annual letter. “This is just the beginning — the tectonic shift towards sustainable investing is still accelerating.”

One of the big goals is “net zero,” which essentially means reducing net human emissions of gases such as carbon dioxide and methane to zero. Aside from the obvious fact that this is impossible short of exterminating the population of the planet (people exhale CO2 and every human and animal activity releases some), the implications of this are extraordinary.

In his letter to CEOs last year, Fink made clear that resistance to the global predatory class’s agenda is futile. “Every company and every industry will be transformed by the transition to a net zero world,” he warned. “The question is, will you lead, or will you be led?”

These are not idle threats. In 2021, when Exxon’s leadership decided to pursue its own path on dealing with alleged man-made “climate change” rather than obey the dictates of corporate-funded enviro-activists, BlackRock weaponized your money to force the energy behemoth to heel. In fact, by voting the shares it manages for its clients, BlackRock’s bosses added three new climate activists to the board of directors.

Perhaps even more alarming, BlackRock’s machinations forced Exxon to slash oil production, conveniently allowing the CCP-controlled PetroChina — one of BlackRock’s big investors — to grab the American energy giant’s oil fields. “Markets don’t like uncertainty, markets like totalitarian governments where you have an understanding of what’s out there,” claimed Fink. “Democracies are very messy, as we know in the United States.”

A major irony of the whole push for ESG and net zero is the 8,000-ton shrieking dragon in the room: Communist China. Fink and companies in which BlackRock holds a dominant stake have been funneling American capital into CCP-controlled entities in massive quantities, including into CCP military “companies” developing AI and other war-fighting technologies that will be decisive in any future conflict between the United States and China.

While Fink and his fellow travelers claim to be ever-so-concerned about “climate,” the “environment,” and “human rights,” they don’t blink when funneling U.S. investment into the hands of the most murderous and environmentally destructive group of gangsters to ever walk the planet. This obvious threat to U.S. national security is completely ignored by Fink’s buddies in the government.

Of course, BlackRock is not alone in this. Its largest competitors have also jumped on board the ESG net-zero bandwagon, joining forces with the UN and other asset managers in a quasi-conspiracy to manipulate the market and destroy all competitors who will not bow down. While questions have been raised by leading law-enforcement officials surrounding possible legal violations involving failure to fulfill fiduciary responsibilities and anti-competitive collusion, so far the conspirators are moving ahead rapidly with very little external interference or even public scrutiny.

If left unchecked, BlackRock and its fellow travelers will ultimately bankrupt all businesses and industries that do not meet the demands of the nightmarish “New World Order,” as the emerging global economic and political system has been described by its architects. Through its ability to manipulate markets and by starving companies and whole sectors of the economy of investment and credit, the prospect is very real. That was likely the goal all along.

Milking Taxpayers

Fink’s rise to prominence has been intimately intertwined with Big Finance and Big Government. According to the Financial Times, Fink was one of the key economic players behind the scenes in the Obama administration. During a battle over the debt ceiling in 2012, Obama Treasury Secretary Timothy “Turbo Tax” Geithner consulted Fink more than anyone else.

“Mr Geithner’s chats with Mr Fink were among at least 49 conversations the two men had over the past 18 months, making Mr Fink the Treasury secretary’s most frequent corporate interlocutor and an emblem of BlackRock’s growing influence in global financial affairs,” the Times reported in a 2012 piece that also mentioned BlackRock’s ties to various European governments.

In addition to governments, Fink and BlackRock enjoy a very cozy relationship with the usurious banking cartel masquerading as a federal agency known as the Federal Reserve, as well as other leading central banks. In fact, BlackRock was a key partner of the Federal Reserve in the 2007-2008 economic crisis. “It helped the Fed value, manage and sell the collection of toxic securities known as Maiden Lane accumulated at the height of the financial crisis through the government’s rescue of AIG,” the Times continued in its 2012 article about BlackRock’s political influence.

Fink and BlackRock actually began under the roof of Blackstone in the late 1980s alongside a number of other co-founders. But within a short time, the firm was doing well and was spun off to become its own independent entity. Through a series of acquisitions and behind-the-scenes Deep State assistance, the company grew throughout the 1990s and 2000s into the multi-trillion-dollar beast it is today.

Especially lucrative was the 2007-2008 financial meltdown that Fink helped engineer, according to critics and analysts. The reason so many pin the blame on Fink was his crucial role in creating the whole mortgage-backed security bonanza that, thanks to Federal Reserve policies, produced the subprime meltdown that ended up taking down multiple major banks. The crisis was an unbelievably prosperous time for BlackRock, as governments and central bankers called upon it to “help.” BlackRock even oversaw the Fed programs dealing with Bear Stearns and AIG assets during the crisis.

Exchange Traded Funds (ETFs) became a major business for BlackRock, as investors handed over their money to the company to manage as part of various ETFs — and to misrepresent those investors by voting their shares in a way that advances the nebulous “ESG” goals determined by the global predator class Fink represents. BlackRock dominates the ETF industry today, controlling almost 40 percent of the market, more than the next two biggest competitors — Vanguard and State Street — combined. Its “iShares” ETFs, originally acquired from Barclays, now contains over $2 trillion in assets.

BlackRock also played a key role in managing the 2020 pandemic “bailout” extravaganza. In fact, in March, the leviathan was enlisted through a variety of no-bid contracts by the Federal Reserve to manage a number of key programs. These included the extremely costly Fed bond-buying scheme and its commercial mortgage-backed security operation, as well as its credit ETF program. Among other schemes, BlackRock plowed huge amounts of Fed fiat currency into its own corporate bonds and stock ETFs.

In short, the Fed was creating currency and stealing your savings while letting BlackRock handle the distribution of that loot to megabanks and other cronies — all while enriching itself and its friends, and all with strings attached, naturally. Talk about a conflict of interest! This is just one of the tools that BlackRock and its allies in government and central banking have weaponized to force ever more aggressive visions of “wokeness” on American businesses and consumers.

One of the most significant transformations of the global economy engineered by BlackRock involved something called “Going Direct.” Masterfully explained by Corbett in his series, this proposal by BlackRock in August of 2019 called for allowing central banks to inject newly created fiat money directly into the economy, not just through bond purchases and interest rate manipulation, by “Going Direct.” The scheme was adopted and implemented not long after being proposed.

In its 2019 paper, BlackRock’s former central bankers sketched out a new vision for a drastically expanded role for central banks in planning the economy and bypassing elected officials traditionally charged with overseeing fiscal policy (taxing and spending). “An unprecedented response is needed when monetary policy is exhausted and fiscal policy alone is not enough,” argued BlackRock. “That response will likely involve ‘going direct’: Going direct means the central bank finding ways to get central bank money directly in the hands of public and private sector spenders.”

Corbett explained the significance of this. “What we were told was a ‘pandemic’ was in fact, on the financial level, just an excuse for an absolutely unprecedented pumping of trillions of dollars from the Fed directly into the economy,” he explained in part two of his series on BlackRock, noting that the firm itself helped oversee and profited from this revolutionary transformation. “It’s sufficient to understand what the central bankers got out of the Going Direct Reset: the ability to take over fiscal policy and to begin engineering the economy of Main Street in a more ... well, direct way.”

Through its “Going Direct” revolution, in partnership with governments and central banks, BlackRock “had truly conquered the planet,” Corbett continued. “It was now dictating central bank interventions and then acting in every conceivable role and in direct violation of conflict-of-interest rules, acting as consultant and advisor, as manager, as buyer, as seller and as investor with both the Fed and the very banks, corporations, pension funds and other entities it was bailing out.”

Ultimately, BlackRock is on pace to become master of the universe, Corbett explained. “The transition of BlackRock from a mere investment firm into a financial, political and technological colossus that has the power to direct the course of human civilization is almost complete,” he concluded.

Aladdin

But wait — there’s more! BlackRock’s proprietary AI system known as Aladdin now oversees tens of trillions of dollars’ worth of investments beyond those managed by BlackRock itself. Nobody knows the true number, because BlackRock decided to stop making it public after the number ballooned to over $21 trillion. Ironically, even the firm’s biggest competitors, Vanguard and State Street, rely on Aladdin, as do many of the Big Tech companies and countless institutional investors whose funds are being weaponized by BlackRock to impose the company’s technocratic vision on the economy.

On its website, BlackRock offers a rosy view of it all. “Everything we do is guided by the conviction that investors need this clarity at every point in the investment process in order to make more informed decisions, scale efficiently and achieve better investment outcomes,” the firm says. “In pursuit of this goal, we are relentlessly innovating and constantly evolving Aladdin technology. More than investment software, Aladdin technology brings clarity and connectivity to the world’s financial ecosystem.” It sounds so innocent — so helpful, even. And yet there is much more to the story.

According to a 2020 piece in the Financial Times, half of the top 10 insurers by assets rely on BlackRock’s Aladdin system. The world’s largest pension fund, the Japanese government’s with some $1.5 trillion, also does. The three largest publicly traded companies in the United States rely on the system to “steward” their hundreds of billions in corporate treasury investments as well. It is becoming increasingly difficult for any firm in the industry to remain competitive without the system, insiders say. In short, this AI-powered beast is rapidly coming to dominate the global investment landscape.

Governments, investors, and banks around the world rely on Aladdin for everything from deciding where to allocate bailout funds to deciding where to invest capital. In fact, by some estimates, almost three out of four trades on the U.S. stock exchange are made by Aladdin or some derivative of its systems. Countless fund managers have been sidelined within BlackRock and beyond as Aladdin advances. Real estate may be the next frontier, as Aladdin-fueled megabanks and managers buy up even single-family homes.

Because the system is proprietary, outsiders have no way of fully grasping or understanding all that goes on “under the hood.” The company portrays it as merely a “risk management” tool, which has been BlackRock’s specialty since the company’s genesis in the late 1980s. But in reality, there is much more going on than just calculating risk on the various investments such as stocks that are held by BlackRock’s clients and customers. The amount of data being gobbled up by the system is simply incomprehensible.

In a way, Aladdin is a microcosm of the future that Fink and his World Economic Forum comrades want for humanity. Decisions on everything — not just asset allocation and stock picks — will be removed from the hands of mere mortals. Instead, those decisions will be made by machines and the complex algorithms that power them. Like BlackRock’s decisions, AI will decide based on not what is best for a particular individual, but what is best for those at the top — those who determine what the algorithms do and how they make decisions.

Today, BlackRock uses its position in the market to force every company — even private ones, since they have to do business with public firms — to adopt “woke” policies to keep their ESG scores up. In the past, humans would have made decisions of where to allocate capital based on profitability and risk. Today, capital is allocated based on how well companies and managers comply with woke dictates such as peddling LGBTQ fanaticism and global-warming alarmism. In the not-too-distant future, similar processes will be put in place for AI-powered systems designed by technocrats to make even more decisions for you — at least if BlackRock and friends are not stopped.

Fighting Back

Even as BlackRock and the forces connected to it continue the long march through America’s corporate institutions, critics are marshalling their forces for war. There was a time when liberals and leftists would have been fighting against the unchecked power of a rogue corporation. (Occupy Wall Street, anyone?) To the extent that corporate-funded leftists are protesting BlackRock at all, it is to express displeasure with the firm for not doing enough to end capitalism and self-government.

But opposition among conservatives is growing, and Republican-led states are working aggressively to rein in BlackRock’s abuses. Just over the last year, GOP-led states have pulled almost $5 billion from BlackRock. In late 2022, Florida announced that it was pulling billions of dollars from BlackRock over its “woke” ESG schemes. “Using Florida’s cash to fund BlackRock’s social-engineering project isn’t something we signed up for,” said Florida CFO Jimmy Patronis. “It’s got nothing to do with maximizing returns and is the opposite of what an asset manager is paid to do. We’re divesting from BlackRock.”

West Virginia State Treasurer Riley Moore actually started a coalition of close to 20 state treasurers dedicated to protecting their constituents from BlackRock. In a series of interviews with The New American, Moore warned that BlackRock and other financial predators were seeking to undermine the industries that his state — and the U.S. economy — depend on. Meanwhile, BlackRock seems to have no problem with those industries in China when they are controlled by ruthless mass-murderers. “Our own money is being weaponized against us,” Moore said before putting BlackRock on the blacklist of companies not allowed to do business with the state.

Numerous state attorneys general involved in a coalition who spoke with this writer said they were investigating BlackRock’s schemes, too. Among other concerns, the top lawmen for their states suggested the company may not be fulfilling its fiduciary obligations. Instead of focusing merely on returns, BlackRock is focused on all sorts of other goals, many of them political. There may be numerous other legal violations such as anti-trust as well, the state AGs said, vowing to hold the firm accountable.

In an August letter to Fink, a coalition of state AGs warned in clear terms that his company’s machinations may be illegal — not to mention immoral. “Our states will not idly stand for our pensioners’ retirements to be sacrificed for BlackRock’s climate agenda,” they said, pointing to several potential legal violations involving the firm’s ESG investing and blasting its adherence to the UN’s “Sustainable Development Goals.”

Awareness is gradually growing, too. Last year, then-Fox News host Tucker Carlson, by far the most popular cable news personality, exposed Fink and BlackRock to his millions of viewers. As the head of the largest asset manager in the world, Fink has “unparalleled control over the U.S. economy and of the companies that comprise it,” Carlson warned his viewers before introducing anti-ESG investment manager Vivek Ramaswamy. “That’s a pretty significant fact given that Larry Fink has a political agenda that’s at least as aggressive as his investment strategies.”

Ramaswamy, who runs his own fund and is now seeking the GOP nomination for president, slammed Fink and his schemes. “He is what I call the king of the woke industrial complex … and what they do is they cause companies to bend the knee to woke orthodoxy,” the investor said, blasting Fink as “the puppet master behind the scenes of corporate America” who weaponizes your money against you. “BlackRock says that we won’t invest in your company unless you abide by these progressive standards, or we’ll dock the pay of a CEO or fire a CEO who refuses to bend the knee to woke orthodoxy.”

The financial guru also brought up George Soros, suggesting Fink was worse and far more dangerous. “Say what you will about George Soros, at least it’s his money,” Ramaswamy continued. “In this case, it is money that belongs to you, to everyday Americans in this country whose blood would boil if they actually knew the way their own money was being used to force a progressive social orthodoxy back onto them.”

Ramaswamy is one of many working to provide alternatives to investors who do not want their money being wasted or worse in pursuit of nebulous “ESG” scams designed to reshape the planet. The Timothy Plan offers multiple funds to help Christian investors put their money to work based on biblical principles, refusing to invest in anti-Christian companies supporting abortion and other evils. There is also an American Conservative Values Fund (ACVF) and even a MAGA fund.

BlackRock, which did not respond to a request for an interview, became the evil giant that it is through its symbiotic relationship with the U.S. government and central banks. As such, reining it in will simply require that Congress and state governments stop bleeding their constituents dry to feed this monster’s unquenchable appetite for money, power, and control. Consumers and investors can help accelerate this by refusing to allow any of their money, including retirement accounts, to be placed under BlackRock’s management. Now is the time, before BlackRock and friends destroy or devour everyone and everything standing in their way.