So says President Trump’s trade advisor Peter Navarro. On Tuesday he told CNBC’s “Squawk Box”: “I’m looking forward to a great 2020. Forecast-wise, I’m seeing closer to 3% real GDP growth than 2%. I’m seeing at least 32,000 on the Dow.”

He added: “It’s going to be the roaring 2020s next year. [Dow] 32,000 is a conservative estimate of where we’ll be at the end of the year.”

Navarro, it will be remembered, told “Squawk Box” the morning after Trump was elected in 2016 that his election would be “a very bullish thing for the markets” and then proceeded to predict 25,000 on the Dow which was then trading at about 18,000.

Navarro, in retrospect, was too conservative. The Dow has gained more than 172 percent since 2010, the fourth-best decade-long performance in the past 100 years. For 2019 the popular averages all notched gains of more than 20 percent (for the record: Dow +22%; S&P 500 +28%; NASDAQ +35%). Even gold, usually considered a “safe haven” during times of economic difficulty, notched a gain of 20 percent.

U.S. citizens are enjoying the ride and predicting that it will continue. A USA Today/Suffolk University poll reported earlier this month that 80 percent of those polled predicted that their lives will be even better in 2020, with just 11 percent disagreeing.

What a turnaround from a year ago! The Federal Reserve had raised interest rates and Trump’s trade war with China was heating up. The stock market dropped in anticipation of a recession when the so-called “yield curve” indicator turned negative.

And then the Fed lowered interest rates in July for the first time in a decade, followed by additional cuts in September and October. This was followed by promises from Chairman Powell that he wouldn’t be intervening in the markets for the foreseeable future.

For the year the Dow gained 5,000 points while gold jumped by $259 from its low in May to close well above $1,500 an ounce to close out the year.

Is Dow 32,000 even possible? That would tack on another 12 percent to 2019’s remarkable gains.

Leave it to the Fed to answer that question. Despite protestations to the contrary the Fed is in fact intervening in the markets, but it is refusing to call it such. It added $500 billion to the money supply to “support” the “repo” market, which was having trouble digesting the enormous flood of new spending by the Treasury. Most of those billions went to help fund “repurchase agreements” between secondary parties handling the tsunami of new debt, with the balance used to purchase Treasury bills outright.

Can gold continue its run? The “wall of worry” that Wall Street has climbed in 2019 remains in place for gold: Will the UK finally end, once and for all, its affiliation with the European Union? Will the Hong Kong protests be resolved peacefully, without China’s Peoples’ Liberation Army clamping down in a replay of the Tiananmen Square massacre? Will there be another drone attack on Saudi oil fields? Will the airstrikes by the United States against Iraq and Syria lead to more intervention by the U.S. military? Will China test Trump’s mettle in the South China Sea?

The U.S. dollar has steadily weakened since early October, falling more than 2.6 percent in response to the flood of new currency entering the bond markets. Bond yields, as measured by the 10-year bond, have dropped from near three percent a year ago to less than two percent currently in response. Experts think those yields could fall further especially as global central banks try to stimulate economic growth abroad.

Fawad Razaqzada, a technical analyst at London’s City Index, thinks the stock market is long overdue for a correction: “If U.S. stocks were to correct themselves in 2020, then this surely could lead to elevated levels of safe-haven demand for gold. As the U.S. equity market bubble finally bursts, safe-haven demand could nudge gold past its 2011 peak of $1,920 [per ounce], before tagging the $2,000 hurdle.”

Lukman Otunuga, senior research analyst at FXTM trading, says that escalating tensions in the Middle East could provide the catalyst for that stock market selloff in 2020: “If geopolitical tensions increase in the Middle East, there will be more reasons for investors to increase their allocation in gold. Otherwise the gold rally makes little sense while equities are making record highs.”

The only thing certain for 2020 is the high degree of uncertainty. However, Warren Buffett provides investors with this reassurance: “It’s never paid to bet against America. We come through things, but it’s not always a smooth ride.”

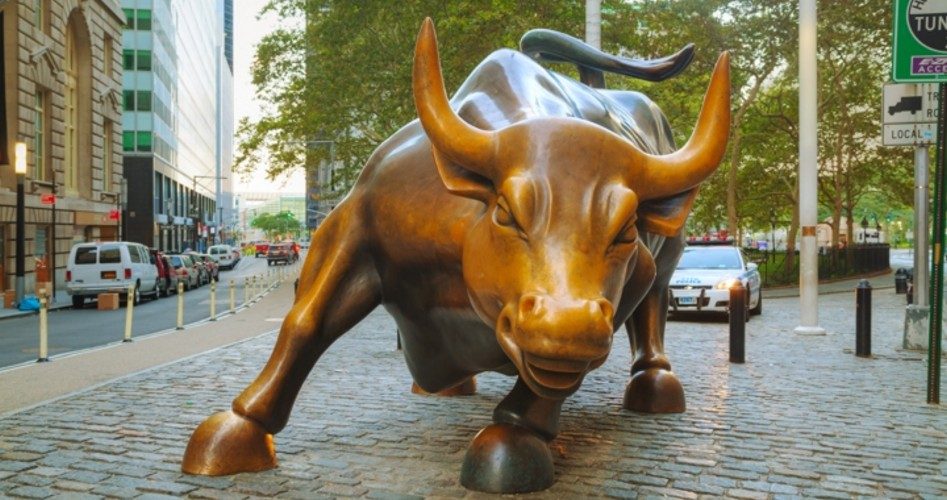

Photo: AndreyKrav/iStock Editorial/Getty Images Plus

An Ivy League graduate and former investment advisor, Bob is a regular contributor to The New American primarily on economics and politics. He can be reached at [email protected].

Related articles:

One Trillion Dollars Repatriated So Far, Reports Commerce Department

Shoppers Set Holiday Records This Year, Exceeding Expectations

Strong U.S. Economy Improving Trump’s Chances for Reelection