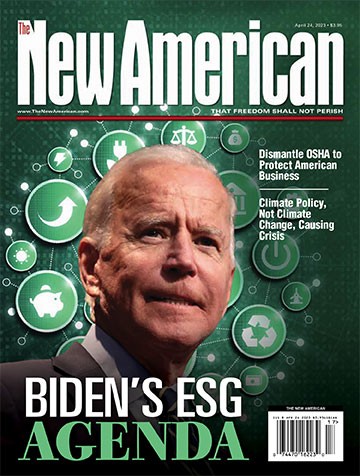

The High-stakes Fight Against ESG

Investing for motives other than pure profit has long been a hobby of idealists with money to spare. “Socially responsible investing,” or SRI, has been around for decades; it’s where you (or your mutual fund) invest only in companies not producing products that, for some, are morally objectionable, such as tobacco, gambling, and weapons. Investing of this type is harmless enough when undertaken privately as a result of private convictions.

But now there’s a newer, more coercive form of moralistic investing, so-called ESG (which stands for environmental, social, and corporate governance), which is being urged upon us by activist government at every level. This is achieved by passing regulations and standards requiring that corporations included in retirement-plan portfolios follow “woke” government standards on matters such as climate change, sustainable development, and a range of social-justice conceits, from LGBTQ rights and abortion on demand to gun control.

The Biden Labor Department’s directive “Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights” and Biden’s “Executive Order on Climate-related Financial Risk” are but two examples of federal attempts to impose ESG standards on retirement and pension funds. The latter was a flagrant reversal of a Trump-era prohibition on ESG rules.

JBS Member or ShopJBS.org Customer?

Sign in with your ShopJBS.org account username and password or use that login to subscribe.

Subscribe Now

Subscribe Now

- 24 Issues Per Year

- Digital Edition Access

- Exclusive Subscriber Content

- Audio provided for all articles

- Unlimited access to past issues

- Cancel anytime.

- Renews automatically

Subscribe Now

Subscribe Now

- 24 Issues Per Year

- Print edition delivery (USA)

*Available Outside USA - Digital Edition Access

- Exclusive Subscriber Content

- Audio provided for all articles

- Unlimited access to past issues

- Cancel anytime.

- Renews automatically