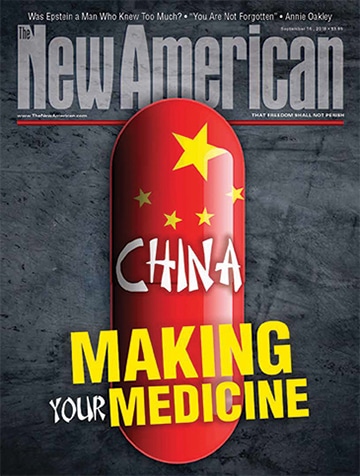

China: Making Your Medicine

If China stopped exporting prescription drugs and their ingredients to the United States, pharmacy shelves across the country would empty within months. “That’s how dependent we are on China,” Rosemary Gibson told The New American. “It’s a national security threat that few people even know about.”

Gibson is a senior advisor at the Hastings Center and coauthor of China Rx: Exposing the Risks of America’s Dependence on China for Medicine, a whistleblower analysis of the dire situation Western countries have brought about by allowing China to dump cheap prescriptions on them, driving domestic producers out of business. “The truth is that America’s dependence on a single country for the active ingredients, raw materials, and chemical building blocks for so many essential medicines is a risk of epic proportions.”

That’s no exaggeration. The communist behemoth is well on its way to controlling the global generic drug market. In June the International Business Times reported that, though India still leads in generics, experts note that country receives some 80 percent of its raw ingredients from China. This means the key components in 90 percent of the prescription and over-the-counter meds Americans take are sourced from a country that our Department of Defense considers a major adversary.

“Think about how China devastated our steel industry, dumping its product here at below-market price and destroying our manufacturing base,” Gibson points out. “They want to do the same thing with medicine. They’ve already done it with penicillin.”

Penicillin is the go-to antibiotic for dozens of bacterial infections such as strep throat and children’s colds. It has been 15 years since the last U.S. penicillin plant closed its doors, in the midst of a massive Chinese campaign that dumped the antibiotic on the global market at extremely low prices. The industry trade association European Fine Chemicals Group dubbed the subsequent loss of business a “landslide.” By 2007, China dwarfed all remaining competitors and slapped a significant price increase on this common but crucial medicine.

Other antibiotics stand in the cross hairs: bio-warfare safeguard ciprofloxacin, anthrax antidote doxycycline, and vancomycin, a last-resort antibiotic for drug-resistant infections. The anthrax attacks on Capitol Hill in 2001 offer a chilling example. Unable to supply our own needs, “The U.S. government turned to a European company to buy 20 million doses of the recommended treatment for anthrax exposure, doxycycline,” explains Gibson. “That company had to buy the chemical starting material from China. What if China were the anthrax attacker?”

But this is only the tip of the iceberg. Common high blood pressure medications such as losartan; chemotherapy drugs for children and adults; birth control pills; antidepressants and psychotherapeutics; anti-seizure meds for epilepsy; and drugs to treat Alzheimer’s Disease, diabetes, HIV/AIDS, and Parkinson’s, as well as medical implants and devices — all of these make the “made in China” list, as do over-the-counter pain killers and vitamins. Chances are many of the pills you and your loved ones take each day contain ingredients from China.

Even the vitamin C that supplements your breakfast cereal is probably Chinese. Along with penicillin, we ceded ascorbic acid (the active ingredient in vitamin C) to China in the early 2000s. The last U.S. production facility shuttered a short time after Congress passed the U.S.-China Trade Relations Act of 2000 — a measure that then-President Bill Clinton promised would secure American jobs and safeguard against surges of Chinese imports. Instead, China’s predatory pricing crushed U.S. producers and wiped out jobs. After they obtained dominance, Chinese firms raised the price of ascorbic acid by as much as 600 percent. The ensuing anti-trust lawsuit brought by U.S. businesses against the offenders revealed that the Chinese government “required its domestic companies to fix prices and control exports of vitamin C,” relates Gibson. Aspirin’s active ingredient, acetylsalicylic acid, suffered an identical fate from a Chinese cartel.

Think You’re Immune?

Do you want to find out the source of your meds? You likely won’t read it on labels or product literature. The U.S. Food and Drug Administration (FDA) only requires drug makers to list the name and place of manufacture or distribution, not country of origin. A company here may take powders and pound them into pills, but the powders themselves could all come from China. Call the manufacturer, and you may be told either that the source information is proprietary or that the company has worldwide sources, subject to change over time. Results of online searches are iffy, though Gibson lists sites such as DailyMed and Drugs.com as good leads.

Why is Big Pharma so tight-lipped about its sources? Pharmaceutical companies do not want to undermine their integrity by admitting they buy from China. For many American consumers, “made in China” means shoddy workmanship and poor quality. When it comes to medicines, imperfect ingredients can have severe, even life-threatening, effects.

Take the case of contaminated heparin in 2007 and 2008, when 246 Americans, including some children, died, and hundreds more were seriously injured after receiving the common blood thinner, used daily in U.S. hospitals and dialysis centers. As the body count rose, the FDA investigated to discover the culprit: a toxic contaminant deliberately placed during the manufacturing process in China. It was used because a fierce virus called blue-ear disease had decimated China’s pig population in 2006. (Heparin is made from pig intestines.) The price of pigs skyrocketed, and oversulfated chondroitin sulfate, substituted for as much as 60 percent of the safe ingredient, was deemed acceptable because it mimicked the real product — and saved lots of money. When U.S. officials complained, China denied responsibility, blaming its U.S. customer. But that doesn’t explain the deaths and adverse reactions reported in 10 other countries that also imported the contaminated heparin.

Gibson tells the story of one survivor, an Arizona physician who went into the hospital for a simple endoscopy procedure and, after receiving the contaminated heparin, ended up requiring heart and kidney transplants. He will spend the rest of his life on immunosuppressive drugs that prevent his immune system from attacking the transplanted organs — a high price to pay for cheap medicine.

Rocket Fuel Contaminants

Just 10 years ago, the United States surpassed other nations by importing “the most pharmaceuticals and medicines by weight from China: 188 million pounds in 2009,” according to the Pew Prescription Project. Only 10 percent “of the active pharmaceutical ingredient [API] factories listed in generic drug applications [were] in the United States,” while 40 percent were in India. (APIs are the key ingredients in medicines.) At the same time, the FDA inspected domestic drug manufacturing plants every two to three years, while foreign sites averaged FDA visits every nine years.

Fast forward to the present day, when experts estimate that 80 percent of APIs worldwide come from China, and despite scant inspections, the FDA is powerless in oversight of their manufacture. A decade-long investigation of Chinese drug manufacturing facilities by journalist Katherine Eban, which resulted in her 2018 New York Times best-seller Bottle of Lies, exposed the bizarre situation. She testified at a July 31 hearing of the congressionally mandated U.S.-China Economic and Security Review Commission (USCC) that it is the FDA’s practice to announce overseas inspections in advance instead of making surprise visits as it does to domestic facilities. This gives foreign manufacturers six to eight weeks’ notice, allowing them to “stage manage” their inspections. “The companies are making travel arrangements for the FDA, they’re taking FDA investigators out to dinner,” she said, noting that often there is only one inspector with a short amount of time, relying on a translator provided by the company in question. Her book documents cases of several Chinese manufacturers pooling their resources to set up “show factories” with textbook-perfect conditions. “Because the FDA investigators can’t even read the street signs, they’re each inspecting the same facility,” thinking they are at different companies.

She concludes that there is rampant fraud and regulatory infraction. As an indicator, Eban recounted a pilot program of unannounced foreign inspections that the FDA conducted in India five years ago. During that time “the rate of ‘official action indicated’ findings — which is the most severe finding — increased by almost 60 percent.” However, for no stated reason the agency dropped its pilot program in 2015 and fell back to announcing inspections in India. It never expanded the pilot program to other countries. Now, Gibson says, the FDA is so hamstrung that it must “make tradeoffs between defective medicines and shortages.”

That is exactly what is currently happening with valsartan, the active ingredient in many common high blood pressure medications. In mid-2018 various major pharmaceutical companies suddenly began recalling their valsartan-containing products; the API was sourced from China and contaminated with a cancer-causing impurity. By October, the FDA had identified a second carcinogen, sparking another rash of recalls. In late February of this year, researchers discovered a third carcinogenic toxin. However, because of shortages brought about by the massive recalls, the FDA announced it would allow the tainted meds to remain on the market as long as the toxins’ concentrations were below specified limits. The rationale: Uncontrolled high blood pressure poses greater risks to patients than the cancer-causing agents.

Dr. Larry Wortzel, senior fellow at the American Foreign Policy Council who serves on the USCC, gave his first-hand experience with valsartan recalls during the commission’s July hearing:

I’m a military retiree.... In the past three months I have had four blood pressure medications recalled. When I tracked down the sourcing, they all came out of India but originally sourced in China, from four different U.S. [providers]. In [three of the four cases] that particular medication was contaminated with rocket fuel.... I imagine active duty people have the same problem, and that affects the readiness of our force.

The “rocket fuel” contaminant is actually a substance known as NDMA, which, according to the FDA, is no longer used to make rocket fuel because of its carcinogenic potential. NDMA and the other valsartan contaminants are byproducts of the faulty manufacturing process that Zhejiang Huahai Pharmaceutical Co., the manufacturer responsible for the debacle, has had in place since 2011.

Worse yet, Bloomberg published an investigative report in May revealing that the FDA definitely knew in 2017 about data manipulation of valsartan quality-test results conducted by Zhejiang Huahai. The agency ignored its own inspector’s recommendation to penalize the company, trusting Zhejiang Huahai to follow through on its proposed corrective actions, even though the inspector noted the company’s track record of giving “passing scores for drugs that originally fell short of U.S. standards on routine quality tests.”

Despite the red flag, it was European regulators, not the FDA, who first detected carcinogenic contaminants in generic valsartan a year later. Eban wasn’t surprised; she explained that unlike U.S. regulators, European authorities conduct routine surveillance testing of imported medicines. In fact, FDA spokesman Sarah Peddicord told Bloomberg, the agency expects pharmaceutical companies to police themselves, saying it is the “manufacturer’s responsibility” to conduct “appropriate tests that are capable of detecting impurities.” The FDA relies on results of those tests in approving drugs.

How’s that working out? “I found that there is extensive fraud in CROs,” Eban said, referring to contract research organizations, which are companies that provide quality testing services for pharmaceutical manufacturers. “It is the drug companies themselves that are paying the CROs, and it is a very frequent thing to have a ‘back channel’ agreement to make the data work out okay.” That seems to be the case with valsartan; the FDA’s follow-up investigation discovered that Zhejiang Huahai had once again lied about test results.

Disturbingly, valsartan is only one example of a nefarious problem that has been growing since the U.S.-China Trade Relations Act became law in 2000. Gibson notes that in 2015, the FDA banned 29 active pharmaceutical ingredients from China owing to bacterial contamination and systemic data manipulation. Ensuing shortages of vital medicines, including several chemotherapy drugs, forced the agency to exempt 14 of the products from its import ban.

The High Price of Cheap Meds

U.S. pharmaceutical giants realize that our domestic generic drug industry is collapsing as they purchase based exclusively on price at the expense of quality and reliability. Gibson quotes the newsletter FiercePharma from a 2012 article, “Dangers Aside, Drugmakers Can’t Live Without Chinese Active Ingredients”:

When it comes to Chinese-made active pharmaceutical ingredients, Western drugmakers are between a rock and a hard place.... They know Chinese oversight of ingredient manufacturing is insufficient to snuff out substandard producers, but that has not deterred companies from buying anyway.

It’s telling that the industry successfully lobbied for tariff exemptions on medicinal products made in China. The argument was that tariffs would increase drug prices, but is that because we have too few reliable alternatives? You can’t shop around in a monopoly market.

Maintaining high profit margins in this way will backfire, says Gibson, who points out that if we allow China to undercut domestic producers by dumping cheap products here, price increases are inevitable. “Once China completes its pharmaceutical chokehold on the United States, it will be devastating. They’ll be able to dictate prices,” she predicts, just as they scalped us with penicillin and vitamin C after wiping out those global markets. Gibson foresees repeat performances as China employs the same playbook with other generics.

We have every reason to expect it as tensions run high in the current trade war. Beijing countered U.S. tariffs of $200 billion in May with $60 billion in retaliatory measures. U.S. agricultural exports to China have nose-dived in the past months. Chinese officials also recently announced plans to restrict exports of essential rare earth minerals to the United States, which relies on China for 80 percent of its strategic mineral demand, according to the U.S. Geological Survey. These raw materials are crucial to many industries, including electronics, manufacturing, medicine, and munitions.

What if China decided to do the same with prescription ingredients? What’s preventing them from exploiting medical products in the tug-of-war? How did it get to the point that we have so little recourse?

“We consider our medicine as a cheap commodity, to be purchased at the cheapest possible price. That has got to change,” Gibson warns. “We have to remember that when you control the supply of medicines, you control price, you control quality, you control the world.” She estimates that the United States is on track to lose virtually all of its generic drug manufacturing capacity within the next five to 10 years. Yet while we surrender control of our national health security for the sake of cheaper prices, Gibson points out, we have no system in place to monitor risk. “It’s no one’s job in the federal government to know who controls the supply of our medicine. We wouldn’t do that for oil; we wouldn’t do that for food.”

National Security

Nor should we allow it when national security is at stake. Our military has strict rules about procurement of everything from weapons and ammunition to nuclear submarines and aircraft carriers; on grounds of national security, outsourcing manufacturing of these instruments of war is not an option. The same policy applies to medicines and medical supplies under the Buy American and Trade Agreement Acts, which require the Department of Defense (DoD) and Veterans Administration to negotiate with approved vendors based on price, not country of origin. For medicinal products, moreover, DoD is entirely dependent on the consumer market, inundated with ingredients from China.

The Defense Department’s “compliance with these acts drives up DoD pharmaceutical costs while having little or no effect on … the commercial sector, which is bending toward foreign production sources,” testified Christopher Priest of the DoD’s Defense Health Agency at the July USCC hearing. “The national security risks of increased Chinese dominance of the global API market cannot be overstated — pharmaceuticals that are crucial to DoD’s ability to promote the health of its warfighters and protect them from nuclear, biological and chemical threats.”

Even in peacetime, Priest warns:

Should China decide to limit or restrict delivery of APIs to the U.S. it would have a debilitating effect on U.S. domestic production and could result in severe shortages of pharmaceuticals for both domestic and military uses. Our concern is the ability of the domestic manufacturing capability to adjust to that risk, alternate sources, if any, and how long those solutions would take to produce results.

Priest told the commission that the Defense Department is only now in the process of determining its vulnerability. He said the “murkiness of the data add[s] to the risks,” but pointed out the valsartan recalls as a telling indicator: The military is exposed to the same dangers as the general public.

Doxycycline and ciprofloxacin, two bio-warfare antidotes crucial to our armed forces, are no longer produced domestically, he complained. In fact, there are around 150 lines of pharmaceuticals that the Defense Department can’t get without special exceptions to compliance with the Trade Agreements Acts. When asked about vulnerabilities of military-specific items, Priest brought up the joint trauma system and noted, “A lot of this conversation focuses on the pharmaceutical side. There are a host of implications when you start looking at medical devices, laboratory services,” and other biotechnologies in which China is now a global leader. The range of products is immense, from relatively simple (e.g., bandages and diagnostic tests) to life-enhancing (e.g., prosthetics and wheelchairs) to life-preserving (e.g., pacemakers and cardiovascular stents).

“I cannot overstate Chinese medtech companies’ desire to overtake the Western medical device business,” writes international industry consultant Ames Gross in MedTech Intelligence in 2016, warning his readers to “be very careful” and practice “extreme due diligence” when it comes to China’s standards. He said Western companies are now buying lower price, lower quality products from China and conducting clinical trials here at home to add them to “their sales teams’ bag of tricks.” Considering the rampant contract research organization fraud of which Eban warns, even if we are comfortable with trusting our personal health to these companies’ testing methods, do we really want to subject our military combat readiness and force protection to it?

Weaponizing Pharmaceuticals

Equally devastating is the prospect of China using meds as weapons of war. Beijing is synonymous with human rights violations, espionage, and cyber hacking. Would China scruple to withhold vital antibiotics, sell placebos in place of real medicine, or even lace drugs with lethal contaminants in wartime? “I have no doubt that they would consider weaponizing their dominance of the pharmaceuticals market if they felt that that would give them an advantage over us strategically,” retired Brigadier General John Adams told Fox News.

None of this is happening by accident. China has stated designs to corner the bio-pharmaceutical market globally in less than 10 years. In 2015, Chinese government officials published “Made in China 2025,” their ambitious national plan to dominate 10 high-tech manufacturing sectors — including biotechnology and medicine. At that time, China’s pharmaceutical market ranked second-largest worldwide after the United States, according to global management consulting firm McKinsey & Company. Part of the strategy involves sweeping regulatory changes to catalyze China’s pharma industry by encouraging innovative drug development. “We have seen rapid growth of new drugs in the pipeline,” bragged Frank Jiang, CEO of CStone Pharmaceuticals, who told McKinsey that applications for medicines entering clinical trials grew from 21 in 2011 to 88 in 2016.

However, plans were under way long before 2015, thanks in large part to Capitol Hill’s Beijing lobby. “China’s pharmaceutical industry has been growing at a breakneck pace for decades, especially since the normalization of U.S.-China trade relations in 2000,” said author and investigative journalist Ben Westoff in USCC hearing testimony. From 2008 to 2015 China increased investment in pharma research and development by 254 percent, compared with 7.3-percent growth in the United States during the same time period. In only four years, from 2010 until 2014, China more than doubled its biopharmaceutical production capacity, including active pharmaceutical ingredients. Data from the Information Technology and Innovative Foundation (ITIF) also shows that between 2009 and 2013, the Chinese government quadrupled funding of medical research. Most of the world’s top 20 pharmaceutical giants maintain manufacturing and/or medical research facilities in China.

They haven’t necessarily come by all this growth honestly; China has a track record of devious behavior. “In other industries, such as solar panels, high-speed rail and robotics, China caught up to leaders by copying their technology — often through theft or forced technology transfer — and then using a variety of means, including predatory pricing supported by government subsidies, to weaken foreign competitors,” ITIF relates.

China also has a penchant for state-backed purchases of foreign companies. Take the 2013 buyout of the world’s largest pork producer, Smithfield Foods of Virginia, by China’s largest meat-processor, Shuanghui International, a company both controlled and funded by the Communist Party. The sale caused distress as the largest Chinese acquisition of an American firm, and more importantly, because “Smithfield was the source of the raw material to make 25 percent of the heparin used in the United States,” says Gibson. African swine flu is currently devastating China’s pig population, an ominous reminder of the deadly 2007-2008 heparin contamination, and could easily mean U.S. shortages of the crucial drug. Regardless, “now that Smithfield is a wholly owned subsidiary of a Chinese company, Congress has no leverage to question where a product from America’s heartland ends up,” notes Gibson. Moreover, in regard to food safety, Shuanghui “could use provisions in a bilateral investment treaty to challenge new food safety standards Congress might enact that would increase the company’s costs,” a juridical game plan China has effectively used in other industries to circumvent U.S. law.

Make America Safe Again

China is on target to achieve its biopharma dominance goals, and if it does, it could obliterate us without launching a single warhead or hacking the electrical grid. American consumers and taxpayers are funding that growth for the sake of cheap, second-rate medicines, while the adversary drains our domestic industry dry.

It’s time to turn off the spigot. Congress must reclaim the leverage it wielded prior to 2000 when it voted annually on China’s trade status. The U.S.-China Trade Relations Act is a proven failure, having ushered in staggering trade deficits and a manufacturing exodus unheard of in our nation’s history. We must bring our industry home. In the meantime and toward that end, Congress should act quickly to preserve the American biopharma industry with protective tariffs, essential for national security and health.

Congress must favor domestic manufacturers over foreign competitors, offering corporate tax incentives and regulatory relief. It must encourage companies such as online pharmacy Valisure, based in Connecticut, which tests every batch of medication it sells, says Gibson. (Ten percent of the batches fail for issues such as dosage inaccuracies and toxic contamination.) Fostering companies such as Valisure would eliminate calls for federal regulatory expansion into drug testing while providing a better safeguard for patients than the inefficiencies and ineffectiveness typical of federal bureaucracy.

Our courts must prosecute predatory pricing and cartels, instead of rewarding them, as did the U.S. federal appeals court in 2016 when it cleared Chinese companies of antitrust charges and paved the way for copycats of the destructive vitamin-C cartel. Moreover, if foreign manufacturers want access to our market, they must be held to the same regulatory standards that shackle domestic companies, and should likewise be subject to unannounced inspections. No foreign government or industry can be trusted to police itself.

Instead of buying meds from the lowest bidder, our military and Veterans Administration must procure them based on national security interests, demanding country-of-origin transparency and using the Defense Department’s purchasing power to spur U.S. production. This is already working in the private sector. Gibson relates that Civica Rx, a nonprofit formed by Mayo Clinic and 900 other hospitals nationwide, is ensuring transparent sourcing from trustworthy manufacturers, and providing long-term contracts to ensure stability. Civica Rx announced in May it plans to deliver 14 generic medications this year, including several crucial antibiotics.

That’s good news in the current landscape and shows that, unlike our government, private industry acknowledges our medicines to be valuable assets, as crucial as food commodities and energy resources in preserving not just our high standard of living, but life itself. All Americans need to realize that, too, and demand that our policymakers act accordingly. Otherwise, we have a bitter pill to swallow.

Photo: varunchristensen/iStock/Getty Images Plus

This article originally appeared in the September 16, 2019 print edition of The New American.