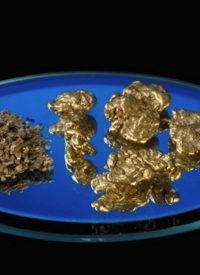

Commodities markets have soared on news of a global currency inflationary war by central banks around the world, with gold prices climbing to more than $1,375 per ounce in overnight trading October 14. Other precious and semi-precious metals such as silver, platinum, palladium, and copper also topped recent highs in successive days of trading.

But it’s not just metals that have risen sharply in the wake of the competitive devaluation of the dollar, euro, and other major currencies. Agricultural commodities have also soared as the anticipation of a higher volume of dollars chasing a stable amount of material goods. The Thomson Reuters/Jefferies CRB Index, an index of 19 major commodities that includes farm products, oil, and metals, is up nearly 19 percent since June 1. For example, corn prices have increased more than 10 percent in the past two days.

Currency inflation has a number of negative impacts upon the economy, not the least of which is that much of the business investment needed to jump-start the moribund economy is being chased into material goods as a hedge against inflation. Because raw commodities do not create jobs or dividends (though some investment ETFs do), the economy is being starved out of entrepreneurial capital and into a protracted recession/depression by the inflationary actions of the Federal Reserve Bank.

Moreover, inflation will eventually lead to higher interest rates, as investors seek to recoup inflation losses. This will result in higher U.S. government debt refinancing costs, spiking the level of the federal budget deficit. Each one-percent increase in the interest rate needed to finance the $13 trillion (and climbing) U.S. national debt will add $130 billion per year to the federal deficit. This one-percent increase in interest rates (and the resulting increase in federal debt) will essentially amount to more than a $1,000 per year tax upon each of the approximately 115 million households in America for each one percent increase in interest rates.