Nelson Bunker Hunt, R.I.P.: The Myth of the Hunt Brothers’ “Scheme to Corner the Silver Market”

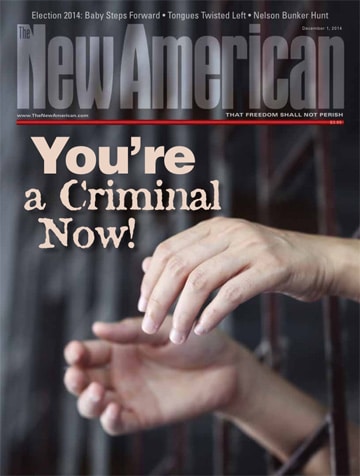

“Nelson Bunker Hunt, oil fortune heir whose bid to corner the silver market led to ruin, dies.” So ran the headline of the Associated Press report, as it appeared in the U.S. News & World Report online edition for October 22. Similar headlines accompanied many other obituaries of the famous Texas investor/entrepreneur, and if the “tried to corner the silver market” charge didn’t appear in the title it was often in the opening sentence. Hunt (shown, center), a political conservative, was fated to be tagged with that epitaph by hostile Wall Street forces and the liberal-left media for the past three-decades-plus of his life. However, there is little evidence to support the “corner the market” narrative, regardless of the myriad of times it has been reported as “fact.”

During the 1970s, Hunt's savvy investments in oil, sugar, commodities, real estate — and especially silver — made him one of the wealthiest individuals on the planet. Because of his independence and his outspoken opposition to the Federal Reserve System and the ruinous policies of the federal government that were destroying the value of the dollar, he became a marked man. Political and financial insiders repeatedly changed the rules of the game on commodities trading and put the squeeze on him (along with his brother and investment partner Herbert Hunt) and then perpetuated the lie that the Hunt brothers had been “squeezing” the silver market. We will return with details of the great silver debacle below.

Nelson Bunker Hunt was born in 1926, in El Dorado, Arkansas, the second son of legendary Texas wildcatter H.L. Hunt, who had amassed one of the world’s great fortunes by developing the East Texas Oil Field. Following in his father’s footsteps, Bunker (he went by his middle name) built — and lost — a number of fortunes in oil, silver, sugar, soybeans, pizza, cattle, coins, real estate, ranching, and thoroughbred horse racing.

He died on October 21 at age 88. “Despite his riches,” noted the Dallas Morning News obituary, “Hunt lived modestly. He flew coach, wore off-the-rack clothing and drove nondescript cars. Many noted that his personal spending habits were as conservative as his politics, which included a leadership role in the John Birch Society.”

In an article entitled, “Hunt for Silver,” for the December 1980 issue of American Opinion magazine (forerunner of The New American), best-selling author Gary Allen offered a portrait of Hunt that contrasts sharply with the picture provided by the establishment media. He wrote:

Nelson Bunker Hunt, fabled son of the legendary billionaire H.L. Hunt of Texas, has been called “Silverfinger” by financial journalists eager to dramatize his silver investments in the purple ad hominems of a James Bond novel. Hunt is neither an eccentric villain out of James Bond nor a sinister schemer in the mold of J.R. Ewing of the “Dallas” television series. He is, in fact, a happy combination of sober realist and idealistic visionary. He is a sober realist because he understands the perilous direction in which our civilization has been headed — the political instability, the civil turmoil, the financial catastrophe of hyperinflation and moral bankruptcy. And he is an idealistic visionary because he is working for a better world in which the people govern themselves and their economy without being victimized by a paper aristocracy which profits by manipulating government and inflating currencies.

Allen continued:

Mr. Hunt is a faithful Christian, friendly, unassuming, and temperate. He refrains from both liquor and tobacco, flies tourist class on commercial airlines, and dresses simply. A member of the National Council of The John Birch Society, he is a formidable opponent of Establishment Insiders who seek to make America one more colony in a New World Order.

Earlier this year, Bunker Hunt and his brother Herbert were targets of one of the most spectacular swindles in financial history. This was marked by the now-famous silver crash that culminated on March 27, 1980.

Gary Allen then proceeded to detail the manipulation and collusion by the insiders of the Commodity Exchange (COMEX) in New York, the Chicago Board of Trade (CBOT), and their confederates at the federal Commodities Futures Trading Commission (CFTC) and the Federal Reserve. As Allen and other analysts of the silver crash have pointed out, the industry insiders and their regulatory co-conspirators were frantically trying to cover up the fact that they had fraudulently sold contracts for far more silver than existed; they were massively short and couldn’t deliver. The “shorts,” facing a deadly reckoning that would send many of them to the poor house (and maybe even to jail), turned to their pals at the CFTC and the Federal Reserve. The Fed’s inflationary policies and interest rate manipulation were major reasons why the Hunt brothers had decided to move their investments into silver in the first place.

Alan Trustman, writing in the September 1980 issue of Atlantic, provided one of the few defenses of the Hunt brothers in a “mainstream” publication. Trustman wrote regarding the Hunts:

Their behavior was not typical of that of cornerers. In the first place, they told everybody who would listen what they were doing; they were big, big buyers and intended to buy more and more. A cornerer operates in secret until he owns substantially the entire available supply, and then he squeezes the surprised innocents who have sold short and must buy in higher.

You would have to have been belligerently deaf and disbelieving and anything but innocent to sell short and then be caught surprised if Nelson Bunker and William Herbert had cornered silver and then demanded that you deliver. Everybody knew they were buying and willing to pay a higher price.

In the second place, they never tried to squeeze anyone. They took their deliveries slowly, over many months, even accepted in settlement of some of their contracts non-certified silver not on deposit with the exchanges, and gracefully rolled the bulk of their futures forward into later and later months so as not to squeeze the sellers. Cornerers? Not quite.

“Bunker Hunt,” Gary Allen noted, “was not a speculator in silver. Speculators are short-term players. They do not buy their holdings to keep, as Hunt was doing and continues to do. People gamble on the future price of pork bellies to make money in a relatively short period — not as a long-term investment. With gold and silver, on the other hand, there are many who — like the Hunts — see the metals as cash and prefer them to paper money. They are investors for the long term.”

The FSKrealityguide financial blog wrote of the Hunts vs. the Insiders' silver showdown:

The CFTC/COMEX/CBOT are the regulators that set the rules for the commodities exchanges. The people sitting on the regulatory body are all financial industry insiders, EACH OF WHICH HAD A HUGE SHORT POSITION IN SILVER! First, they set position limits. The number of silver contracts each person could own was restricted, although the Hunt brothers' existing position was partially grandfathered. Second, THEY BANNED OPENING TRANSACTIONS. ONLY CLOSING TRANSACTIONS WERE ALLOWED. Third, they raised margin requirements for long speculators BUT NOT SHORT SPECULATORS! This forced the Hunt brothers into margin calls, while the short speculators could wait to buy and cover!... The only people [the Hunts] could sell to were the financial industry insiders, who had huge short positions. Knowing the rules of the game had been changed to favor them, the financial industry insiders knew they were going to be able to cover their humongous short position at favorable prices.

The Federal Reserve also joined the party. The Federal Reserve jacked up interest rates. This made it hard for the Hunt brothers to meet the interest payments on their margin debt. Borrowing at five percent to buy silver is a bargain when inflation is 15 percent, but borrowing at 20 percent to buy silver is a ripoff when inflation is 15 percent! The Federal Reserve also issued a special request to banks: They were to stop issuing loans for "speculative activity." The Federal Reserve didn't specifically say they were targeting the Hunt brothers, but everyone knew they were. Without this request by the Federal Reserve, if the banks colluded to stop extending the Hunt brothers credit, they would be guilty of an antitrust violation. When the Federal Reserve said, "Stop lending the Hunt brothers money," the banks felt comfortable colluding to stop loaning the Hunt brothers more money, which is what they wanted to do!

Herbert Hunt later remarked: “To put it in terms of a football analogy: the game starts, the rules are changed, and finally when you get to the last quarter the referee says only the other side can have the ball.”

The manipulations that crashed the price of silver effected a huge reversal of fortunes, stripping the Hunts of much of their wealth and richly rewarding the politically connected short traders. But the Hunt brothers were not the only victims; many ordinary middle-class folks who had invested in silver to protect their savings from the inflationary ravages of the Fed’s policies and the free-spending habits of the federal government suffered much more seriously from the unethical and illegal silver market machinations. This was but a foretaste of the massive fraud and theft that the Fed and its Wall Street banking cronies would again visit upon America in 2008 when the housing bubble crashed.

Bunker and Herbert Hunt were well aware of the conspiratorial intrigue between the Fed and the insider bankers, and as advocates of free market capitalism — not the corporatist, fascist-style, crony capitalism that falsely appropriates the free market label — they steadfastly opposed the Big Government programs that have become the hallmarks of both the Democrat and Republican Parties. In addition to being a longtime member and supporter of The John Birch Society, Bunker Hunt was also a founding member of the conservative Council for National Policy and a major funder of the anti-communist Western Goals Foundation, founded in 1979 by Birch Society Chairman Rep. Larry Patton McDonald (D-Ga.), along with Major General George Patton IV, Gen. John Singlaub, former Chairman of the Joint Chiefs of Staff Admiral Thomas Moorer, economist Henry Hazlitt, Dr. Edward Teller, and other prominent American patriots.

Bunker Hunt was also a major financial supporter and past chairman of the Bible Society of Texas, as well as a significant contributor to Campus Crusade for Christ and other Christian organizations.

“He was an ever-cordial gentleman and probably the most unassuming, plainspoken billionaire ever,” Larry Waters, the National Development Officer for The John Birch Society, told The New American. Waters, who worked with Hunt over the course of 40 years, said, “Bunker was amazingly accessible and generous with his time and money. He hosted two meetings for the Society at his Texas ranch and one at the Broadmoor Hotel in Colorado Springs that drew numerous well-known folks. He hosted seminars in Dallas for JBS and sponsored the first few meetings of a new JBS business chapter at the Dallas Country Club. He attended our Dallas business chapter meetings when his busy schedule permitted and he helped host one of first seminars given by Dr. Larry McDonald at the Dallas Country Club.”

John Birch Society President John F. McManus told The New American: “Bunker Hunt was a one-of-a-kind American patriot, a billionaire who was down-to-earth, gracious, and committed to liberty. He easily could have joined the ‘Big Boys Insider Club’ if he had been so inclined, and he would have benefitted handsomely from doing so. Instead, he threw in his lot on the side of freedom, and has been vilified and persecuted by the powers that be for doing so. Now that he has passed on, the IRS, the CFTC, the Fed, and the other agents of the entrenched money power will have to find new scapegoats to target.”