Beginning August 1, men’s blue jeans and underwear sold at Walmart will carry electronic radio identification tags. The company, the world’s largest retailer, insists the devices are crucial to improving the logistics of inventory management, while critics point to the privacy concerns associated with the tags.

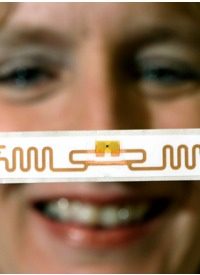

The markers in question, called radio-frequency identification (RFID) tags, are implanted in the garments and can be read by hand-held scanners. Wal-Mart officials praise the portability of the tags and the boost in speed and accuracy they bring to inventory control. “This ability to wave the wand and have a sense of all the products that are on the floor or in the back room in seconds is something that we feel can really transform our business,” crows Raul Vasquez, Wal-Mart’s representative for its stores in the western states.

RFID tags are nothing new at Walmart (or many other retailers). Until now, however, the tags were chiefly used to track pallets of goods from factory to warehouse to the local outlet. After August 1, though, for the first time Walmart will bring the technology out of the storeroom and into the consumer’s pants — literally.

In order to understand why Walmart’s selling of clothes loaded with RFID tags is worrisome, one needs to know a bit about how the devices work.

Radio-frequency identification tags are made of two principal components: an integrated circuit for storing and processing data and modulating a radio-frequency (RF) signal; and an antenna for receiving and transmitting the radio signal.

There are three types of RFID tags in common use: active RFID tags, which contain a battery and transmits signals autonomously; passive RFID tags, which have no battery and require an external source to stimulate signal transmission; and battery assisted passive (BAP) RFID tags, which operate only when “turned on” by an outside source, but have significant higher forward link capability providing greater range. The tags being used by Walmart are reportedly the passive version.

The workings of the technology reveals the privacy privations feared by critics. These tags can be scanned not just by Walmart employees, but by anyone with a scanner tuned to the signal. And, the signal given off by these “inventory control devices” cannot be turned off. Even if removed by consumers, as Walmart anticipates, the tags remain active and, whether sitting in the garbage or in the closet, they are emitting a signal.

That perpetually “on” aspect of the RFID tags is what sends chills down the spine of privacy advocates like Katherine Albrecht. Albrecht is the founder of Consumers Against Supermarket Privacy Invasion and Numbering, an organization dedicated to tracking the tracking.

Albrecht told reporters that, “This is the first piece of a very large and very frightening tracking system.”

Large and frightening are apt descriptions of a plan being implemented by a company with the global footprint of Walmart. The plain economic fact is that Walmart sets the standard for many other retailers by exerting control over suppliers and compelling them to alter their methods according to the wishes of the Behemoth of Bentonville.

This influence is felt by stores of all sorts that draw inventory from the same supply stream. Thus, as goes Walmart, so goes retail. This domino effect works to expand the scope of the RFID tracking issue to cover most of the population.

The Wall Street Journal reports that “several other U.S. retailers, including J.C. Penney and Bloomingdale’s, have begun experimenting with smart tags on clothing to better ensure shelves remain stocked with sizes and colors that customers want.”

International industry journals report that Indian suppliers to other retail heavy hitters such as Metro, Target and U.K.-based Tesco have already been issued directives to replace bar codes with RFID tags. While this may lower margins of these suppliers, it is also expected to create a demand for RFID tags in India. The value of the entire RFID market — tags, readers, software/services and labels — is expected to touch $5.63 billion in 2010, according to a recent survey conducted by IDTechEx.

Is there any doubt that supply will meet the challenges of demand? Especially when the demand is made by those earning their livelihood by catering to the wishes of Walmart.

Industry insiders, while trying to downplay the “Big Brother” aspect of the technology and promote the logistics applications, illuminate red warning lights in their praise of RFID. Robert Carpenter, chief executive of a group that helped universal product codes (UPC) reach ubiquity, now predicts the same saturation of retail by RFID codes.

There is, of course, a stark distinction between UPC and RFID. As stated above, RFID is always “live” and continuously transmits a signal despite the consumer’s efforts to remove them. UPC, on the other hand, can be removed and is a static, or dead, device and can be defaced or erased, thus terminating its tracking capabilities.

Another concern to Albrecht and others protective of the privacy of citizens is the potential for coordination with other objects embedded with the chips and carried by people who shop at Walmart.

According to Albrecht and other privacy sentinels, drivers in states along the Canadian border (Michigan and Washington) are now issued licenses containing RFID tags that enable them to cross back and forth across the border with ease. Albrecht explained her fear to USA Today that “retailers could scan data from such licenses and their purchases and combine that data with other personal information.”

Theoretically, stores could scan these licenses without foreknowledge of the consumer, then amalgamate all the data broadcast by the RFID tags to form a composite image of the activity, movements, and buying behavior of those carrying such licenses. Then the next time the consumer comes in the store, employees could instantly indentify the person and know how to tailor the consumer’s shopping experience, including the ads that run on the TVs placed throughout Walmart.

While such corporate surveillance may sound far-fetched, Albrecht argues that “there are a lot of corporate marketers who are interested in tracking people as they walk sales floors.” It isn’t just inventory that could be controlled, but access and advertising, as well.

Despite assurances from Walmart executives that the RFID technology will only be used to better manage inventory in order to cut costs and pass along those savings to consumers, those familiar with the immense potential for RFID scanning admit that “they’ll cut down on employee theft because it will be easier to see if something’s gone missing from the back room.”

So, the party line has gone from supply chain management, to cost-cutting for the consumer, to monitoring of employees. Still, advocates contend that there is nothing to worry about — unless you’re a supplier, a consumer, a driver, or an employee of Walmart.

Photo: AP Images