The U.S. national debt eclipsed the $16-trillion mark on Friday, August 31, the Treasury Department reported Tuesday, September 4, adding to Republicans’ growing criticisms of President Obama’s purportedly failed economic policies. In the fiscal year ending September 30, the government is estimated to spawn a deficit of more than $1.1 trillion, leaving tax revenue far behind government spending and nudging the national debt closer to its $16.394-trillion borrowing limit.

Despite the common belief that China holds an enormous portion of U.S. debt, two-thirds of the bankrolling comes from the Social Security Trust Fund, American investors and future retirees, and pensions for public-sector workers and military personnel. Meanwhile, China bankrolls less than 8 percent of the U.S. government’s current borrowing.

“It is true that China is the largest foreign owner of our debt,” asserted Josh Gordon, policy director of the Concord Coalition, a debt-watchdog based in Virginia. “But the vast majority of our debt is held by us.” Fox News explains:

Economists differ on when the National Debt actually crested the $16 trillion mark, with some saying it occurred on Friday and others saying it happens on Tuesday. But none doubt that the federal government’s tab is immense and growing. Just under $5 trillion of the national debt is owed to the Social Security Trust Fund and federal pension systems. A little more than $11 trillion is owed to foreign and domestic investors and the Federal Reserve, which buys up treasuries in order to drag down interest rates through quantitative easing.

Moreover, China’s nation’s willingness to bankroll America’s mounting debt burden is only diminishing:

China has actually decreased its holdings of U.S. debt over the past year, dropping from $1.31 trillion in June 2011 to $1.16 trillion a year later, according to the Treasury Department. Japan holds nearly as much, at $1.12 trillion. Those countries are by far the biggest foreign holders, but dozens of other nations, including Brazil, Russia, Taiwan, Switzerland and the United Kingdom hold trillions more.

Private U.S. investors hold around $1 trillion in federal debt, while insurance companies, investment funds, and state and local governments hold about double that amount. Still, China is perceived as a chief creditor of U.S. deficit spending. During her campaign for the Republican presidential nomination, Rep. Michele Bachmann (R-Minn.) quipped that when it came to our nation’s debt, “Hu’s your daddy,” an allusion to Chinese President Hu Jintao.

Moreover, during his 2008 presidential bid, Obama blasted President Bush for taking “out a credit card from the Bank of China in the name of our children, driving up our national debt from $5 trillion for the first 42 presidents … so that we now have over $9 trillion of debt that we are going to have to pay back.”

Naturally, the federal government’s $16-trillion milestone has ignited a flurry of Republican criticism, prompting House Speaker John Boehner (R-Ohio) to say, “Instead of working in a bipartisan way to fulfill his promise, the president went on a ‘stimulus’-fueled spending binge. This debt is a drain on our economy and a crushing burden on our kids and grandkids.”

Americans are “worse off than when we took office,” GOP presidential challenger Mitt Romney added. “But it’s not just this generation that’s paying the price. The next generation has been saddled with enormous debt because of President Obama’s policies.”

“We just heard about an hour ago that our government eclipsed the $16 trillion mark in our national debt,” Romney’s running mate Paul Ryan echoed at a rally on September 4. “This is a serious threat to our economy. Of all the broken promises from President Obama, this is probably the worst one because this debt is threatening jobs today, it is threatening prosperity today and it is guaranteeing that our children and grandchildren get a diminished future.”

The president and congressional Democrats counter that the Obama administration inherited a weak economy spurred on by President Bush’s big-spending programs and tax cuts for the wealthy. And their accusation regarding spending is legitimate, as Bush led the nation in to two wars while congressional Republicans followed with costly spending measures — including Medicare Part D, No Child Left Behind, and a slew of other big-government programs.

In February 2009, President Obama pledged to curb the spendthrift mentality of the Bush era, asserting that his predecessor’s spending schemes have left future generations in peril. “We cannot, and will not, sustain deficits like these without end,” Obama affirmed. “Contrary to the prevailing wisdom in Washington these past few years, we cannot simply spend as we please and defer the consequences to the next budget, the next administration, or the next generation.”

In turn, the president declared, “And that’s why today I’m pledging to cut the deficit we inherited in half by the end of my first term in office.”

Of course, Obama’s promise has not come to fruition, as his fiscal policies have only added to the already mounting pile of debt now plaguing future generations of Americans. Regardless of who holds the debt — China, private investors, public-sector pensions — the nation’s fiscal condition is in jeopardy. And a return to the constitutional principles that founded this great nation is the only viable solution to the pending doom of fiscal collapse.

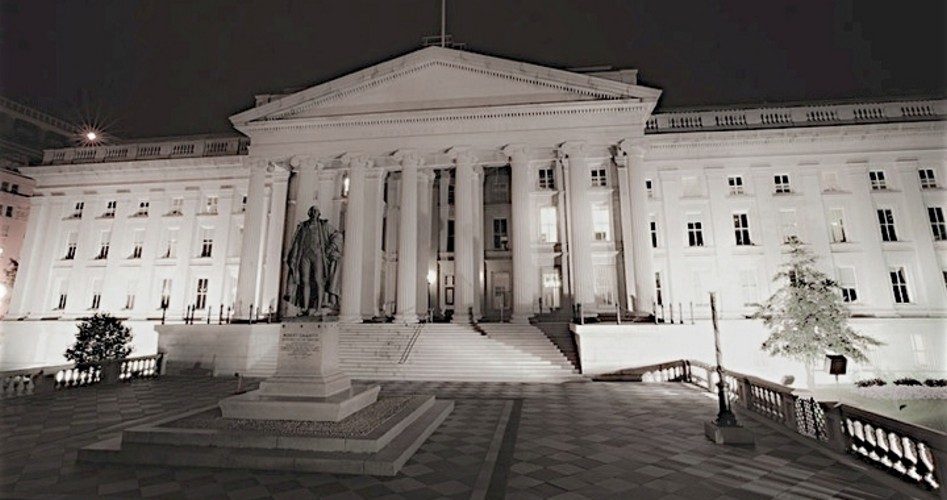

Photo: United States Department of the Treasury building, Washington