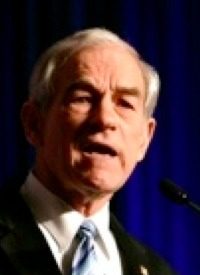

The media response to the appointment of Rep. Ron Paul (R-Texas) to the chairmanship of the House Domestic Monetary Policy Subcommittee has been swift and — somewhat surprisingly — mostly positive. Perhaps it is due to the fact that public opinion has been turning against the Federal Reserve, Paul’s longtime target that is overseen by his subcommittee.

A Bloomberg poll released on December 9 revealed that 39 percent of Americans believe the Fed needs more oversight and that 16 percent think it should be abolished outright. The percentage of Americans favoring abolition of the Fed has doubled in the past two months, undoubtedly spurred largely by recent revelations of $3 trillion in Fed bailouts of corporations and foreign banks. As Reason editor-in-chief Matt Welch told his colleague David Weigel:

Paul’s commentary on, and cross-examination of, the Federal Reserve has only seemed less crazy with the passage of time. It sounded crazy when he kept pestering Bernanke or whoever about whether the Fed was involved in various overseas bailouts. But then the Fed was involved in various overseas bailouts! By trying quixotically to End the Fed, he will succeed in doing more to audit the Fed, because there is a growing interest/concern in the post-TARP world about the unprecedented and not-very-well-controlled power that the institution has to do whatever it wants.

Or as Paul himself put it in an interview with Bloomberg Television, “It was never intended that a secret body like this could create money out of thin air, spend to take care of some banks and big business and foreign banks. We have to look into it, and we have to start to consider reforms.”

Because Paul has lately been the unofficial leader of the movement to the audit the Fed (he sponsored a bill to do just that in the last Congress) or, better still, to abolish it altogether (hence the title of his bestseller, End the Fed), it was inevitable that coverage of his appointment would center on these issues — and on the expected conflicts between Paul and Fed Chairman Ben Bernanke. Politics Daily’s Christopher Weber, for example, likened Paul’s appointment to “putting the fox in charge of the henhouse.” Brent Budowsky of The Hill wrote that “the best show in town, and possibly one of the most important policy debates in decades, begins when Rep. Ron Paul (R-Texas) takes the gavel of oversight of the Federal Reserve Board.” And Ray Esally of the blog Everything Gold pointed out with evident glee:

… what has probably kept Ben Bernanke up in cold sweats since Republicans took control of the house [sic], were fears nemesis Ron Paul would be named as head of the House subcommittee that oversees the Federal Reserve, and by extension, Bernanke….

The Federal Reserve, which has largely received a free pass for decades as to its secretive actions and deals, can’t be happy about the renewed interest and focus on them, which is a worst case scenario from their point of view.

Add Ron Paul, who has written a book called “End the Fed” to the mix, and things aren’t going to be boring over the next several years concerning the Fed and the increasingly nervous and defensive Ben Bernanke.

Despite expectations of conflict, most commentators seem to recognize that, as Peter Schroeder blogged at The Hill, Paul is “aware of the limits he faces” in pressing for Fed abolition and will therefore take a slower, more deliberate approach to his new position. Paul made that clear in his Bloomberg interview, responding to the question “Will you end the Fed?”:

Not right up front, but obviously, that is the implication. Even in my book about ending the Fed, I do not talk about turning the keys and locking the doors. I talk about a transition and why don’t we legalize the Constitution and allow legal tender to compete with paper money. Today it’s the opposite. We are forced to use depreciating money and they do a very good job of depreciating money. At the same time, the Constitution still says that the only thing you are allowed to use is gold and silver. All I want to do is legalize that and if nobody cares, if nobody likes gold and silver, in paper assets and put their savings accounts in paper money.

Later in the interview he demonstrated his understanding of the limits of his power as chairman of the subcommittee, saying:

It is not like I am a powerful person. My ideas are powerful, but I am not. There is a committee chairman, Speaker of the House. I am realistic, and I know what that means. But I also know the strength of ideas, and that is what will prevail. It wasn’t my political power that prevailed last year to get 320 cosponsors of auditing the Fed. It was the power of the ideas. That is what they ought to worry about.

Some pundits also noted that Paul’s appointment “hands Tea Party activists their first big victory in a committee fight,” in the words of a Weigel blog for Slate. In fact, thus far it is their only victory, as Weigel explained:

When the midterms were over, with the corpses of Democratic incumbents still being counted and labeled, conservatives and Tea Party activists went after the Republicans in line to take over key committees. They opposed Michigan Rep. Fred Upton’s bid to run Energy and Commerce. They worked the phones against Hal Rogers of Kentucky, a “prince of pork” in line to run Appropriations. They backed outsiders to run Banking, the Republican Study Committee, and the Conference Committee. They lost all of these fights, which means that of all the committee fights that activists were watching, the only one they definitively won was Ron Paul’s.

Weigel also perceptively pointed out in his blog that Paul’s appointment “makes it less likely that Paul will run for president in 2012” because “the denial of this job would have been a clear sign that he couldn’t move up in Congress, nudging him to look for another way to spread his message.” Perhaps the GOP bigwigs are crazy like foxes.

Oddly, as of this writing the only excessively negative comments among press coverage of Paul’s appointment come from self-described libertarians, the sort of people one would expect to be most excited about having a libertarian in charge of the subcommittee. Weigel, for one, appears not particularly thrilled with this turn of events, entitling his lengthy piece on the subject “Congratulations! Now Shut Up.” He writes of “libertarians who consider the Paul takeover in open-mouthed horror.” Among them is Megan McArdle, a libertarian blogger and economics editor of the Atlantic, who claimed that while Paul “cares passionately about monetary policy … he doesn’t understand anything about monetary policy.” “My personal opinion,” she said, “is that he wastes all of his time on the House Financial Services Committee ranting crazily.” Mark Calabria, director of financial regulation studies at the Cato Institute, said, “I don’t think he’s often the best messenger for the things he believes in…. He needs to avoid going down the path to conspiracy theories and keep the focus on economics.”

Of course, many other libertarians are indeed jumping for joy at the news of a Paul chairmanship. Paul’s former chief of staff and close friend Lew Rockwell, less concerned with inside-the-Beltway respectability than Weigel and company, exulted, “Get ready for some fun! They must be hanging the black crepe at bankster central, the Fed.”

Weigel cited complaints by some libertarians that Paul has “distracted libertarians and Tea Partiers by focusing their ire on the easily demonized Fed.” That assumes, of course, that targeting the institution that has, as Paul is fond of pointing out, inflated away 95 percent of the dollar’s value over the last century, financed trillions of dollars’ worth of federal debt, bankrolled unconstitutional wars, bailed out favored corporations and both domestic and foreign financial institutions, and created an ongoing cycle of booms and busts, culminating in our present economic distress, is somehow distracting us from the real cause of our woes. Benzinga.com’s Michael Snyder may have put it best: “There is a reason why people like Ron Paul are so obsessed with the Federal Reserve. It is not because they don’t have anything better to do. It is because the future of our country literally hangs in the balance.”

Related article: