On page 1,980 of the recently passed Senate health care overhaul readers will find the mandates regarding the so-called “Cadillac Tax.” Simply, the Cadillac Tax is a 40 percent excise assessed on all employer-provided health insurance policies that fall into the “luxury” category.

According to the report filed by the Congressional Budget Office, about one-fifth of such plans will qualify for such a distinction and thus be subject to the tax increase. The CBO analysts anticipate that in order to avoid paying the extra tax, employers will either reduce the coverage provided by the plans they provide or they will pass the “savings” on to employees who will get the one-two sucker punch of decreased insurance benefits and decreased take-home pay.

Exactly which plans merit the Cadillac distinction? According to the bill, any plan whose value exceeds $8,500 for individuals and $23,000 for families. While certainly high-quality plans, these are not the “super, gold-plated Cadillac plans” enjoyed by millionaire Wall Street executives that were identified as the target of such proposals by President Obama last summer. Far from hitting the Goldmans and the Sachs, this tax, as with almost every such impost, will be borne by the hard-working middle class, even though President Obama promised them immunity from such increases.

Various exposés have been published wherein the horsepower of these Cadillac plans are questioned. Beth Umland, the Research director for financial consulting firm, Mercer, explained that although the “Cadillac tax” is ostensibly aimed at running down expensive health insurance policies, the likely victims of this scheme are older workers employed in high-risk industries, thus more susceptible to work-related health concerns. Strangely, there’s not a lot of risk of sustaining a significant injury in the course of employment in a Goldman Sachs boardroom.

Predictably, unions are working feverishly and leaning heavily on their allies in the House of Representatives to make sure that their members (many of whom work in steel, electricity, and construction) aren’t unfairly burdened with the new excise. These union workers typically make about $42,000 a year which is hardly the “billionaire boys club” that was supposed to be taking up the slack in favor of their less-fortunate fellow citizens.

Despite its obvious flaws and disproportionate apportionment, the Cadillac tax has its advocates. In a Washington Post article, the author praises the tax as a long overdue closure of a noxious tax loophole through which overly generous health care perks passed through tax-free. According to the piece, “the tax code has for years provided a large subsidy to the most expensive health plans — at a cost to the U.S. taxpayer of more than $250 billion a year.” The effect of this repeal, then, would be to mitigate the preference provided by the tax code to those enjoying more than their fair share of healthcare coverage.

The problem with the foregoing evaluation is the responsibility for appointing an arbiter of what is “fair” and what isn’t. Predictably, those supporting the Cadillac tax and similar revenue raising provisions currently written into the Senate bill consider all who agree with them to be reputable sources. These advocates have never met a tax they didn’t like.

Those most likely to finance this revolutionary recast of health care in America have a different interpretation of the proposed provisions, however. Opponents point to the fact that higher cost sharing will eventually trickle down from insurance companies to the insured, which will result in forced picking and choosing of needed care (in favor of the cheaper alternative or of no care at all). This will negatively impact the overall healthiness of the American middle class and widen the gap between those wealthy enough to not be forced to make such decisions and those whose financial well-being is precarious at best and will be pushed closer to the brink of ruin — thanks to the unconstitutional meddling by government in an arena that lays far beyond the borders drawn by our Founders around the enumerated and limited powers of Congress.

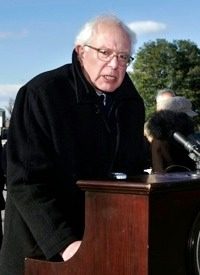

Photo of Sen. Bernie Sanders (I-Vt.) and union leaders discussing the "Cadillac tax": AP Images