Not only is “Bidenomics” not working, its failure is showing up in the polls. The latest survey from Bankrate.com reveals that half of Americans think they are worse off, not better, under Biden’s economic plan to rescue and revive the economy. Among the key voting demographic — Independents — 60 percent of them say they’re worse off.

Not only do most think they’re worse off, but just one in five think their financial situation has actually improved. Those are not election-winning numbers.

The voters polled by Bankrate.com are well-informed. Half of those suffering under Bidenomics blame the resident of the Oval Office, while a third blame Congress. But more than one-quarter place the blame where it belongs: on the Federal Reserve, the “engine of inflation.”

When the government spends more money than it can raise through taxes, it goes to that “engine,” which creates digital currency and uses it to buy government bonds. Just today, for instance, the Treasury Department announced it is selling $40 billion of 10-year government notes. And if investors don’t step up to the plate to buy them, there’s always the Fed as the last resort, which will purchase them using the newly created funds. This further dilutes the purchasing power of the currency. Or, to put it another way: Inflation is an unavoidable tax on everyone working to earn a dollar.

Americans are not stupid. When they see the cost of necessities such as food, gasoline, rent, and childcare going up, they know whom to blame.

Voters’ angst is showing up as credit card debt hits a new record — nearly $1.1 trillion, an increase of 46 percent in the last three months, erasing a record going back to 2003.

And more Americans — 35 percent — are falling behind in making even minimum payments. In September, there was more than $30 billion owed that was already in some stage of delinquency. It’s not helpful that the average credit card interest rate just hit a new high, at just under 21%, last week.

Example: If $5,000 is owed on a credit card and the holder makes just the minimum monthly payment, it will take him 279 months, or more than 23 years, to pay it off. And his total payments over that period, to clear the $5,000 due, will add up to $8,124. This is indentured servitude to the credit card company.

Car loan balances climbed $13 billion in the last quarter, to $1.6 trillion, while student loan debt (with repayments now required starting in October) increased by $30 billion and mortgage balances jumped by $126 billion over that same period.

It’s no wonder, then, that total household debt has jumped by $228 billion from the end of June — to a staggering $17.3 trillion owed now.

To make ends meet, a growing number of Americans are making “hardship” emergency withdrawals from their 401(k) plans. When they make that withdrawal, they get hit with income taxes plus an early withdrawal fee of 10 percent. And when things improve, they cannot return the money to the plan, pushing out their retirement plans further into the future.

In addition, many are taking withdrawals from their health savings accounts just to pay for current healthcare expenses, as opposed to keeping them for future expenses.

Biden has been touting that, thanks to his policies, inflation came down from over 9 percent to “just” 3.7 percent in September. Assuming it stays at that rate — and forgetting about the continued deficits being funded by the Fed into the future — the value of the American dollar will drop by half in 20 years. Put another way, if nothing changes, prices will double in that period.

All of which is showing up in current polls. A new CNN/SSRS survey of registered voters shows Trump leading Biden 49 percent to 45 percent, and a New York Times/Siena College poll shows significant leads for Trump over Biden in key swing states.

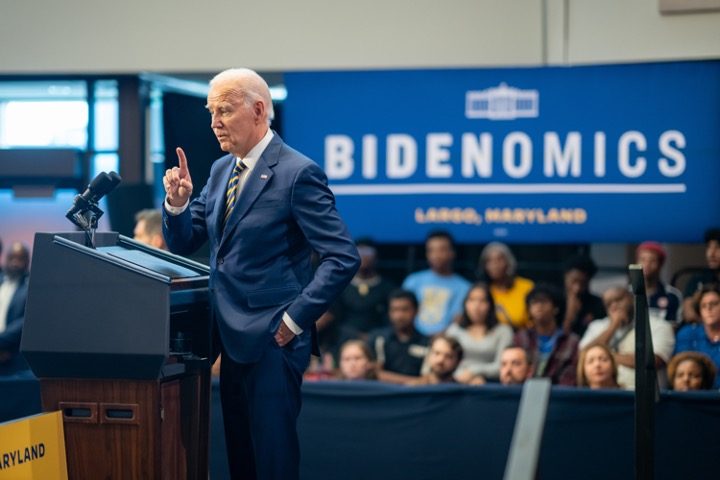

Even liberal CNN was forced to admit that Biden’s “strategy of highlighting strong job and economic growth numbers and his historic infrastructure package — sold under the umbrella of ‘Bidenomics’ — is currently a failure,” adding that “a sense of malaise, not reflected in many economic indicators, is nevertheless conjuring voter nostalgia for the Trump economy.”

One part of the Bankrate.com survey revealed just how important these numbers are: “89% of Americans say the economy will be an important factor in their 2024 vote.” Not only are their economic concerns showing up in the polls, they are also likely to impact the presidential election, now less than a year away.

Related article: