International Monetary Fund head Dominique Strauss-Kahn made a series of headline-grabbing statements late last week, calling for new supervisory authority over world financial markets and even the exploration of a new global reserve currency.

“Our mandate must cover the full range of macroeconomic and financial sector policies that bear on global stability in the modern world,” Strauss-Kahn told the annual gathering of the Bretton Woods Committee on Friday. “And that, in many ways, is the bottom line: to strengthen the fund’s role as the guardian of systemic stability.”

Declaring the need for a new “multilateral surveillance” system, the French managing director said what the IMF wants “is a new focus and capacity to deal with systemic risks.”

If approved, the new surveillance procedures “would allow — indeed require — the fund to assess the broader and systemic effects of country-level policies, and the associated risks, in a fundamentally different way," Strauss-Kahn said. The proposal expands on calls from the G20 to allow multilateral monitoring of national economies under the guise of stability.

“We must build on this positive momentum to transform the fund into an institution even better equipped to meet the challenges of the post-crisis era,” Strauss-Kahn said during his February 26 speech. "There may be a need for a clearer mandate to pursue risks to global economic and — I stress — financial stability."

Echoing similar statements by U.S. Treasury Secretary Timothy Geithner, the Russian and communist Chinese regimes, and various United Nations officials, Strauss-Kahn also suggested it would be “intellectually healthy to explore” the creation of a new IMF-backed world reserve currency.

"One day, the fund might even be called upon to provide a globally issued reserve asset, similar to — but in important respects different from — the SDR," he said, referring to the IMF’s Special Drawing Rights, a sort of global fiat currency already used by the institution and its 186 members.

In September of last year, the UN Conference on Trade and Development issued a report attacking the dollar and claiming the financial crisis “supports the case for a more fundamental rethinking of global financial governance.” It also proposed new powers for the IMF. And evidently, the Washington-based institution plans to answer the call.

Among the specific targets in the report was the current global reserve currency status of U.S. Federal Reserve Notes. “In the discussion about necessary reforms of the international monetary and financial system, the problem of the United States dollar serving as the main international reserve asset has received renewed attention.” It goes on to state that an “artificial” international currency would solve some of the imbalances related to the global financial system, and that international controls and wealth redistribution would be good for the economy.

In a February 18 column published by the Financial Times, Staruss-Kahn also argued for a tougher world financial regulatory system. "Pending a global agreement, we have a system with holes and go-it-alone national approaches," he wrote, praising the work already accomplished on the issue by unelected central bankers and international institutions.

"Time is of the essence in reaching an international agreement lest political patience with regulatory conclaves runs out and we enter a cycle of uncoordinated policy, distorted capital flows and regulatory arbitrage," he wrote. The IMF also recently reversed its position on capital controls, arguing now that they can be an effective tool.

Another proposal Strauss-Kahn discussed during his speech was the creation of a “Multi-country Credit Line” to provide loans to groups of countries which had not requested assistance. The plan, which should be ready after September, would also be designed to reduce the “stigma” associated with IMF help.

During the current economic crisis, noted Strauss-Kahn during his speech, developing nations had turned to the U.S. Federal Reserve and other central banks as a sort of “first responder.”

“But what assurances do we have that they would be willing and able to provide such liquidity support in the future? We should not take this support for granted,” he said. “For this reason, it is critical that a multilateral institution be ready to answer the call. In this context, we are currently exploring various options — including for short-term, multi-country credit lines that the Fund might extend in a systemic crisis.”

The global financial industry has obtained over $11 trillion in assistance from taxpayers around the world via governments and central banks, the Organization for Economic Cooperation and Development revealed in a study released in January. How much “assistance” was provided to foreign governments by the Federal Reserve is still unknown, though foreign banks have received hundreds of billions or more so far from the American central bank.

The IMF has increased its resources by nearly a trillion dollars in just the past year, which Strauss-Kahn said "should” be enough to hold it over for the “coming period.” The institution has also consented to giving more power to the communist Chinese regime and other governments.

But despite frequent globalist claims, the problems of the global financial and economic systems do not require global regulators, global fiat currencies or global government. What is truly needed is the abolition of debt-based and fiat currencies, central banking including interest rate manipulations, fractional reserve lending, and the associated market distortions. These systemic factors inevitably result in economic crises and ultimately a transfer of wealth away from the people.

Rather than giving Strauss-Kahn and the IMF more power over the U.S. and global economies, Congress should withdraw from the institution and focus on fundamental monetary and financial reform for America. That would be a positive step toward solving the current crisis and preventing future ones. But such efforts would require significant pressure from Americans; so for now, the world is likely to see more of the same IMF “solutions” for years to come.

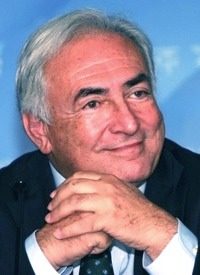

Photo of International Monetary Fund head Dominique Strauss-Kahn: AP Images