The Federal Reserve’s monopoly on money and credit has caused so many problems for average Americans and the nation that addressing this issue is a prerequisite for returning the nation to economic sanity. Congressman Ron Paul has introduced a bill called the “Free Competition in Currency Act” (H.R. 4248), which would end the government-enforced monopoly by repealing “legal tender” laws, allowing private mints, and eliminating taxes on gold and silver coins.

It would definitely be a great start to getting rid of the central bank altogether. But unlike Paul’s proposal to audit the Fed, the free competition legislation has not yet enjoyed much visibility.

In fact, because of the constant loss of purchasing power of Federal Reserve Notes (dollars), various alternatives have already been developed and tried over the years. Many are still in existence. But each one has its drawbacks, and the government has already quashed some of the efforts.

The “Liberty Dollar,” privately issued silver and gold coins as well as warehouse receipts for the metal, was touted as “America’s inflation proof currency” when it was in circulation. It was founded in 1998, but the federal government eventually confiscated what it could of the backing and arrested its founder in late 2007 on ludicrous charges that the Liberty Dollars had a “resemblance” to “genuine coins of the United States.” The legal troubles persist, but a class action lawsuit against the feds is also in progress.

“Digital gold currency” and other “e”-metals are making significant headway. A company called e-gold Ltd, which allows users to trade in gold electronically, claims to have over five million accounts set up through its system. It stores gold and other precious metals and allows account holders to spend or accept electronic gold as payment with each other. GoldMoney, a firm that provides a similar service, says on its website that it is holding nearly a billion dollars worth of gold, silver, and platinum.

Alternative paper monies are also being used. In several communities across the nation, entrepreneurs have banded together to produce their own currencies, which operate alongside Federal Reserve Notes, but are used only locally by those willing to accept them in exchange for goods and services. Among them are Detroit Cheers, BerkShares in Massachusetts, and Ithaca Hours in New York. “The systems generally work like this: Businesses and individuals form a network to print currency. Shoppers buy it at a discount — say, 95 cents for $1 value — and spend the full value at stores that accept the currency,” USA Today reported last year in an article entitled “Communities print their own currency to keep cash flowing.” The goal is to help local economies in bad times.

But while various routes to set up alternative currencies and expose — and eventually end — the Federal Reserve gather momentum, none of the options currently in existence would offer a viable substitute for the present system if and when it suddenly collapses. And that has one monetary expert very worried.

But while various routes to set up alternative currencies and expose — and eventually end — the Federal Reserve gather momentum, none of the options currently in existence would offer a viable substitute for the present system if and when it suddenly collapses. And that has one monetary expert very worried.

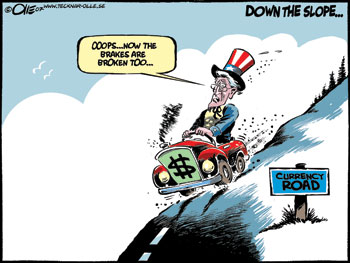

“We have to start looking seriously at what the practical remedy is going to be as this system comes down,” warned Edwin Vieira, a constitutional attorney and an expert in monetary theory who has litigated cases involving money issues. He compared the central bank’s effect on the economy to having square wheels on a car: “Sooner or later, you’re going to shake something loose and the car will fail. And that’s our situation, we’re driving this car with square wheels — the front end, the rear end and the transmission are about to fall out — and we’re in the middle of Death Valley. Literally!”

Vieira told The New American that “the whole present monetary system is unconstitutional,” but if the scam was exposed and the general population suddenly lost faith in its paper debt money, an economic collapse and chaos would quickly follow without a viable system ready to replace it. “This is frightening to me, because imagine one of these lawsuits [against the Fed] wins, and now it becomes absolutely clear to the general public that this operation is totally permeated, if not entirely based on fraud … the house will come down.”

While Vieira had varying opinions of the different attacks on the Fed’s monopoly and secrecy, he praised e-gold and competition as practical solutions. He also noted that, despite various government barriers, it is possible to negotiate contracts in precious metals. But his main suggestion for now is to start at the state level with a precious-metals-based monetary system in which the state government collects part of its tax revenue from corporations in gold.

Vieira has actually written model legislation that would accomplish this goal, and he predicts that the system would catch on. “If — or rather, when — we have another crisis down the road, at least you already have a system set up and it can immediately expand to take the entire state out from under the collapsing banking structure. So it’s a kind of insurance policy — a really cheap insurance policy,” he said.