With the reckless activities of the Federal Reserve and the United States Treasury over the past several years, some among the punditry are starting to fret that America may soon find herself engulfed by high inflation or even hyperinflation. The former has been a scourge since time immemorial wherever improvident governments chose to debase the value of their own currency. The latter — the catastrophic decline in a currency’s value, manifested by consumer price increases by hundreds or thousands of percent or more over a brief interval — has wreaked financial and social havoc on empires large and small for millennia, bringing post-World War I Germany to its knees in the 1920s, overthrowing the government of Argentina in the 1980s, and driving once-prosperous Zimbabwe into utter ruin in the current decade.

Begotten by irresponsible fiscal policy — the expansion of the money supply via the printing press — both inflation and hyperinflation have the potential to damage severely the body politic. Hyperinflation in particular is usually accompanied by civil unrest, regime change, and dictatorship. Wherever it rears its ugly head, confidence in banks, money, and the economy as a whole is lost. Savings are wiped out as currencies lose value, and pauperized citizens revert to a barter economy. Bereft of assets, the desperate often turn on one another, prompting an explosion in violent crime and even revolution. The damage done by hyperinflation can require generations to undo.

Small wonder that many American economists, dismayed at the enormous expansion of the money supply under Bernanke’s Fed, are warning of the specter of hyperinflation and its potentially devastating consequences both to the economy and to the American body politic. Yet such a calamity is not without precedent in American history. Both during the Colonial period and during the Revolutionary War, America endured bouts of crippling inflation and hyperinflation, always caused by the same mistaken policies — and always curable by the same remedy.

Inflation and hyperinflation since the 17th century — the time that witnessed the birth of modern banking and finance in northwestern Europe, especially in England and Holland — have always been by-products of so-called fiat money, money that is issued without convertibility into a precious metal like gold or silver (“specie”). Because consumers typically prefer gold and silver, fiat money is usually reinforced by “legal tender” laws that compel people to use it.

Before the invention of the modern computer, the printing press was the tool used by governments and their kept banks to issue fiat money. To be sure, the printing press can wreak havoc merely by issuing more paper money than there exist reserves of specie to redeem it, should the demand arise. But the worst damage has always been done by the issuance of pure paper money backed by nothing but the say-so of banks and governments that it will forever retain its value.

The dubious distinction of the invention of paper money, at least in the Western world, falls to the Massachusetts Bay Colony. In the late 1600s, this ambitious and prosperous colony was in the habit of conducting regular military raids on French Canada and paying the soldiers who participated in these campaigns with plunder. But the 1690 expedition did not go as planned. The French in Quebec routed the Massachusetts raiders and sent them home empty-handed. Massachusetts, unable to borrow money from Boston merchants to pay the soldiers, hit upon a novel scheme: The colony would print 7,000 pounds worth of paper notes to pay the soldiers, but would pledge to redeem them within two years in gold and silver extracted from the colonists via taxation. The Massachusetts Bay colonial government also promised never to print any more money.

But within a few months, the government, unable to resist the siren song of the new paper money, printed tens of thousands of additional paper pounds, triggering massive inflation and driving good money — silver, mostly — out of circulation. Two years later, the Massachusetts government, frustrated by citizens’ understandable reluctance to use the rapidly depreciating paper currency, passed laws making it legal tender.

Despite the unhappy experience of Massachusetts, other New England colonies began to issue paper money as well. By 1711, both Connecticut and Rhode Island were doing their part to inflate the money supply. More than 200,000 pounds of paper money had been printed in New England, pyramided on an asset base of at most a few tens of thousands of pounds in gold and silver coin and bullion. Silver was being driven out of circulation by the inexorable effects of “Gresham’s Law,” the economic truism that bad money always drives out good. In 1711, Massachusetts suffered another failed expedition to Quebec, and printed an additional 500,000 pounds to cover the shortfall.

And so it went. Far from being chastened by Massachusetts’ poor example, the other colonies all jumped on the paper-money bandwagon. Massive inflation in all 13 colonies was the result, with the value of paper pounds depreciating over the first few decades against silver. In Rhode Island, the most inflationary of all the colonies, paper notes originally issued at par with the pound sterling had sunk by 1740 to a ratio of 23 to 1, corresponding to a rate of inflation of 2,200 percent over several decades. The least inflationary of colonial paper, that of Pennsylvania, had appreciated by 80 percent, while Massachusetts, the originator of the madness, had endured inflation of roughly 1,000 percent — not numbers worthy of modern-day Zimbabwe, to be sure, but formidable enough to create unending economic and civil woes. The colonial governments, faced with chronic shortages of specie, passed various legal tender laws threatening those who refused to use the depreciated currency with confiscation of assets and imprisonment. But the destruction of the money supply continued apace — indeed, accelerated — through the French and Indian War, as cash-strapped colonial governments printed still more money to pay for the war.

The British parliament, meanwhile, dismayed at the destructive effects of runaway inflation in the colonies and under pressure from British traders who resented being paid for their wares in nearly worthless colonial scrip, promulgated two Currency Acts, in 1751 and 1764, to rein in the insanity. The first act cracked down on the New England colonies, allowing the continued payment of public debts (i.e., taxes) in existing paper money (which had come to be called “bills of credit”) but prohibited its use for private transactions. The future emission of bills of credit was severely limited. The 1764 Currency Act, enacted soon after the end of the French and Indian War, extended the provisions of its predecessor to the rest of the British colonies, but did not outright prohibit the emission of bills of credit. Instead, the act forbade the passage of legal tender laws to compel their acceptance.

Although the British parliament, whatever its motives, was acting in the best economic interests of the financially intemperate colonies, many colonists resented the Currency Acts as hindrances to economic activity and as encroachments on their liberties. With the exception of Delaware, the colonies came to view the Currency Act of 1764 as one of the “major grievances” committed by the British government against the Americans. It was labeled by the first Continental Congress of 1774 as one of seven acts of parliament “subversive of American rights.” The right to debase one’s own currency, it would seem, was an entitlement of sovereign states — one the Americans would soon put to the test in their war of independence.

Paying for War

The American colonies were, by the time of the outbreak of war with Britain, thoroughly steeped in the seductive sorcery of fiat money. It is therefore not surprising that one of the first things the Continental Congress did in 1775 was approve the issue of $2 million in brand-new paper money, pyramided atop an estimated colonial money base of about $12 million. Gouverneur Morris, the brilliant young New York aristocrat who became one of the authors of the United States Constitution a generation later, led the movement for paper money. Congress made no promises ever to redeem the money in specie, but it was fondly hoped the scrip would be retired by the states within seven years via taxation.

Of course, the initial promises and austerities were soon abandoned, and by year’s end, the Continental Congress was printing money on a scale the world had never seen before. Unable to cover the war expenses with the initial $2 million issue, it printed another $4 million by year’s end, thereby increasing the entire existing money supply by 50 percent.

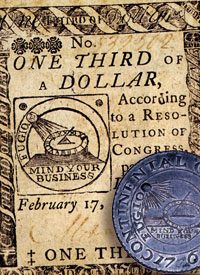

Nor was Congress finished. The next year — the year the Declaration of Independence made a protracted, all-out war inevitable — an additional $19 million was printed, more than doubling the pre-war money supply. The printing presses ran without surcease for the next five years, emitting a total in $225 million in new “Continentals,” as the currency was called. In the meantime, the states, newly emancipated from the perceived restraints of the Currency Acts, were running the printing presses on their own, cranking out bills of credit that competed with Continentals in an inflationary — and eventually, hyperinflationary — race to the bottom.

And bottom out the Continental dollars did, depreciating with astonishing speed until, by early 1781, they were worth only 1/168th of their original value, a rate of inflation of 16,700 percent over a mere six years. Much the same happened with dollar-denominated bills of credit issued by the states, which, like the Continental, faded into worthlessness by war’s end as a result of more than $200 million in new money emitted by state-based printing presses.

The social calamity occasioned by this inflationary wartime finance is difficult to overstate. Soldiers were paid in Continentals, but farmers and merchants refused to accept them, leading the Continental Army to confiscate needed goods like foodstuffs in exchange for promissory notes or “certificates” that soon became as worthless as the paper they were printed on. Attempts to fix prices and compel redemption of bills of credit at par led to shortages and other ills. The British took advantage of America’s financial vulnerability by printing large numbers of counterfeit Continentals to further debase the value of the American currency. By war’s end, the American government abandoned any further pretense at redeeming the hundreds of millions of new dollars of printed money. Worthless wartime Continentals and state-issued bills of credit disappeared from circulation, and inflated wartime prices quickly collapsed. This deplorable state of affairs, wrote economist Murray Rothbard, was at least the lesser of two evils:

The one redeeming feature of this monetary calamity was that the federal and state governments at least allowed these paper issues to sink into worthlessness without insisting that taxpayers shoulder another grave burden by being forced to redeem these specie issues at par, or even to redeem them at all.

By the time of the Constitutional Convention in Philadelphia in 1787, most Americans had had enough of paper money, inflation, and hyperinflation. American finances had been a spectacle of instability for almost a century, making it difficult for ordinary Americans to accumulate monetary wealth. If America were to realize her potential as a new nation, she would have to grow out of her monetary adolescence and furnish for her citizens a financial climate in which savings could accrue and confidence could be maintained.

Maintaining Sound Money

The monetary solution hit upon at the Constitutional Convention was not novel, but it proved effective for generations to come. Sound money was restored by returning to a strict standard of gold and silver, a state of affairs given full countenance by the new Constitution.

Congress alone was given the authority, in Article I, Section 8, to “coin money, regulate the value thereof, and of foreign coin.” (This last provision reflected the fact that Spanish silver dollars — which gave their name to the new American currency — were, until well into the 19th century, widely circulated in the United States.) It is worth noting that the term “coin” would appear to disallow the printing of paper money, or at least of paper not fully redeemable in gold and silver coin. This interpretation is supported by additional provisions, in Article I, section 10, prohibiting the states from coining money, emitting bills of credit, or “make[ing] any thing but gold and silver coin a tender in payment of debts.” Contrary to the uninformed claims of some modern self-styled sophisticates, the American Founders were well aware of the distinction between coined and printed money, and did not intend for the nation they created to repeat the experiences of the Colonial period and the Revolutionary War with fiat money.

The new American government under the Constitution acted with relative dispatch in discharging its new delegated monetary powers. In 1792, the Coinage Act was passed denominating the new American coins to be minted. The act authorized three gold coins — $10.00 eagles, $5.00 half eagles, and $2.50 quarter eagles — and five silver coins ranging from the silver dollar to the half disme (five cents, abandoned in the 1870s in favor of the nickel). Additionally, copper cents and half cents were minted, although the latter were discontinued in 1857. Any American citizen could bring gold or silver to the mint to be coined. All coins were required to have a representation of liberty (usually Lady Liberty in some guise) and the inscription “liberty” as well as a representation of an eagle and the date of minting. As any numismatist can attest, the coins of early America are not only uniquely beautiful, they also contrast remarkably with the parade of presidents, statesmen, buildings, and Native Americans that adorn more modern coins and paper money and which are emblematic of rather different national priorities from those of the lovers of liberty who founded our nation’s finances.

Although the bimetallic standard established by the Founders was effectively abolished by the Fourth Coinage Act of 1873, the United States remained on a full gold standard until 1934, when FDR made private ownership of gold coins illegal, ending the ability of ordinary Americans to redeem paper money for specie, a right Americans had enjoyed since the ratification of the U.S. Constitution.

Not coincidentally, the money supply under the modern fiat money regime has been inflated enormously; in the past eight decades or so, the U.S. dollar has lost much of its original purchasing power. Although modern fiat money is created by computer entry rather than the printing press, the results are the same — the gradual debauchment of currency, subtly eating away at savings accounts and propelling the cost of everything from supermarket eggs and milk to houses and college educations into the stratosphere.

Like colonial Americans, our generation has gotten used to “a little inflation,” unaware that the same forces that once caused investment portfolios to swell and real-estate holdings to appreciate almost without limit are also responsible for the monumental bust we are now experiencing. Even more ominously, the efforts of the Federal Reserve to re-inflate the bubble by pumping more and more money into the economy has the potential to trigger not merely a currency correction but a calamitous collapse of the entire economy, on a scale that would dwarf even the hyperinflation of the Revolutionary War and its doleful aftermath. Modern America is dependent on savings accounts and other dollar-determined measures of wealth to a much greater degree than were Americans in the 18th century. An episode of Weimar Republic-esque hyperinflation would wipe out untold trillions in savings accounts, retirement accounts, and other assets whose value is determined ultimately by bookkeeping entries. It is difficult to imagine the social and economic dislocation such a catastrophe would entail.

On the other hand, as the Founders discovered after several generations of colonial monetary folly, the solution to the ills of inflation and hyperinflation is to be found in sound money. With the ratification of the Constitution, the Founders reinstated sound money, an institution that had been out of favor in the colonies for nearly a century. The economic miracle that ensued propelled the United States to the apogee of wealth and power within a few generations.

Although our present time of troubles will admit of no instant fix, our financial troubles can only be solved in the long run if we follow the example of the Founders and restore a precious-metal standard to America. Otherwise, if we persist in our madcap dash into hyperinflationary turmoil, the choice will be made for us.