The European Union just announced plans for a central bank digital currency to be implemented at the end of next year. A member of the European Central Bank said this digital euro is the future of money. But rest assured, it would not take the place of other forms of money, he claims.

So we have to ask, “How much do you trust digital currency?” Or perhaps a better question is, “How much do you trust the government to manage money, including your access to it?”

We’ll look at just how well our own federal government has managed money and show you a few examples of why this move should be very concerning for anyone who cherishes their freedom. All this in today’s episode of Analysis Behind the News.

If you’re concerned about American independence and freedom, then please watch and take the recommended actions. Also, be sure to like, subscribe, and share, so we can break through Big Tech censorship and reach many others.

Breitbart recently reported,

A presentation from Piero Cipollone, a Member of the Executive Board of the European Central Bank (ECB), published on Wednesday said that a “digital euro,” which he dubbed “the future of money,” could be made available to the public by November of 2025.

The central banker said that a digital euro would bring cash-like features to the digital world, saying that it would be functional on and offline, would be free for basic use, have “Pan European reach,” would be “respectful of privacy,” and crucially would be issued by a central bank.

Gee, what could go wrong?

First of all, let’s recognize a basic fact: The individual member states of the European Union have lost much of their sovereignty and independence over the many decades of EU bureaucratic rule. For example, those in the European Commission, who are unelected and unaccountable to the people of those nations, draft laws that the Commission expects every member to adopt.

Such bureaucracy helps each nation to integrate under a regional government that takes over more and more of the governing duties of each country. This is a main reason why the U.K. voted in 2016 to get out of the EU.

Modern business textbooks explain the seven stages of the concept of economic integration and point to the EU as an example of successful integration:

1. Preferential Trading Area

2. Free Trade Area

3. Customs Union

4. Common Market

5. Economic Union

6. Economic and Monetary Union

7. Economic Integration

A Central Bank Digital Currency, or CBDC, would further this integration, allowing the regional government to gain much more control over the spending and saving habits of not just the country, but of its individual people and businesses. Keep in mind that these same steps are being used on the U.S., Canada, and Mexico to form a North American Union, although we are much further behind thanks in large part to The John Birch Society and other liberty-minded organizations and individuals that stood with us in a coalition over a decade ago.

This digital currency has the potential for massive invasive digital surveillance that could track purchasing decisions and consumption patterns. Plus, as China has demonstrated with its tracking capabilities, the opportunity for social engineering is overwhelming.

Case in point: Remember what happened to the freedom convoy of truckers in Canada? In 2022, thousands of truckers protested against Covid shot mandates. They blocked access to cross-border bridges and interstates, and then eventually surrounded the government buildings in Ottawa.

Using powers granted under the Emergencies Act, the federal government has directed banks and other financial institutions to stop doing business with people associated with the anti-vaccine mandate convoy occupying the nation’s capital.

According to the regulations published late Tuesday, financial institutions are required to monitor and halt all transactions that funnel money to demonstrators — a measure designed to cut off funding to a well-financed protest that has taken over large swaths of Ottawa’s downtown core.

Unfortunately, it did more than that. Protestors soon found themselves not able to access their money, including cryptocurrency. Canada’s federal government also went so far as to order insurance companies to suspend policies on vehicles involved in the protest.

CBC also reported, “A senior government official, speaking to reporters at a technical briefing on the Emergencies Act, said these measures are designed to target ‘key sources of funding.’”

“’The economic order does require financial service providers to do some due diligence around the property they own of entities and individuals involved in the illegal protests,’ the official said.”

If the Ottawa government was willing to go that far in preventing free speech and a redress of grievances affected by government tyranny, then what power will be extended over those that don’t conform to official narratives or official sustainable development consumption habits as the United Nations would like to see implemented?

Also, thanks to a change in the Merchant Category Codes last year, banks and credit-card companies have a way to track gun sales made on credit cards, which gives them the option of not allowing the purchase. Since then, only eight states have stepped forward to ban this tracking.

Implementing a CBDC in any country would put tracking on steroids. Perhaps this opportunity for control is why it’s being advocated for by the World Economic Forum, the Bilderberg group, and others that have a large stake in implementing globalism through large-scale economic integration.

The Federal Reserve reported last month that 90 percent of central banks are exploring CBDCs.

As William Jasper reported for The New American, “A crucial component of the [World Economic Forum’s] Great Reset’s schemata for global social-political-economic control is the adoption of Central Bank Digital Currencies (CBDC), a cashless, digitized monetary system that would bestow on governments the power not only to create unlimited ‘money’ with a computer keystroke, but also to surveil your every transaction. Moreover, it would give governing authorities unprecedented powers to ‘cancel’ you, to wipe out your digital savings, and/or your permission to buy-sell-rent, should you engage in political dissent or thought crimes.”

The majority of consumers who learn that CBDCs offer an opportunity for government to control what they purchase are against the Federal Reserve from implementing one, according to a poll conducted by the Cato Institute.

Yet, 119 countries are in some stage of CBDC development, according to the Atlantic Council, that has set up a map to track such developments.

Regarding what a CBDC would like look in this country, Investopedia.com suggests, “The U.S. central bank digital currency (CBDC) will be the digital or electronic form of the U.S. dollar issued by the Federal Reserve. This form of digital fiat money will be similar to cryptocurrencies, but the fundamental difference will be that a CBDC will be backed and regulated by the Federal Reserve and act as a legal tender.”

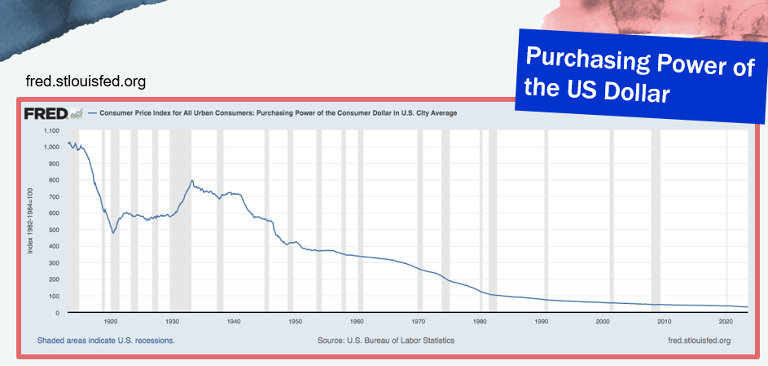

Let’s repeat that key phrase, “regulated by the Federal Reserve.” Our monetary system is regulated by the Federal Reserve now. How do you think it is doing?

If it was doing a good job, then the value of the American dollar would be very high, which gives us a plenty of purchasing power.

According to the Federal Reserve, here is how it is doing:

This chart shows you the decline in the value of the American dollar from 1913 to 2021. The value has dropped about 98 percent!

But it didn’t used to be that way. The American dollar used to be backed by gold and silver, which kept the value of a dollar very high, compared to other currency that had no backing. However, money backed with precious metals is not easily inflatable. If you wanted to increase the supply of money, more gold and silver would have to be mined. Currency with no backing is easily inflatable either through counterfeiting or through government creation.

Throughout the 20th century, the American dollar was slowly weaned off of gold and silver and is now only backed by the promise that the federal government will honor its value.

In order to satisfy the spending appetite of Congress, the Federal Reserve creates money out of thin air, lends it to the U.S. Treasury with interest, and American taxpayers are responsible for paying this back. When the Federal Reserve creates this money, it adds more to the supply, thereby inflating the money supply, otherwise known as inflation.

When the markets are flooded with additional money not backed by precious metals, the entire money supply goes down in value, just like flooding a market with a specific product, which drives down its value. Unfortunately, devalued currency requires more of it to buy products. Thus, prices rise. So don’t blame your grocery store, your gas station, or your big box store for rising prices. Blame your government for its reckless and irresponsible spending.

Do you think this will improve with a CBDC, or make things much worse?

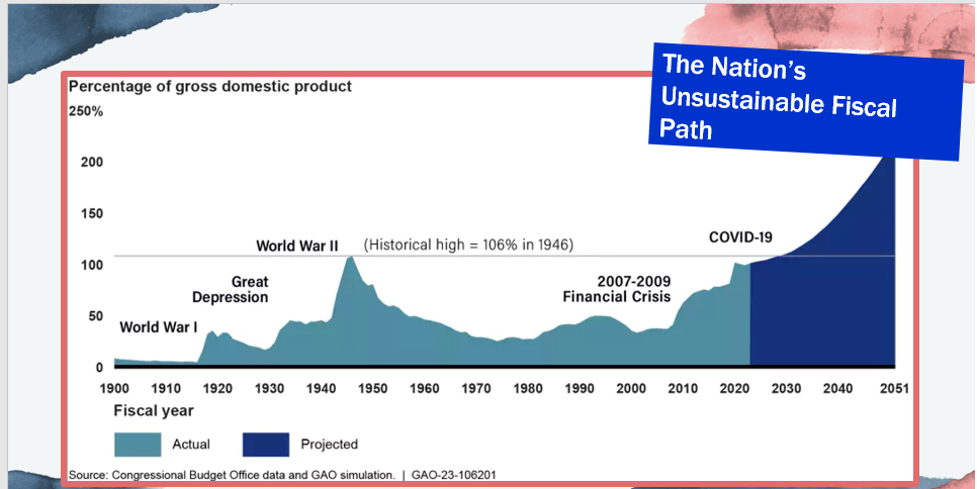

Instead of allowing the Federal Reserve to manage money, including any CBDCs, we should end the Fed to force Congress to stop spending. Just look at the size of the federal debt compared to Gross Domestic Product. The debt stands just above $35 trillion, while GDP is $28 trillion. The Fed continues to prop up the federal corpse with nearly unlimited dollars. This graph is already out of date, as we have been over 100 percent GDP for a few years. This means that the country would have to work for free for more than a year to pay off the federal debt.

I haven’t met a single American willing to do this, and unfortunately, neither is Congress. Congress adds a trillion dollars to the debt every 100 days. Families and businesses following a similar path don’t get too far down this road. How long do you think the nation can keep this up?

Our nation’s governing document, the Constitution, offers guidance on money. In Article I, Section 8, it mentions that within its enumerated powers, Congress shall have power … to coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures.”

This means the federal government can establish a mint to stamp the people’s precious metals into coinage of a fixed size, weight, and purity. It can also determine and then publish the value of various foreign coinage. And then to create a standard of weights and measures to facilitate normal transactions.

That’s it! The government doesn’t have permission to print as much money as it needs, including a CBDC. Nor is it allowed to rob Americans of their money by devaluing the dollar through inflation.

Allowing a CBDC would like be throwing gas onto the fire of tyranny. This could ultimately give government and its regulators the ability to determine who may buy or sell in the marketplace. The John Birch Society has warned against this very thing for decades. As we pointed out in an issue of our news magazine in 1987, “A move is underway to create a cashless society — because cash makes men free — and freedom is out of fashion.”

The war on our money has been a war of control over citizens. The near-digital world that all of us enjoy from smart phones to smart TVs to credit and debit cards to social media, emails, texts, and apps have helped to condition society for the end game of tyranny under a world government.

Back in 2009, after the bailout mania of the biggest banks, The John Birch Society began a sound money campaign to put the brakes on the upcoming collapse. The seven-step plan we proposed then is very much fitting today:

1. Restate the only legal definition of the “dollar” ever provided by the U.S. government.

The U.S. Mint Act of 1792 defined the dollar as the nation’s monetary unit, containing 371.25 grains of silver. Accompany that statement with a companion assertion that gold coinage shall be valued in dollars according to whatever the corresponding market value for gold may be at any given time.

2. Allow private mints to compete with the U.S. Mint.

While the U.S. Mint shall continue to stamp the people’s silver and gold into coinage, the only government involvement in this process shall be prosecution of any persons producing falsely labeled coinage not equivalent in value (purity, weight, etc.) to what is claimed for the coins by their producer.

3. Abolish all legal tender laws that currently provide legitimacy only for Federal Reserve Notes.

Such laws have effectively given the Fed a monopoly.

4. Prohibit government issuance of “bills of credit.”

Allow any bank or mint to issue its own notes, provided there is real money to back them. Banks issuing unbacked currency should expect to be repudiated, even prosecuted.

5. Abolish the Federal Reserve.

It must not be replaced by some federal agency that will have power to repeat the process currently employed by the Fed. There is no authorization in the Constitution for the government to do anything but “coin money” and establish a standard of values. Let there be competition in the coinage of money. Competition will result in excellence.

6. Support bills in Congress to abolish the Fed, audit the Fed, and cancel legal tender laws.

Members of Congress must be encouraged to support enactment of these important measures.

7. End deficit spending and unconstitutional programs.

Once federal government programs not authorized by the Constitution can be abolished, then the federal income tax can be abolished. Instead of doing something, federal officials must be persuaded to undo an array of existing programs.

And perhaps we should add an eighth: Get control of your personal financial situation. This means paying people what you owe them, getting out of debt, and not borrowing money. Don’t follow Congress’s example. Be responsible with your money and make it work for you. The more responsible you are, the less excuse you give Congress to step in.

The John Birch Society has long supported sound money and a restoration of constitutional government. We are seeing results of these in many states throughout the country.

The ground game that we bring to the movement is second to none and sets us apart from all other patriotic organizations. If you want to save America, then join The John Birch Society, where you will work shoulder-to-shoulder with other like-minded patriots in your community.

Helpful links are located in the video description, including a link to tell Congress to audit the Fed and restore the gold standard.

I’m Bill Hahn for The John Birch Society, and until next time, learn more, and take action!

ACTION ITEMS:

Tell Congress to Audit the Federal Reserve

Tell Congress to Restore the Gold Standard