Many economists, politicians and pundits assert that median wages have stagnated since the 1970s. That’s a call for government to do something about it. But before we look at the error in their assertion, let’s work through an example that might shed a bit of light on the issue.

Suppose that you paid me a straight $20 an hour in 2004. Ten years later, I’m still earning $20 an hour, but in addition, now I’m receiving job perks such as health insurance, an employer-matched 401(k) plan, paid holidays and vacation, etc. Would it be correct to say that my wages have stagnated and I’m no better off a decade later? I’m guessing that the average person would say, “No, Williams, your wages haven’t stagnated. You forgot to include your non-monetary wages.” My colleagues Donald Boudreaux and Liya Palagashvili discuss some of this in their recent Wall Street Journal op-ed, “The Myth of the Great Wages ‘Decoupling.'”

They start out saying: “Many pundits, politicians and economists claim that wages have fallen behind productivity gains over the last generation…. This story, though, is built on an illusion. There is no great decoupling of worker pay from productivity. Nor have workers’ incomes stagnated over the past four decades.” There are two routinely made mistakes when wages are compared over time. “First, the value of fringe benefits — such as health insurance and pension contributions — is often excluded from calculations of worker pay. Because fringe benefits today make up a larger share of the typical employee’s pay than they did 40 years ago (about 19 percent today compared with 10 percent back then), excluding them fosters the illusion that the workers’ slice of the (bigger) pie is shrinking.”

The second comparison problem is a bit technical, when the consumer price index is used to adjust workers’ pay for inflation while a different measure (the gross domestic product deflator) is used to adjust the value of the nation’s economic output for inflation. Harvard University’s Martin Feldstein noted in a National Bureau of Economic Research paper in 2008 that it is misleading to use different deflators. Boudreaux and Palagashvili point out that when more careful measurements have compared worker pay (including the value of fringe benefits) with productivity using a consistent adjustment for inflation, they move in tandem. The authors say: “The claim that ordinary Americans are stagnating economically while only ‘the rich’ are gaining is also incorrect. True enough, membership in the middle class seems to be declining — but this is because more American households are moving up.”

Many economists and other social scientists determine well-being by looking at income brackets instead of people. When one looks at people, he finds considerable income mobility. According to a report by the Department of the Treasury titled “Income Mobility in the U.S. from 1996 to 2005,” there was considerable income mobility of individuals in the U.S. economy during that period. Using Internal Revenue Service tax return data, the report says that more than half of taxpayers moved to a different income quintile over this period. More than half of those in the bottom income quintile in 1996 had moved to a higher income group by 2005. The mobility also goes in the opposite direction. Of the highest income earners in 1996 — the top one-hundredth of 1 percent — only 25 percent remained in this group in 2005. The percentage increase in the median incomes of those in the lower income groups, between 1996 and 2005, increased more than the median incomes of those initially in the higher income groups.

Boudreaux and Palagashvili conclude that “middle-class stagnation and the ‘decoupling’ of pay and productivity are illusions. Yes, the U.S. economy is in the doldrums, thanks to a variety of factors, most significantly the effect of growth-deadening government policies like ObamaCare and the Dodd-Frank Act. But by any sensible measure, most Americans are today better paid and more prosperous than in the past.”

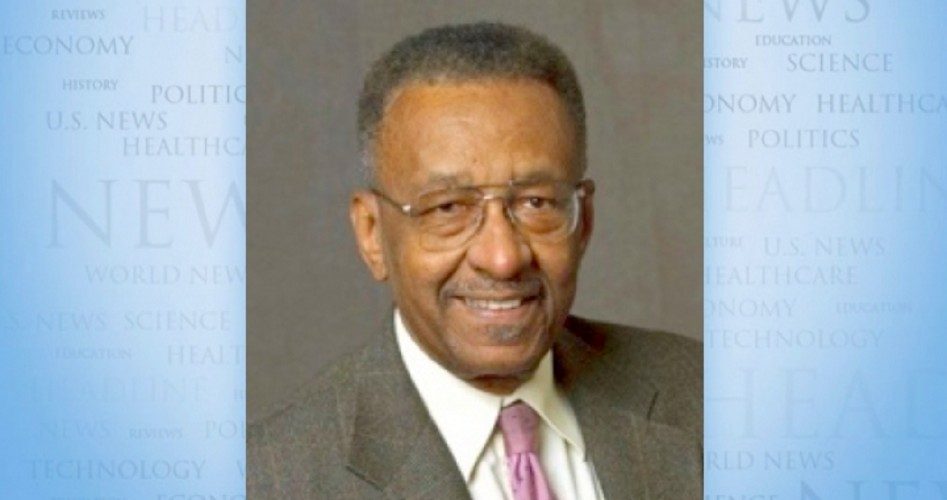

Walter E. Williams is a professor of economics at George Mason University. To find out more about Walter E. Williams and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate Web page at www.creators.com.

COPYRIGHT 2014 CREATORS.COM