August is the month when parents bid farewell to not only their college-bound youngsters but also a sizable chunk of cash for tuition. More than 18 million students attend our more than 4,300 degree-granting institutions. A question parents, their college-bound youngsters and taxpayers should ask: Is college worth it?

Let’s look at some of the numbers. According to the National Conference of State Legislatures, “when considering all first-time undergraduates, studies have found anywhere from 28 percent to 40 percent of students enroll in at least one remedial course. When looking at only community college students, several studies have found remediation rates surpassing 50 percent.” Only 25 percent of students who took the ACT in 2012 met the test’s readiness benchmarks in all four subjects (English, reading, math and science). Just 5 percent of black students and 13 percent of Hispanic students met the readiness benchmarks in all four subjects. The NCSL report says, “A U.S. Department of Education study found that 58 percent of students who do not require remediation earn a bachelor’s degree, compared to only 17 percent of students enrolled in remedial reading and 27 percent of students enrolled in remedial math.”

The fact of business is that colleges admit a far greater number of students than those who test as being college-ready. Why should students be admitted to college when they are not capable of academic performance at the college level? Admitting such students gets the nation’s high schools off the hook. The nation’s high schools can continue to deliver grossly fraudulent education — namely, issue diplomas that attest that students can read, write and compute at a 12th-grade level when they may not be able to perform at even an eighth- or ninth-grade level.

You say, “Hold it, Williams. No college would admit a student who couldn’t perform at an eighth- or ninth-grade level.” During a recent University of North Carolina scandal, a learning specialist hired to help athletes found that during the period from 2004 to 2012, 60 percent of the 183 members of the football and basketball teams read between fourth- and eighth-grade levels. About 10 percent read below a third-grade level. These were students with high-school diplomas and admitted to UNC. And it’s not likely that UNC is the only university engaging in such gross fraud.

Many students who manage to graduate don’t have a lot to show for their time and money. New York University professor Richard Arum, co-author of “Academically Adrift: Limited Learning on College Campuses,” says that his study shows that more than a third of students showed no improvement in critical thinking skills after four years at a university. That observation is confirmed by the many employers who complain that lots of recent graduates cannot seem to write an email that will not embarrass the company. In 1970, only 11 percent of adult Americans held college degrees. These degree holders were viewed as the nation’s best and brightest. Today, over 30 percent hold college degrees, with a significant portion of these graduates not demonstrably smarter or more disciplined than the average American. Declining academic standards and grade inflation tend to confirm employer perceptions that college degrees say little about job readiness.

What happens to many of these ill-prepared college graduates? If they manage to become employed in the first place, their employment has little to do with their degree. One estimate is that 1 in 3 college graduates have a job historically performed by those with a high-school diploma or the equivalent. According to Richard Vedder, who is a professor of economics at Ohio University and the director of the Center for College Affordability and Productivity, we had 115,000 janitors, 16,000 parking lot attendants, 83,000 bartenders and about 35,000 taxi drivers with bachelor’s degrees in 2012.

The bottom line is that college is not for everyone. There is absolutely no shame in a youngster’s graduating from high school and learning a trade. Doing so might earn him much more money than many of his peers who attend college.

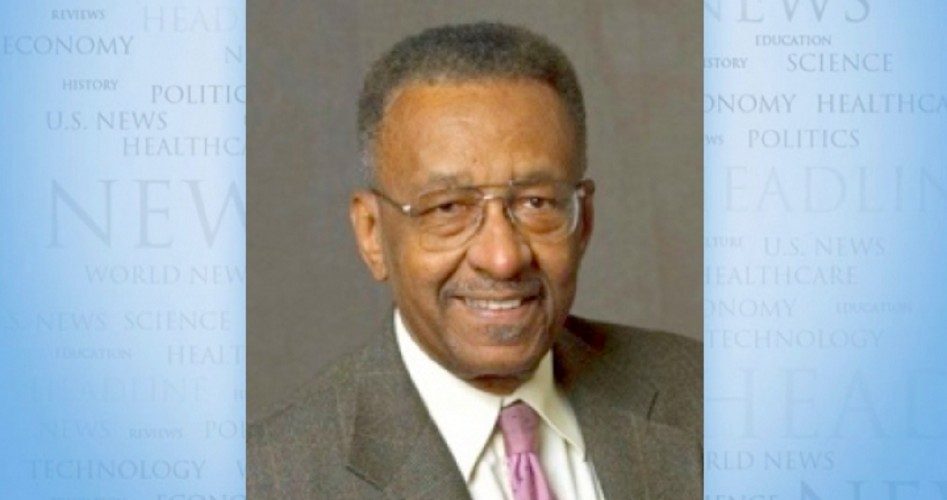

Walter E. Williams is a professor of economics at George Mason University. To find out more about Walter E. Williams and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate webpage at www.creators.com.

COPYRIGHT 2017 CREATORS.COM