Many investors, businesses, and consumers cheered the Federal Reserve’s first interest rate cut since March of 2020. The Fed’s 50 basis points interest rate reduction was larger than many Fed watchers anticipated and was followed by suggestions that there are more rate cuts on the way.

A drop in borrowing costs following the Fed’s rate reduction can help make people more optimistic about the general economy and their own financial situation. The uptick in consumer sentiment could help Democratic presidential nominee Vice President Kamala Harris who has lagged behind Republican nominee former President Donald Trump on the matter of which candidate is seen as better on economic issues.

Even before the Fed’s rate cut, President Trump and pro-Trump commentators were suggesting that a rate cut would be a “September surprise” designed to boost Vice President Harris. This claim was dismissed by the “mainstream” media as a baseless “conspiracy theory.” However, anyone familiar with the Federal Reserve’s history of tailoring monetary policy to advance political goals would not have any trouble believing that the Fed would cut interest rates to help its preferred candidate.

Federal Reserve Chairman Jerome Powell has an incentive to prevent a Trump return to the Oval Office. While in the White House, President Trump regularly criticized Powell for not further lowering already historically low interest rates.

President Trump has also indicated that, if he wins, he will push Congress to give the president a direct role in monetary policy. Vice President Harris, in contrast, has promised to not interfere with the Fed’s conduct of monetary policy. It is easy to see why Powell and his Fed colleagues might want to help Harris.

Anyone who has been to a grocery store knows the Fed has not “defeated” price inflation. However, even official government data shows “softness” in the labor market. This Fed rate cut likely had more to do with concerns about increasing unemployment than the Fed’s claim that inflation will soon reach the Fed’s two percent target.

The Fed is between a rock and a hard place. If it does not lower rates, there is concern that unemployment will increase as the economy falls into a recession. On the other hand, keeping rates low runs the risk of hyperinflation and a collapse of the dollar’s value. The most likely scenario is a return of “stagflation” where rampant price inflation coexists with high unemployment.

Interest payments on the national debt will exceed one trillion dollars this year, putting more pressure on the Federal Reserve to monetize the debt, thus creating more inflation.

The Fed’s interest rate reduction may have increased Kamala Harris’s chances to win the presidency. However, the rate cut also increases the odds that the next president will face a major economic crisis. The crisis will either be caused by or result in a rejection of the dollar’s world reserve currency status.

The best thing politicians can do in the crisis is to avoid the temptation to “stimulate” the economy. Instead, they should let the recession run its course and begin dismantling the welfare-warfare state and the fiat money system.

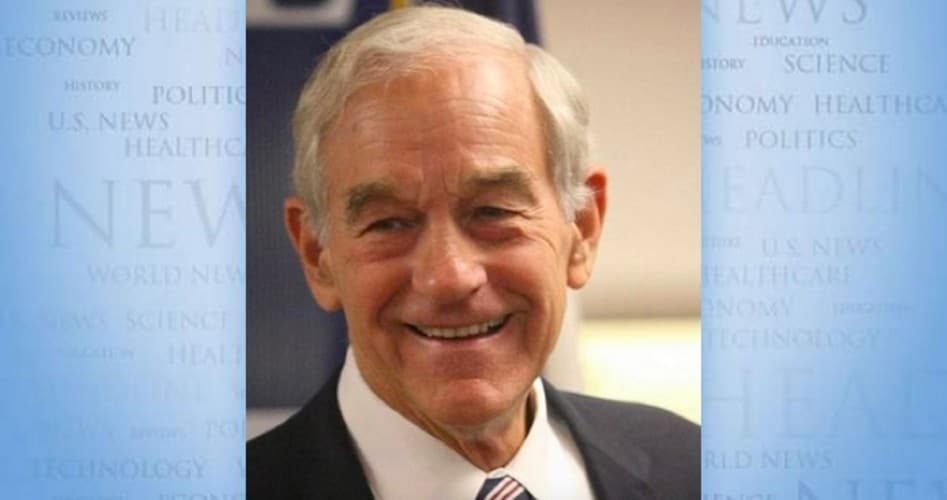

Ron Paul is a former U.S. congressman from Texas. This article originally appeared at the Ron Paul Institute for Peace and Prosperity and is reprinted here with permission.