New York University economics professor Nouriel Roubini made a name for himself back in 2005 by predicting the Great Recession long before others did. Fortune magazine wrote “In 2005 Roubini said home prices were riding a speculative wave that would soon sink the economy.” The New York Times said he predicted “homeowners defaulting on mortgages, trillions of dollars of mortgage-backed securities unraveling worldwide and the global financial system shuddering to a halt.” In September, 2006 Roubini warned that “the United States was likely to face a once-in-a-lifetime housing bust, an oil shock, sharply declining consumer confidence, and, ultimately, a deep recession.”

And so when Robert Zoellick, president of the World Bank, suggested that gold might be used as a “reference point” for a new world currency, Roubini weighed in on the matter. In an interview with NetNet on Monday, Roubini dusted off many of the tired arguments against a gold standard that Keynesians have used for years, including that it would:

a) exacerbate business cycles

b) restrict central banks’ ability to fight deflation

c) eliminate central bank’s ability to stimulate the economy, and

d) remove the central bank’s ability to be a “lender of last resort”

He told NetNet that “When you had a traditional gold standard, boom and bust with severe swings in economic activity were the norm — really big ones. It was only [when] we moved to fiat [paper] money that central banks were able to smooth the business cycle, and make it less volatile….” The interviewer ended the interview with this challenge to Austrian economists who generally support the gold standard: “In short, Roubini’s view challenges the Austrian economists where they live: at the intersection of monetary policy and the business cycle. We eagerly await [your] response. Over to you Ron Paul and the Mises Institute!”

The response was almost immediate. Lew Rockwell, Chairman of the Mises Institute, wrote on his website, www.LewRockwell.com, that “newspapers, governments, and their favored academic economists [like Roubini] all hate the gold standard. I can understand this. The absence of the gold standard has made possible the paper world they all love, one ruled by the state and its managers, a world of huge debt and endless opportunities for mischief to be made.…” He reviewed the arguments Roubini raised and concluded that each of them proved the merits of the gold standard, whether he knew it or not:

• Gold limits the flexibility and range of actions of central banks (check!)

• Under gold, a central bank can’t “stimulate growth and manage price stability” (check!)

• Under gold, central banks can’t provide lender of last resort support (check!)

• Under gold, banks go belly-up rather than get bailed out (check!)

Rockwell expressed surprise that Roubini thought that the gold standard would increase economic volatility, especially since he had called the Great Recession so accurately and convincingly. Rockwell said, “How can [he] say such a thing in the immediate wake of one of history’s biggest bubbles and its explosion…Newsflash [to Roubini]: it wasn’t the gold standard that gave us this disaster.”

The beauty of a true, 100-percent gold coin standard is that it puts control of money back into the hands of its owners: the citizens themselves. It becomes a normal business activity, like buying a pair of shoes or a tank full of gas: real value is exchanged for real value. It is a system that can’t be manipulated to rob its owners. It limits government only to what is has. Gold fulfills all five of the essential elements for true money: it is liquid, it is stable, it is fungible (interchangeable), it is marketable, and can serve as a store of wealth.

The Daily Bell also was surprised at Roubini’s disabusing gold as money.

He believes that a handful of bankers in a room consulting together can set the price of money more effectively than the Invisible Hand. This is a form of price-fixing….

The central banking ideology of the 21st century [espoused by Roubini] still maintains that a few individuals can determine how much money an economy needs. [That ideology] basically denies 300 years of accumulated economic knowledge….

Roubini is supposed to be a hard-nosed proponent of the free market, sound money and entrepreneurialism. But he is evidently and obviously a statist, a socialist who believes that groups of powerful people can make up prices for the market and then attempt to enforce them successfully. [That is] an economically illiterate position.

Rockwell says it’s a matter, at bottom, of a difference in political philosophy: “What kind of society do we want to live in? One ruled by an ever-growing, all-controlling state, or one in which people have freedom…?”

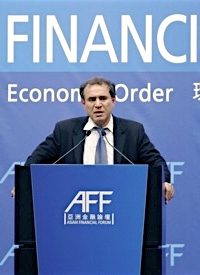

Photo: Professor of Economics at New York University and Co-founder & Chairman of Roubini Global Economics Nouriel Roubini speaks during a luncheon at the Asian Financial Forum in Hong Kong, Jan. 21, 2010, in Hong Kong.: AP Images