Anyone who watches television news for more than a few hours is likely to see an advertisement for gold. As the Federal Reserve continues to print fiat money in vast quantities — backed by nothing except the vague promise that this paper is legal tender and can be used to pay all debts public and private — people are increasingly looking for something of real value. And that something is gold.

When American currency was redeemable in gold, its value was stable. Even “bimetallism,” which provided that currency could also be redeemed in silver, did not significantly affect the value of the dollar.

Historically, a major issue in certain presidential campaigns — such as those of William Jennings Byran v. William McKinley in 1896 and 1900 — was whether to allow dollars to be redeemed in silver. Because of America’s silver mines — primarily in the Rocky Mountain region — allowing such an exchange would bring more currency into circulation, producing mild inflation. What person alive then would have ever imagined the dire straits of today, when our currency is backed only by a federal government drowning in debt?

In today’s economy, home values are stagnant (or even declining), stocks are limp, and interest rates on bonds spiraling downward. What can prudent Americans do to protect themselves? Copper has risen dramatically in value, and it is an abundant metal. However, because substantial values of it are not easily carried about, using it as a form of money is impractical.

Diamond prices, too, have soared in the last few years, and millions of Americans own some sort of jewelry with these gems. Their value, however, depends upon a number of factors which only an expert can judge. Like works of art, which are another hedge against government-induced inflation, diamonds certainly have their place in an investment portfolio, but likely not for average Americans with limited knowledge of their value.

Gold, however, is different. It is fairly easy to distinguish solid gold from other metals or from gold-plated coins. Although rare coins may have value many times greater than the actual metallic worth of the coins, most gold bought as an investment consists of either ingots or common stamped gold coins such as the Canadian Maple Leaf or the South African Kruegerand. Additionally, there are Canadian silver, platinum, and palladium coins.

Though the value of platinum and palladium coins is less familiar, the worth of most of these coins can generally be determined by a simple review of the daily newspaper. Silver, though a precious metal, is less valuable than gold and is also less portable in significant amounts.

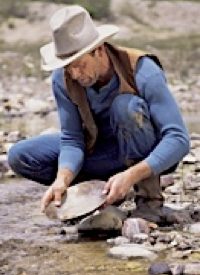

Interestingly, Americans who cannot afford to buy gold are increasingly returning to the time-honored practice of actually panning for it. Bob Gustafson of Liberty, Washington, is one such prospector — who, as CNN notes, looks at his work as something between a hobby and a pipe dream. The retired grandfather of three explains, “You’ve got people who are retired … out here[;] that’s what they do for a living now — they go around and dig for gold.” Gustafson uses a dredge to pull up the sediment, which he then dries and sifts through looking for gold flakes.

According to CNN,

Gustafson dreams of finding “nuggets,” the chunks of gold that other prospectors still sometimes discover in this mountain-ringed valley a century after the first prospectors arrived here.

A few minutes into the dredging, Gustafson points out what he calls “the color” or small gold flakes glinting back at him from the sediment.

“If you get in a good area and find some pieces you can find an ounce fairly fast,” he said.

That ounce can bring gold hunters as much as $1,800. Pumped up gold prices and the popularity of reality TV shows on prospecting fuel what Chris Brawn calls “the new Gold Rush.”

Brawn, a fifth-generation miner, says he would mine regardless of the price of gold. He started when he was only three years old, and is already teaching his son how to mine. He explains what people wanting to mine for gold always ask him:

The most common question I get is, “What’s the biggest piece of gold you have ever got?’” The next is, “Where is the gold?”

He says that some people “are trying to make a living at this. Some people do, some people don’t, but there’s a lot of color left there.”

Brawn also notes that gold mining can become a family outing and a way to get the children outdoors to enjoy the scenery and wildlife:

People have lost their second home or can’t afford to fly to their time shares. They’re looking at this as their next vacation. It’s a great way to get out of the office … and get in the creek with your family.

Brawn dismisses as absurd the claim by environmentalists that prospectors damage the environment, noting that those panning for gold often leave the areas they work cleaner than they found it. He is concerned about plans in several states to ban some of the prospecting methods used by modern amateur gold miners.

Two Washington State retirees who have just begun prospecting for gold are Sandy and Jeff Smith. Sandy loves the aspect of camping in the beautiful surroundings. Jeff notes, “There’s a huge demand for gold at this point because it’s stable. Paper money looks like it’s on the way out. People just don’t have confidence in it anymore.” Sandy adds, “I’d rather do this kind of hard work than other kinds of hard work, even if it just pays for the gas.”

Gold prospecting and panning maps can be purchased from private vendors, and people who use them often combine their prospecting with hiking, fishing, hunting, and similar activities. The U.S. Department of Agriculture does not require a permit to pan for gold. One state in which prospecting for gold is making a comeback is California, where the dismal economic situation, low employment rates, and the collapse of the housing market has produced a sort of second Gold Rush.

Americans who extract gold from the ground are actually helping the economy. This metal is valued around the world. These modern-day prospectors are also helping maintain their economic status without any handout from the federal government or “stimulus” jobs. As well, they are engaging in a healthy, family-oriented recreation when they camp in the woods and pan for gold.

It is not just small part-time prospectors who are taking gold seriously in our economy. The state of California has already reopened several gold mines, including the Briggs Mine in Death Valley, which produced $30 million worth of gold last year — and also created some good-paying, productive jobs so desperately needed in the Golden State.

According to London’s Daily Telegraph, a California complex known as the Lincoln Mine “will extract 1800 oz. of gold per month and create 100 jobs. There could be around $800 million of gold underground — at a time when the price of gold is rising in an uncertain economic situation.”

Whether the gold is taken out commercially by modern firms or panned out by families in creeks, the creation of very real wealth can help our economy — if government doesn’t get in the way. Is that possible? The Obama administration has already attempted to create onerous tax reporting on small-scale gold sales, effectively squeezing these middle-class American prospectors out of the gold market. Additionally, radical environmentalists are pressuring the government for controls, alleging that gold miners are somehow damaging wildlife and streams.

At a time when the Obama administration claims to be looking for ways to produce prosperity in our floundering economy, one sure method is to ensure the right of Americans to do what their ancestors did: go to our streams and extract real wealth for themselves.