To invent, you need a good imagination and a pile of junk. — Thomas Alva Edison

The narrative would be reassuring if it weren’t written with the Federal Reserve’s fiat ink.

U3 unemployment in the United States — unemployed people who have looked for work in the past four weeks — has ratcheted steadily downward, falling from 10.0 percent in October 2009 to 4.9 percent today. Gas prices have dropped 57 percent since April 2011, while real estate prices have rebounded. At 79 months and counting, the current economic expansion is now the fourth-longest in U.S. history.

And yet, the economy is a juiced house of cards, courtesy of the Fed’s easy-money policies over the past seven years. With trillions of stimulus dollars circulating throughout the economy, it’s a race against time for the Fed to raise interest rates in order to stave off inflation without kicking the very underpinnings out from under the house of cards it built.

Is it too late? The bond market thinks so.

The Relationships Between Bonds, Interest Rates and Stock Prices

Bonds and yields (interest rates) have an inverse relationship: As interest rates go up, bond prices move downward. Stocks and bonds, on the other hand, normally trend in the same direction over time. Per Investopedia:

Bond prices and stocks are generally correlated. When bond prices begin to fall, stocks will eventually follow suit and head down as well. As borrowing becomes more expensive and the cost of doing business rises due to inflation, it is reasonable to assume that companies (stocks) will not do as well. Once again, we will see a lag between bond prices falling and the resulting stock market decline.

The markets are extraordinarily diverse and influenced by countless factors, not the least of which is the perceived health of the U.S. economy. As long as investors are convinced that economic growth will continue, they have strong incentive to stay in both stocks and bonds — especially if alternate investments hold less appeal.

The Federal Reserve Juiced a Toothless Recovery

Believing that the economy was at the edge of an abyss in 2008 and unwilling to wait for market forces to self-correct, the Fed undertook desperate measures in order to stimulate the economy. Its most significant steps were three rounds of quantitative easing, a controversial approach which Investopedia defines as follows:

Quantitative easing is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

Although history has proven that the economy would have recovered without the massive negative consequences of government intervention, quantitative easing and other Federal Reserve measures no doubt shortened the Great Recession. The Fed aggressively purchased bonds, forcing down interest rates in the process. Near-zero interest rates fueled a meteoric rise in the stock market, helping Americans to feel wealthier after the housing crash. Low interest rates eventually reignited bank lending.

The recession officially lasted from December 2007 through June 2009, after which the economy began a recovery. Rather than galloping out of the downturn as in previous recoveries, however, the economy has limped along instead, eking out growth at less than two-thirds its post-WWII average.

Market Corrections

Now that the era of easy money has ended, the markets are doing what they always do: correcting themselves. Although the Dow Jones has bounced back over the past few sessions, it is still down nearly 10 percent from its all-time high. GDP growth — no longer benefiting from the Fed’s white hot printing presses — is slowing to a crawl. The Gallup Economic Confidence Index stands at -13 after trending downward for the past year.

The most ominous example may be the bond markets. More specifically, the junk bond markets.

The Bond Markets Are Predicting a Recession

Let’s go back to Investopedia for one last definition, this time the meaning of the term “junk bond.”

A junk bond is a colloquial term for a high-yield or non-investment grade bond. Junk bonds are fixed-income instruments that carry a rating of ‘BB’ or lower by Standard & Poor’s, or ‘Ba’ or below by Moody’s. Junk bonds are so called because of their higher default risk in relation to investment-grade bonds.

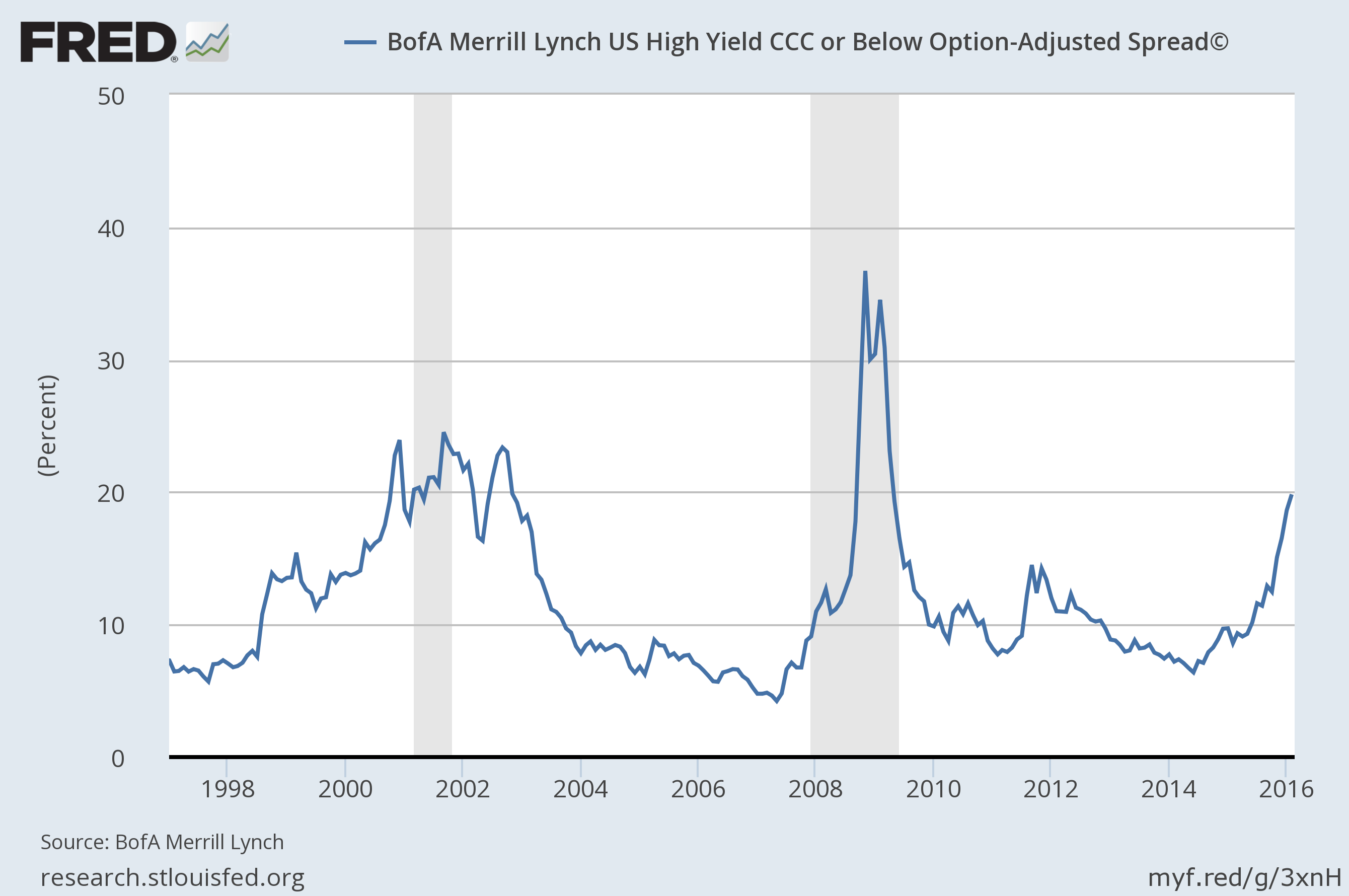

Looking back over the past 20 years, periods of rapid increases have invariably led to recessions.

It’s uncanny. The Option-Adjusted Spreads (OAS) shot upward prior to the 2001-02 recession, and again just before the historic 2007-08 downturn. Although the St. Louis Fed graph doesn’t go further back in time, a quick check of investment-grade corporate bonds showed they did the exact same thing immediately preceding the 1990-91 recession. Investment-grade corporate bonds are one step above junk bonds.

Now, the spreads are rising at an alarming rate.

In Some States, a Recession Is Already Here

Four U.S. states are already technically in recession: Alaska, North Dakota, West Virginia, and Wyoming, with Louisiana, New Mexico, and Oklahoma teetering on the edge. The crashing energy sector is primarily to blame, but rising interest rates, a lack of stimulus money, and other market corrections have also played roles. Storm clouds are on the horizon, not just in energy-dependent states but throughout the country.

Depending upon the media outlet, the percentage risk of a U.S. recession has been reported to be between 20 percent to 44 percent over the next 12 months and rising, especially in the wake of China’s struggles. The world economy may be at an even greater risk: According to a recent Bloomberg article, Citigroup pegged the chances of a China-led global downturn at 55 percent.

No matter what percentage you believe to be valid, it’s clear that the previously juiced economy is beginning to run out of steam. It’s more than a little ironic that it takes a pile of junk to prove that out.

Walter McLaughlin has been in banking and commercial lending for nearly 30 years, specializing in business financing. He manages a small business lending department for a regional bank with offices in Washington, Oregon, Idaho, California, and Utah, winning awards for four consecutive years. He received his Bachelor’s degree in finance from California State University, Northridge in 1986 and graduated from the Stonier Graduate School of Banking in 1997.