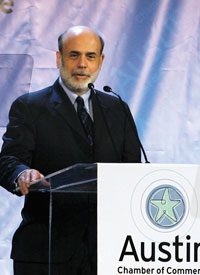

For a man who once worked at South of the Border, the kitschy South Carolina tourist trap on I-95, Federal Reserve Chairman Ben Bernanke has come a very long way. From his hometown in Dillon, South Carolina, where young Bernanke turned heads with his academic achievements (he was a spelling champion who competed in the National Spelling Bee, and achieved a near-perfect score on his college entrance exams), the man who was to become the 14th chairman of the Federal Reserve received a Ph.D. in economics from MIT and eventually became the head of the economics department at Princeton University. Along the way, Bernanke, an admirer of the late economist and Nobel Laureate Milton Friedman, developed a profound interest in the Great Depression and its causes. In 2002, not long after he was appointed to the Federal Reserve’s Board of Governors, Bernanke, speaking on the occasion of Friedman’s 90th birthday, made a startling admission regarding the Federal Reserve’s role in creating the worst economic crisis of the last century:

{modulepos inner_text_ad}

Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve System. I would like to say to Milton and Anna [Schwarz]: Regarding the Great Depression. You’re right, we [i.e., the Fed] did it. We’re very sorry. But thanks to you, we won’t do it again.

Bernanke, like Friedman and other economists of the so-called "monetarist" persuasion, recognizes that the Great Depression was largely created by the policies of the Federal Reserve and other major central banks. But like Friedman and his epigones, Bernanke believes that modern central banking has been "fixed" since then, and that judicious use of the Fed’s powers to expand and contract the money supply is not only possible but far superior to the old-fashioned gold and silver-based money system.

It is thus grimly ironic that Ben Bernanke should have been appointed chairman of the Federal Reserve just in time to reap the economic and financial whirlwind resulting from the policies of his predecessor, Alan Greenspan, in cahoots with a federal government that had shown reckless willingness to finance its welfare/warfare empire via unprecedented levels of debt and deficit spending.

No sooner had Ben Bernanke succeeded Alan Greenspan in early 2006 than the already-shaky U.S. economy, unable to recover from the bursting of the dot.com stock bubble in 2000 and political uncertainty in the wake of the 9/11 terror attacks, began to come apart at the seams. For one thing, even the most foolishly optimistic investors and economists were starting to realize that housing prices had become wildly overinflated and were ripe for a collapse. A few economists and financial advisers, like prominent broker and economist Peter Schiff, began warning as early as 2006 that something much bigger than just a correction in real estate prices was in the offing. Even one congressman, Representative Ron Paul, warned that the real estate bubble was merely one symptom of a much larger problem for which the piper would have to be paid: a wildly inflated money supply and systemic malinvestment that, sooner or later, would have to be liquidated in a massive market correction. But in general, such warnings were brushed aside by the likes of Ben Bernanke and like-minded economists like Arthur Laffer, who were convinced that appropriate corrective steps by the Federal Reserve would be able to ensure a "soft landing" for the U.S. economy.

Spend and Conquer

To understand the disagreement between monetarists like Bernanke and economic thinkers of the so-called "Austrian" persuasion like Peter Schiff and Ron Paul, a bit of history is in order. The standard monetarist explanation for the Great Depression is that the Federal Reserve, instead of pumping more money into the economy as it should have done following the October 1929 stock market crash, instead closed the money spigots, causing a credit crunch that led to bank failures and unemployment on a massive scale.

The way the Federal Reserve usually manipulates the money supply is through so-called "open market operations," whereby Fed representatives at the Federal Reserve Bank of New York buy and sell government securities from a small number of "primary dealers," large brokerage houses with special authorization to collaborate in the creation (or destruction) of money. If the Fed wishes to increase the money supply, it buys government bonds, bills, and notes for which it credits money to the accounts of the primary dealers. The funds quickly find their way onto the balance sheets of large commercial banks. The banks then loan out a portion of the new money, and the money supply expands. That, at least, is the theory.

But what happens if the banks refuse to loan out new money, or if the public chooses to withdraw money from banks? As economist Murray Rothbard has shown, this is precisely what happened in 1929 and afterward:

During the week of the [October 1929] crash,… the Fed doubled its holdings of government securities, adding $150 million to bank reserves, as well as discounting $200 million more for member banks…. As a result, member banks of the Federal Reserve expanded their deposits by $1.8 billion – a phenomenal monetary expansion of nearly 10 percent in one week!… By the end of the year … Fed ownership of government securities had increased by $375 million … but the expansion had been offset by lower bank loans from the Fed, by greater money in circulation, and by people drawing $100 million of gold out of the banking system. In short, the Fed tried its best to inflate a great deal more, but its expansionary policy was partially thwarted by increasing caution and by the withdrawal of money from the banking system by the general public.

Thus the Great Depression occurred despite the Fed’s best efforts to prime the monetary pump. Yet Bernanke and other economists were convinced that, this time around, the Fed would be able to face down any financial crisis by injecting massive amounts of new money into the economy.

Unfortunately for Bernanke and the Federal Reserve System, the ordinary mechanisms for expanding the money supply only work when people want credit and when banks are willing to lend. And, just as was the case in the early years of the Great Depression, Bernanke’s Federal Reserve soon discovered that inducing banks to extend credit was proving a far more difficult task than anyone (save perhaps a few Austrian economists) had anticipated. The mortgage meltdown proved to be far more serious than first believed, wreaking havoc with the balance sheets of major banks and brokerage firms across the globe. Before too many months, banks, wary of each other’s solvency, became leery of lending money to one another and to the public. Although banks in trouble are permitted to borrow money from the Fed via the so-called discount window, few banks were willing to risk the stigma of doing so.

From the perspective of Bernanke and company, something radical had to be done, and quickly. The strategy that the Federal Reserve has since embarked upon is simple enough in its essence: diversify the channels by which the Federal Reserve can pump money into the economy by giving both commercial and investment banks more direct access to Federal Reserve funds. Bernanke accomplished this in a series of revolutionary actions, beginning in December 2007 with the creation of the Term Auction Facility (TAF). This new device allowed banks to bid anonymously on specific amounts of Federal Reserve funds to be made available at auctions held twice monthly.

By early accounts, the TAF was a rousing success. Ailing banks flocked to this new source of badly needed credit, and the Federal Reserve soon announced that the new facility, at first billed as a temporary measure, would be continued indefinitely.

But it soon became evident that the new facility was not having the desired effect. Banks were indeed taking advantage of the new financial lifeline, but were refusing to lend the money they had borrowed. In a word, banks were adding the money to their own battered balance sheets and continuing to tighten the credit reins.

In response, the Federal Reserve created a welter of other new facilities to enable the Federal Reserve to intervene directly in almost any aspect of the financial markets. The Term Securities Lending Facility, created in March 2008, made hundreds of billions of new dollars’ worth of Treasury securities available to primary dealers against a wider range of collateral and for longer time intervals than had previously been the case. This was followed a few days later by the Primary Dealer Credit Facility, which provided still more forms of credit to primary dealers against a still broader range of collateral. These measures were intended to save foundering primary dealers like Bear Stearns, Goldman Sachs, and Merrill Lynch but, as subsequent events showed, failed miserably.

In September, as the economic crisis worsened and other sectors beyond the financial realm began to feel the pinch, the Federal Reserve moved into backing commercial paper with the creation of the improbably named Asset Backed Commercial Paper Money Market Mutual Fund Liquidity Facility. Finally, in late October the Federal Reserve got into backing money market mutual funds with the Money Market Investor Funding Facility.

Simple Really

It must be borne in mind that, behind the façade of obscurantist financial jargon and bewildering new layers of banking bureaucracy, the operation of the Federal Reserve System is simple in principle. Each of these new facilities has as its purpose injecting new money into the economy at different points of entry. This is being done primarily by creating credit — but credit, in order to expand the money supply in any meaningful way, must be loaned out to the private sector — for example, to would-be homebuyers, to large corporations, to students seeking college loans, to small business owners, and to purchasers of automobiles and other big-ticket consumer items. But if banks and other financial institutions refuse to lend or begin requiring much steeper credit terms, or if consumers and businesses prefer to save rather than to borrow new money, even the Federal Reserve can do very little except offer ever more inducements to borrow money.

Despite all the Federal Reserve’s innovations, credit markets are tighter than ever. Students, buyers of homes and automobiles, and small business owners are suddenly unable to get loans under the same lax credit conditions of a few months or years ago. As a result, automobile dealers and manufacturers, colleges and universities, home sellers, and many others are unable to sell property, services, and inventory at customary terms. In spite of all Ben Bernanke’s financial legerdemain, the economic crisis continues to unfold, exacting its brutal toll.

The economic reasons for the Federal Reserve’s failure are straightforward: recessions, panics, corrections, and depressions are all natural and inevitable consequences of the practice of fractional-reserve banking, whereby banks are permitted to pyramid nonexistent assets on top of a small fraction of "real reserves." Fractional-reserve banking allows banks to create money by issuing debt backed by nothing but institutional authority, and inevitably distorts interest rates and credit markets by easy-money policies. Given free rein to do what no other type of business can legally do — loan out assets that they do not actually possess — banks, which stand to make more money the greater the demand for credit, will always tend to offer easy money, creating economic bubbles that sooner or later must burst. Throughout the history of the United States, government-sanctioned fractional-reserve banking has always been practiced. During the time when the United States was still on a precious metal standard, banks were frequently allowed to "suspend redemption in specie" — that is, refuse to redeem their promissory notes in gold and silver — whenever the consequences of their lax credit policies caught up with them.

But with the advent of the Federal Reserve in 1913 and the abandonment, for all practical purposes, of the gold standard two decades later, the problem of boom and bust has become much worse. This is because, absent the restraints that a precious-metal standard imposes on the behavior of bankers and government treasuries alike, the temptation to print money without limit to fund government projects is impossible for the power elites to resist. And with more reckless inflation come boom and bust cycles of much greater severity.

When busts occur, as is happening across the world right now, the scales fall off people’s eyes and the old-fashioned virtues of thrift and savings reassert themselves. Demand for safe investments like gold increases dramatically and credit markets dry up, no matter how many new financial carrots a Federal Reserve or other monetary authority dangles before banks, businesses, and consumers. Confidence is lost for a time and economic sanity, bit by bit, reasserts itself.

Besides the economic fallout, the political fallout from the Federal Reserve’s policies is cause for considerable alarm. Central banks are secretive and autocratic by nature, but the Bernanke Fed has shown a special penchant for secrecy and usurping authority.

Scarcely a month after Bernanke took the reins at the Fed, the Federal Reserve announced that it would no longer compute or make public M3, one of several measures for determining the money supply (M0, M1, and M2 are the others). The Fed justified this action by claiming that M3 is not an important enough index to justify the resources spent in keeping track of it. In point of fact M3 includes, in addition to currency, ordinary bank accounts, and the like (the sorts of monies likely to be held by consumers, which are covered by the other three indices), large-scale aggregates of money like large time deposits (CDs over $100,000, for example), institutional money market funds, and, most tellingly, short-term repurchase agreements. These last just happen to be the Federal Reserve’s preferred method of manipulating the money supply, and the other distinctive components of M3 are all types of monies and funds that are most likely to be at the top of the financial food chain, and most susceptible to Fed-induced changes in the money supply. Thus that portion of the money supply most directly influenced by Federal Reserve policies enjoys much less scrutiny than before; simply put, no one really has any idea how much money is out there anymore.

With its various recent interventions in the financial markets and the creation of new money-making instruments, the Federal Reserve has assumed — without any semblance of a by-your-leave from lawmakers — much greater emergency authority over the finances of our nation, and has positioned itself to become not only a universal lender of last resort but, in the longer run, an overseer and regulator of financial activities far and wide.

What is rapidly turning into the great crisis of our age has become an excuse for an enormous expansion of government power. It has all happened before, and the rationales, then as now, have not changed a whit. Back in 1932, a prominent business periodical, Magazine of Wall Street, ran a long article defending the federal government’s intervention in the workings of the free market. Then, as now, the Federal Reserve and the Treasury Department had indulged in a long train of bailouts and other government actions supposedly to remedy free-market defects responsible for the depression. Theodore Knappen, the author of the article, was at least candid about the motives behind all the financial shenanigans:

The answer made by representatives of business to the charge of socialism is that in all great emergencies, war for example, governments have always thrown themselves into the breach, because only they can organize and mobilize the whole strength of the nation. In war every country becomes practically a dictatorship and every man’s resources are at its command; the country is now at an equally great emergency.

With good reason, Thomas Jefferson once said, "I believe that banking institutions are more dangerous to our liberties than standing armies." What America is now approaching is a financial and economic dictatorship, where the Federal Reserve and federal government will be the arbiters of who shall be allowed to fail and who shall be bailed out and otherwise propped up at taxpayer expense. The proper solution, as even Ben Bernanke’s former employers at South of the Border could probably have informed him, is to allow the free market — that is, the free decision making of individual consumers, investors, creditors, and debtors — to decide how assets and capital shall be allocated, to reward thrift and wise business decisions, and to allow those who have been less provident to assume the full responsibility for their choices by becoming insolvent.

The Bernanke Federal Reserve, however, has been pursuing precisely the opposite tack. The result, as was the case the last time such radical policies were pursued, will be a recession/depression much longer and deeper than might have otherwise been the case.

Photo: AP Images