News stories on August 19 reported that Neil Barofsky, Special Inspector General (SIG) of the U.S. treasury Department’s $700 billion Troubled Asset Relief Program (TARP), had agreed to audit the $301 billion of federal asset guarantees extended to Citigroup Inc. since last November.

Rep. Alan Grayson (D-Fla.) had requested the audit in a June 24 letter to Barofsky, in which Grayson complained: “Congress has very little information regarding the asset guarantee arrangements that the Federal government struck with Citigroup in November, 2008.”

What Congress does know, Grayson continued, is that “the Treasury, FDIC, and Federal Reserve entered into a ‘loss-sharing arrangement’ with Citigroup on a designated pool of $306 billion in ‘primarily mortgage-related assets currently held by Citigroup.’” Grayson went on to observe: “While the assets are still held on the books of Citigroup and the cash flow from these assets accrues to Citigroup, the total downside risk to the Federal Reserve alone from this loss-sharing deal is $234.4 billion.” These enormous public liabilities notwithstanding, Grayson noted: “To date, documents and transcripts describing the negotiations that led to this loss-sharing arrangement are not publicly accessible.”

So, Rep. Grayson has a few questions to which he hopes SIGTARP Neil Barofsky will find answers. They include: “How was this deal negotiated?” “Who should be held accountable for the reckless acquisition of a third of a trillion dollars in assets that ended up requiring a government guarantee?”

Regarding the very important issue of accountability, we might respectfully ask every member of the House and Senate who voted for the TARP bailout (including then-Senators Barack Obama and Hillary Clinton): “Have you looked in the mirror lately?” And we might ask Grayson and other members of Congress: “Why has it taken you seven to nine months to ask these questions?” “Why do you act surprised that SIGTARP has uncovered massive fraud in the fraction of TARP actions it has investigated?” “Why were you not anticipating these problems and asking these questions before granting sweeping emergency powers to the Federal Reserve and Treasury in the Emergency Economic Stabilization Act and the American Recovery and Reinvestment Act?” “Where in the U.S. Constitution did you find authority to allow the Fed and other agencies to engage in these reckless and illegal raids on the wealth and savings of the American people?”

Perhaps most importantly, we should be demanding, “Why not audit the Federal Reserve itself, which is the agency most responsible for placing us in the predicament of potential catastrophic losses?”

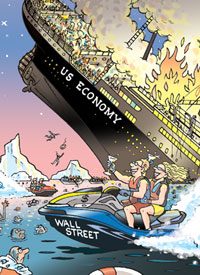

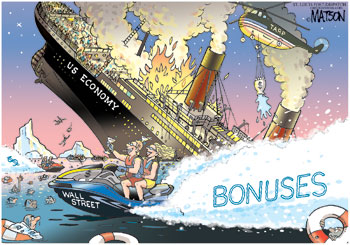

You thought a few hundred billion dollars was horrendous when TARP was proposed. But perhaps you missed the news cycle on July 21 when SIGTARP Barofsky announced, in testimony before the House Oversight and Government Reform Committee: “The total potential Federal Government support could reach up to $23.7 trillion.”

You thought a few hundred billion dollars was horrendous when TARP was proposed. But perhaps you missed the news cycle on July 21 when SIGTARP Barofsky announced, in testimony before the House Oversight and Government Reform Committee: “The total potential Federal Government support could reach up to $23.7 trillion.”

That’s right: $23.7 trillion! Of course, that staggering announcement of the potential economy-annihilating tsunami awaiting us has gone almost unnoticed and unremarked in news cycles glutted with more momentous (and continuous) pop celebrity updates and the other usual distractions du jour.

Rep. Ron Paul (R-Texas) has addressed this issue with his legislation to audit the Fed, the “Federal Reserve Transparency Act of 2009” (H.R. 1207 in the House and S. 604 in the Senate). Dr. Paul has astounded many of his critics (and even many of his staunchest supporters) by obtaining 282 co-sponsors, nearly two-thirds of the members of the House. However, as expected, the Fed and its partisans in the banking industry, the media and academe are pulling out all stops to kill the effort.

The Wall Street Journal reported on July 21 (“Bernanke Heads to Congress Battling Calls to Tame the Fed”) that Fed Chairman Ben Bernanke “strongly opposes the proposal to audit the Fed, calling it ‘self-defeating and dangerous.’” Naturally, the Journal, ever supportive of the Fed, agrees. “Mr. Bernanke has plenty of support,” said the Journal. And it warned ominously: “Most economists agree that fighting inflation requires political independence…. More than 250 prominent economists recently signed a statement warning that the Fed’s independence is at risk.”

In his important 1994 book The Case Against the Fed, eminent free-market economist Murray N. Rothbard exposed this plea for “political independence” as one of the perennial deceits of the Fed and its shills to maintain their secrecy and illegitimate power. He named the Fed as “by far the most secret and least accountable operation of the federal government.” And he noted, “if government becomes ‘independent of politics’ it can only mean that that sphere of government becomes an absolute self-perpetuating oligarchy, accountable to no one and never subject to the public’s ability … to ‘throw the rascals out.’ If no person or group, whether stockholders or voters, can displace a ruling elite, then such an elite becomes more suitable for a dictatorship than for an allegedly democratic country.”