First Impressions at a Recent CCL Conference Promoting H.R. 763

Citizens’ Climate Lobby (CCL) held an all-day, regional conference on Saturday, February 9, 2019 at the University of Houston Central Campus to train registered CCL volunteers from the Gulf Coast states of Texas, Louisiana, and Mississippi. This writer registered to attend the only part of the conference open to the public — an afternoon panel discussion by experts promoting the signature legislative proposal of the CCL, the “Energy Innovation and Carbon Dividend Act” of 2019 (H.R. 763), which would levy a steadily increasing tax on hydrocarbons while rebating net tax revenues to U.S. citizens. The rebate component may sound good, but the dramatic increase in the cost of energy owing to the destruction of the fossil-fuel sector can be expected to dwarf the amount of the rebate.

Before the panel started, this writer observed part of a conference event which illustrates the ambitious outreach of CCL’s lobbying efforts to impose a carbon tax on the U.S. hydrocarbon industry: At a dozen conference tables, more than a hundred CCL volunteers were huddled together for mini-conferences, called “Action Speed Dating,” (shown, from the conference program [picture attached]). Each table was dedicated to a specific lobbying arena, including federal, state, and municipal governments, and interest groups such as conservatives, progressives, higher education, business, faith-based groups, Spanish-speaking communities, media, and high schools. To support CCL’s ambitious lobbying efforts, volunteers were expected to select a table based on their own interests and to strategize briefly with other volunteers about how they could promote the CCL message — a carbon tax to stop allegedly man-made climate change — in that particular arena, before moving on to another table of their choice.

While waiting for the panel discussion to start, this writer asked one of the organizers, Matthew Ott, a few questions, and Ott was eager to promote the conference and CCL’s goals by reassuring this writer that “Jim Baker and Exxon” (James A. Baker III and ExxonMobil) had made great progress in founding and expanding CCL in just the last 10 years, and that CCL’s signature legislation, H.R. 763, would definitely help to protect the environment and fight climate change.

When this writer brought up the Democrats’ “Green New Deal” (recently reviewed here, here, here, and here) — which aims to protect the environment and fight climate change by eliminating hydrocarbon-based energy sources, but adds in several other goals, such as phasing out nuclear energy, “retrofitting all buildings to be energy efficient,” and even establishing a government-funded livable wage for all American citizens whether or not they are willing to work — Ott’s immediate, sharp response was to assert that the CCL does not endorse the “Green New Deal,” and CCL’s only focus is “putting a price on carbon” in order to protect the environment by fighting climate change. He insisted that once H.R. 763’s proposed $10-$15 “fee” on each metric ton of carbon “pollution” is enacted into law, consumers would hardly notice any changes in the price of gasoline compared to the normal fluctuations in the price of gasoline.

This writer then pointed out that the price of gas normally fluctuates up and down, but H.R. 763 would only steadily ratchet up the price of gas. H.R. 763 would add a $15 tax per metric ton of carbon in the first year, and then cumulatively add $10-$15/ton for each subsequent year, and hence the price of gas would only go up. Ott did not disagree, but he insisted that the rising price of gas would surely stimulate new inventions that would benefit mankind.

The conference’s afternoon panel discussion (“Carbon Pricing & Energy: Good for Industry, Great for the Climate”) soon got underway, and the conference audience listened intently as Moderator Pam Giblin, an environmental attorney and partner at Baker & Botts (Jim Baker’s law firm), spoke first to set the tone of the discussion by presenting two alternatives to deal with the “problem” of man-made climate change: 1) Regulations or 2) A “market-based” solution. She claimed that H.R. 763 is a “market-based” solution to fight man-made climate change.

Market-based? If some consumers choose to avoid purchasing hydrocarbons because they are convinced that man’s production of CO2 is causing man-made climate change, then the free market responds naturally to those choices. But if the government steps in to tax the hydrocarbon industry out of the marketplace — then the H.R. 763 carbon tax is not a “market-based” solution.

The other three speakers also spoke favorably about H.R. 763. Renewable-energy infrastructure developer Pat Wood III and innovator/entrepreneur David Berry enthusiastically discussed their own experiences in the expanding renewable energy field, and they emphasized the bright prospects for growth in renewables, especially after passage of H.R. 763. Bill Bray, a retiree from ExxonMobil, discussed the advantages of “carbon pricing” in H.R. 763 for those concerned about fighting man-made climate change.

But none of the panelists seriously examined deeper questions about more controversial aspects of H.R. 763, such as:

1. the constitutionality of a federal law that would systematically crush the vital hydrocarbon sector of the U.S. economy by using an unprecedented tax policy to “pick winners and losers” within the energy sector;

2. the sleazy, not to say un-American, sales pitch to sway a democratic majority of voters to support H.R. 763 for the sake of receiving free “carbon dividends” (the redistribution to all U.S. citizens of the proceeds of the carbon tax as it cannibalizes the hydrocarbon industry);

3. the inviolability of the “Carbon Dividend Trust Fund,” where the carbon tax would be deposited before redistribution (How long did it take for Congress to come up with an excuse to start spending the Social Security Trust Fund?);

4. how a U.S. carbon tax would have any significant effect on man-made CO2 production, when even the supporters of a carbon tax admit that “the U.S. produces only 15 percent of global emissions”;

5. the profoundly devastating effects of H.R. 763 on our economy; or

6. the ultimate political effects resulting from such drastic economic shrinkage.

To summarize, this CCL conference had all the appearance of a cautiously enthusiastic pep rally for promoting H.R. 763 — a bold attempt to “fight climate change” by smashing the U.S. hydrocarbon industry — while ignoring its devastating effects on the U.S. economy.

Why Do Members of the CFR Believe in Man-made Climate Change –– or Do They?

James A. Baker III is a long-time individual member of the Council on Foreign Relations, while ExxonMobil is a corporate member. As John Birch Society CEO Arthur R. Thompson notes in his new book In the Shadows of the Deep State: A Century of Council on Foreign Relations Scheming for World Government, the Council on Foreign Relations “promotes the idea of a one-world government…. This is the end they have in mind.” Furthermore, Admiral Chester Ward, former judge advocate of the U.S. Navy and a 16-year CFR member who finally resigned from the organization in disgust, admitted that “the main purpose of the Council on Foreign Relations is promoting the disarmament of U.S. sovereignty and national independence, and submergence into an all-powerful one-world government”

But don’t Baker, as well as ExxonMobil, claim that they are only seeking to protect the planet from man-made climate change? Let us briefly examine Baker’s public justification for supporting a carbon tax.

In February 2017, at the launch of the Climate Leadership Council, which developed and now promotes H.R. 763 to fight man-made climate change, Baker coyly presented himself as “somewhat of a skeptic about the extent to which man is responsible for climate change” — and yet, he is one of the driving forces behind the CCL and H.R. 763 to shrink the U.S. hydrocarbon industry by massive, cumulatively increasing taxation. Why? Baker: “I do think that the risks associated with it [man-made climate change], if the people who believe that it has happened and is going to continue to happen are correct, the risks are too great to ignore, and that we need some sort of an insurance policy,” just in case man’s production of CO2 really is causing climate change.

Actually, man’s production of CO2 is statistically insignificant compared to the gargantuan forces of nature that release CO2 into the atmosphere and re-absorb CO2 from the atmosphere. As this writer noted in a book review about the on-going, man-made CO2 hysteria:

Man currently releases into the atmosphere about 22 billion tons of CO2 per year. That may seem like a large amount — but in what context? Natural forces all around us — decaying plants and trees, volcanoes, ocean out-gassing of CO2, etc. — release into the atmosphere an estimated 781 billion tons of CO2 per year, which is roughly counterbalanced by an estimated re-absorption of 788 billion tons of CO2 per year into living plants and into the oceans. Man’s CO2 output per year is less than three percent of the total released by the combination of all natural forces and man — about 803 billion tons.

Furthermore, it is worth noting for context that the oceans are a huge reservoir of 139 trillion tons of CO2. According to [the book’s author, Steve] Goreham, “50 times more CO2 is dissolved in Earth’s oceans than is found in the atmosphere.” [Emphasis in original.] Man’s yearly output of CO2 is only 0.016 percent of the oceans’ total reservoir — a proverbial “drop in the bucket.”

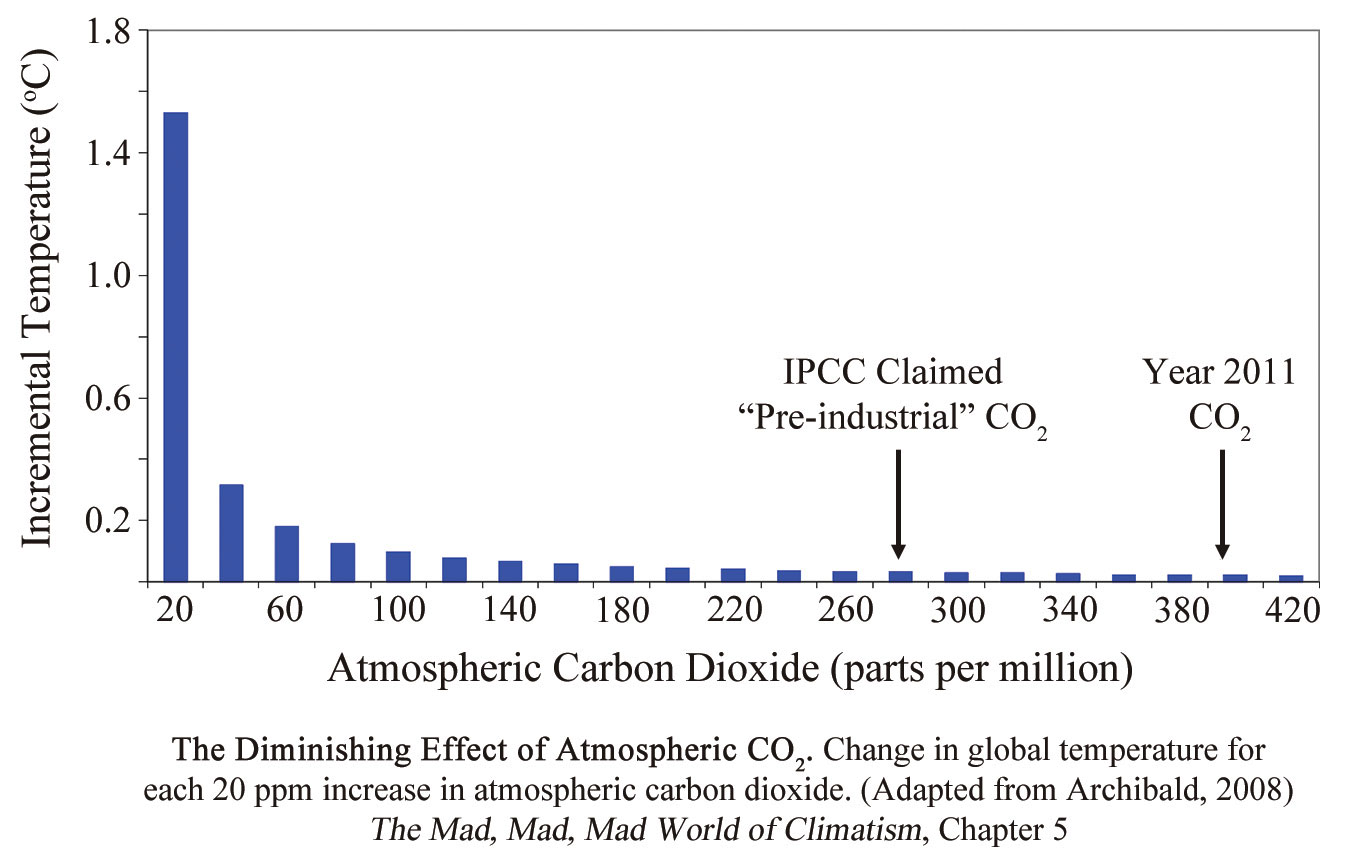

And beyond man’s statistically insignificant CO2 production, it is important to realize that any increases in CO2 atmospheric concentration do not cause a linear warming effect because “as CO2 increases, its greenhouse effect diminishes logarithmically, so that increasing levels of CO2 have a diminishing warming effect” — certainly nothing to get hysterical about.

As Steve Goreham, author of the above-mentioned book, concluded, “if we halted all man-made emissions, we might not even be able to measure the change in Earth’s temperatures.” This genuinely scientific conclusion clearly illustrates the futility of trying to “fight climate change” with human legislation.

So much for the threat of man-made climate change — and so much for the questionable need of Baker’s “insurance policy,” H.R. 763, to fight the bogeyman of man-made climate change.

But why then do CFR members such as Baker and ExxonMobil continue to lead the charge to devastate the U.S. hydrocarbon industry by means of the massive, cumulative taxation in H.R. 763, which would effectively shrink the U.S. economy? What entrepreneur or stockholder would risk investing any amount of money in the U.S. hydrocarbon industry if it had been slated for destruction through federal taxation? If enacted, H.R. 763 would force a very rapid collapse in the production of hydrocarbons, the currently inexpensive and abundant lifeblood of our vibrant economy. And since renewables cannot replace hydrocarbons on anywhere near the scale or reliability as hydrocarbons, our economy would quickly be devastated.

The CFR Also Promotes Globalist “Free Trade” Agreements

Generally speaking, the rhetorical device of calling something “free” — e.g., free market, free trade — pretty much guarantees a high level of popular acceptance, or at least minimizes the possibility of automatic popular rejection. Upon hearing the word “free,” most people assume that if something is free, it’s probably good in some way or another. However, the thoughtful listener should be wondering: Wait a minute — who benefits from whatever is being described as “free”?

Baker and other CFR members have been promoting the carbon tax in H.R. 763 as a “free-market” solution to (the fictitious notion of) man-made climate change while this escalating tax on vital hydrocarbons would result in a devastating economic weakening of the U.S. Baker and other CFR members have also promoted, and continue to promote, “free trade” agreements that are designed, regardless of the U.S. Constitution, gradually to merge the economies of formerly independent nations (e.g., the United States, Mexico, and Canada), into some form of regional government, like the European Economic Community was gradually transformed into the European Union. This gradual process of economic merging into a regional government would necessarily result in the political weakening of the United States.

Although the Constitution clearly assigns to Congress the power to regulate commerce with foreign nations, “free trade” agreements such as NAFTA, the Trans-Pacific Partnership (TPP), and now the USMCA Agreement, contain a real threat to U.S. sovereignty because, Thompson points out in his aforementioned book about the CFR, “once a people loses control of its own economy, it loses control of its country.” The 2,000+ page USMCA establishes an unelected, independent, and self-perpetuating international bureaucracy whose economic regulations of U.S. exports and imports are to be enforced by an international court system from whose verdicts there can be no appeal.

Although USMCA’s bureaucratic control over our commerce with foreign nations would be bad enough, Christian Gomez, in a video entitled “USMCA: What They Are Not Telling You,” finds that the USMCA Agreement would supersede much more than U.S. laws concerning international commerce. This agreement lays down requirements further to circumvent existing U.S. law by:

1. automatically subordinating U.S. laws to forthcoming international conventions of the WTO, the ILO, and the UN, such as the Law of the Sea Treaty, which has been rejected, up until now, by the U.S. Senate;

2. Regulating collective bargaining;

3. Protecting “workplace gender-identity”;

4. Undermining current U.S. immigration laws by making some illegal immigration legal.

If Congress were to approve such a “free trade” agreement, Congress would be handing over to an international bureaucracy much more than our constitutional power to regulate commerce with foreign nations — Congress would be ceding control over many more of our laws to foreigners. Thompson warns “that such trade deals overturn our system of government with extralegal structures outside the control of Congress or the American people.”

Baker and other CFR members know full well that the vitality of U.S. manufacturing has already been deteriorating as a result of bureaucratically rigged “free trade” with many communist dictatorships that command slave labor and systematically steal intellectual property to undercut American-made products. The planned economic and political integration to be implemented by the newest “free trade” agreements — the TPP and the USMCA Agreement — would effectively crush the U.S. economy and snuff out U.S. sovereignty.

Historically, by comparison, the American Founding Fathers protected the U.S. economy with tariffs to prevent the economically destructive effects of international “free trade.”

In contrast, Karl Marx was all in favor of “free trade” among nations — in order to instigate the communist social revolution that must precede the globalists’ planned takeover. In a speech to the Democratic Association in Brussels, Belgium on January 9, 1848, Marx explained why he supports “free trade”:

The free trade system is destructive. It breaks up old nationalities and pushes the antagonism of the proletariat and the bourgeoisie to the extreme point. In a word, the free trade system hastens the social revolution. It is in this revolutionary sense alone, gentlemen, that I vote in favor of free trade. [Emphasis added.]

The quest to destroy nations and establish global government has certainly continued from Marx in the 19th century to the present. According to TNA Foreign Correspondent Alex Newman,

In 1995, speaking at former Soviet dictator Mikhail Gorbachev’s “State of the World Forum,” attended by The New American magazine’s senior editor William F. Jasper, [CFR member Zbigniew] Brzezinski outlined the plan clearly, perhaps assuming he was speaking just to fellow globalists and friends. “We cannot leap into world government in one quick step,” he said. “In brief, the precondition for eventual globalization — genuine globalization — is progressive regionalization, because thereby we move toward larger, more stable, more cooperative units.”

Today, with a “free market” carbon tax to devastate the powerful U.S. economy and various “free trade” agreements designed gradually to take over the economies of formerly independent nations while merging them into some form of regional government (e.g., the European Union, the African Union, the North American Union), what could stop globalists from pressing ahead in their slow but methodical work culminating in the alliance of all such regional governments in a world government?

Instead of saving the planet from bogus man-made climate change or managing global trade for the alleged benefit of all nations — could the ultimate purpose of CFR members such as Baker be the much less publicized CFR goal of gradually establishing world government?

Isn’t it time for We the People to pull the wool off our eyes, to discern the true motives of CFR members who vigorously promote the alleged benefits of global political solutions at the expense of the United States of America, and then to take appropriate action to oppose the carbon tax and any “free trade” agreements?

Related articles:

Alex in Wonderland: AOC’s Green New Deal Would Make Economy Reel

Exposed! Ocasio-Cortez Can Scrub, but She Can’t Hide Green New Deal Details

Green New Deal Would Kill Almost Everyone, Warns Greenpeace Co-Founder

Green New Deal Making Dems Squeal

In the Shadows of the Deep State

Exposing the Con Game of Man-made Climate Change

USMCA: What They Are Not Telling You

Baker Institute Promotes Lame-Duck Passage of Sovereignty-killing TPP

Creating a New World Order Out of Regional Orders

One Man’s Fight Against the Global Trade Order

Stop the Deep State’s “Free Trade” Agenda for Global Government