Vice President Kamala Harris is doing her best to merit her new nickname, Scamala.

The radical leftist candidate has purloined one of Donald Trump’s campaign promises: to end taxes on tips to waiters, waitresses, and others in the service industry.

Trump vowed to do so in June.

One problem, though. Harris cast the tie-breaking vote on 2022’s Inflation Reduction Act, which plugged in the Internal Revenue Service to vacuum as much money as it could from tips.

The Promises

Speaking at a campaign rally, Harris said she plans to help “working families”:

It is my promise to everyone here when I am president, we will continue our fighting for working families of America, including to raise the minimum wage and eliminate taxes on tips for service and hospitality workers.

But Trump said it first in Nevada:

For those hotel workers and people that get tips, you’re going to be very happy. Because when I get to office, we are going to not charge taxes on tips.

Just after Trump’s speech, House and Senate Republicans introduced bills to end the tax.

Representatives Matt Gaetz of Florida and Thomas Massie of Kentucky introduced the Tax Free Tips Act. It eliminates income and Social Security taxes on tips and says they “shall be treated as property transferred by gift.”

GOP Senator Ted Cruz introduced the No Tax on Tips Act, which permits a 100-percent deduction on tips. Representative Byron Donalds of Florida introduced a companion bill.

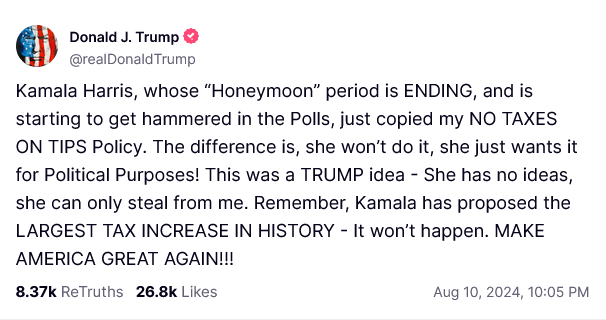

Yesterday, Trump zinged the Jamaican-Indian Democrat on his social media platform.

“Kamala Harris, whose ‘Honeymoon’ period is ENDING, and is starting to get hammered in the Polls, just copied my NO TAXES ON TIPS Policy,” he wrote on Truth Social:

The difference is, she won’t do it, she just wants it for Political Purposes! This was a TRUMP idea — She has no ideas, she can only steal from me. Remember, Kamala has proposed the LARGEST TAX INCREASE IN HISTORY — It won’t happen. MAKE AMERICA GREAT AGAIN!!!

Harris did vote for the IRS crackdown on restaurant and other workers, many of whom are college kids living on a tight budget, and trying to make ends meet in an economy wrecked by Bidenomics.

The Vote

Indeed, days ago, Harris bragged on X and Facebook about breaking the tied Senate vote and passing the disastrous Inflation Reduction Act.

“Two years ago today, I proudly cast the tie-breaking vote to pass our Inflation Reduction Act,” she wrote. “Here’s what it means for the American people”:

☑️ Insulin capped at $35 a month for seniors

☑️ The largest investment in climate action in history

☑️ Over $1 billion in unpaid taxes collected from 1,600 millionaires so far

☑️ Prescription drug costs for those on Medicare capped at $2,000 a year

☑️ The creation of an estimated 1.5 million jobs in the next decade

Harris forgot the part about the IRS.

In February 2023, the agency delivered Bulletin 2023-6, which describes a “revenue procedure that would establish the Service Industry Tip Compliance Agreement (SITCA) program, a voluntary tip reporting program between the IRS and employers in various service industries.”

How long the program will stay “voluntary” is unclear.

The program, the IRS said, is “designed to take advantage of advancements in point-of-sale, time and attendance systems, and electronic payment settlement methods to improve tip reporting compliance. The proposed program would also decrease taxpayer and IRS administrative burdens and provide more transparency and certainty to taxpayers. The proposed program includes several features.”

Among other things, it would monitor “employer compliance based on actual annual tip revenue” and require the submission of an annual report at year’s end.

Leftists Pan Idea

Harris’ omission aside, the leftist media ran off to the usual leftist thinkologists to say dropping the tax is a bad idea.

Politico found Howard Gleckman of the “nonpartisan” Tax Policy Center. In fact, the center is a subsidiary of the hard left Urban Institute and Brookings Institution.

“It’s one bad idea layered on top of another,” the senior fellow opined. “There are not a lot of tax upsides”:

If what you really care about is after-tax income of low-income workers … there’s a lot of other levers you could pull. You could help all workers, rather than just this one slice.

Politico didn’t explain what those “levers” are.

National Public Radio, a key Democratic Party megaphone, raced to the Tax Policy Center, too.

Tax lawyer Steve Rosenthal said not taxing tips is a “bad” idea and could be unfair.

“For Rosenthal, the idea fails on three counts: equity, efficiency and revenue,” the network reported:

A national ban on taxing tips would disproportionately benefit, for example, a South Carolina server who earns a reduced minimum wage and makes a large portion of their income through tips. While a server in California, where tips make up a smaller portion of their income, would benefit less. …

Rosenthal went on to say that a no tax on tips law would be extremely difficult to efficiently administer, regulate and oversee.

“How are we going to tell who is receiving a tip, and when that tip crosses a line into wages?” Rosenthal said. “How will we prevent investment bankers, say, from getting tips? And if we impose income limits, well, wouldn’t we expect low paid workers just to demand a tip rather than compensation?”

It’s safe to say the IRS won’t likely permit investment bankers to claim they receive tips.

H/T: Breitbart