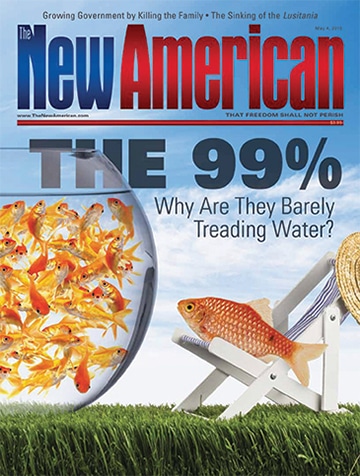

The 99 Percent: Why Are They Barely Treading Water?

"Since 1980, guess how much of the growth in income the 90% got? Nothing. None. Zero. In fact, it’s worse than that. The average family not in the top 10% makes less money than a generation ago.”

— Senator Elizabeth Warren (D-Mass.), in a January 7, 2015 speech to the AFL-CIO

Warren’s source for this claim was the leftist Economic Policy Institute, based on data from French economist Thomas Piketty and French-American Professor Emmanuel Saez of the University of California at Berkeley.

Piketty has become something of a celebrity because of his trumpeting of data about the increasing divergence in income ratios between the poor and the richest Americans. He and most other leftists blame the free market for this divergence, even though the level of government intervention in the U.S. economy has never been greater.

Warren added in the same speech, “When all the varnish is removed, trickle-down just means helping the biggest corporations and the richest people in this country, and claiming that those big corporations and rich people could be counted [on] to create an economy that would work for everyone else.”

Her remarks reflect a long, droning chorus among the political Left in America. Thomas Piketty’s Capital in the Twenty-First Century claims the fact that “the highest incomes and largest fortunes are taxed at significantly higher (or lower) rates can have a strong influence on the structure of inequality.... The spectacular decrease in the progressivity of the income tax in the United States and Britain since 1980, even though both countries had been among the leaders in progressive taxation after World War II, probably explains much of the increase in the very highest earned incomes.”

Probably?

That word suggests not only doubt, but a lack of investigatory research and knowledge — and rightfully so. In fact, while there is data to back up the claim that the richest have grown richer while everyone else has stagnated since the 1970s, there’s no data to show that free enterprise or lower income tax rates are to blame.

That pretty much sums up the research of Piketty and others making similar claims: They do a pretty good job of regurgitating government income statistics that describe how the wealth of the very richest has increased in recent decades as everyone else’s wealth has stagnated, while doing little study on why this has happened.

Those making claims akin to Piketty’s suppose that top-level tax cuts have resulted in limiting government revenue from top earners — revenue that is no longer redistributed to the poor, impoverishing them. Of course, government subsidies for the poor have not been reduced in recent decades as a proportion of the economy as a whole; however, even if there were indeed reduced subsidies for the poor, that only could theoretically explain a small part of why some of the very poorest in America have lost ground in recent decades — if it were true. But it would reveal absolutely nothing about middle-class income stagnation, as the middle class has traditionally not qualified for government redistributive subsidies.

Moreover, if the super-rich were getting richer simply because of lower maximum income tax rates, not just the super-rich would be getting richer. Yet economists have been able to pinpoint the increase in wealth of the wealthy even more tightly, with Emmanuel Saez (UC-Berkeley) and Gabriel Zucman (London School of Economics) noting of income inequality: “The rise of wealth inequality is almost entirely due to the rise of the top 0.1% wealth share, from 7% in 1979 to 22% in 2012 — a level almost as high as in 1929.”

If only those with $20 million or more in net worth are getting richer, then the idea that lower income tax rates since the 1970s are the primary reason for increasing income inequality does not hold water.

So why did the very rich get richer while the rest of the nation is barely treading water economically? In a complicated economy, there’s never just one reason why massive demographic trends occur. But here are a few of the reasons that explain most of the divergence that can be found by following the money.

1. Federal Reserve Bank

The largest reason for the sinking middle and lower income classes has been the Federal Reserve Bank, which has been actively devaluing the dollar since the 1971 collapse of the Bretton Woods system that linked the dollar to gold. The Federal Reserve has hurt the poor and middle classes with both direct and indirect programs, and the indirect impact of inflation may be the most important, even if it is the hardest to measure.

Income disparity between the top one percent of Americans and everyone else hit an all-time low in 1974-75, according to Thomas Piketty’s figures, which was just after the 1973-74 recession and not long after the collapse of the Bretton Woods system that tied the U.S. dollar to gold. The Paris School of Economics database places the top 0.1 percent’s share of income at its nadir the same year as the collapse of Bretton Woods, in 1971 at 1.91 percent of total U.S. income. The early 1970s marked the commencement of an era of non-stop expansion of the money supply (inflation), resulting in rising prices that robbed poor and middle-class Americans on fixed incomes of much of their wealth and income. The dollar has lost 83 percent of its value since 1971. It’s perhaps no coincidence that the rich — who typically keep a much smaller share of their wealth in cash and instead invest it in hard assets such as stocks and real estate — have not experienced the same type of economic distress or devaluation of their property as working people.

Not only that, but when the Federal Reserve pumps new money into the economy through the banking system, the negative impact this inflation has on prices does not take place immediately. Put simply, those who get this new money first are able to spend it prior to the price rise caused by the inflation. And who gets the new money first? Large Wall Street-connected banks, of course. And those banks are generally owned by the super-rich.

More recently the Federal Reserve Bank has been aiding the very rich directly, providing subsidies to them, and the largest of these has been its “Quantitative Easing” (QE) program — the process of creating money out of thin air. From 2007 to present, the Federal Reserve Bank’s balance sheet has been increased from less than $1 trillion to more than $4.2 trillion. About half of that increase has gone directly to Wall Street banks, as the Fed has purchased mortgage-backed securities and loans (the other half has been the purchase of federal debt). With a total net worth of all American households of $81.3 trillion, the $2 trillion transfer to the largest Wall Street banks since 2007 has been a significant transfer of wealth to the very richest institutions in a very short time.

There are two other significant results that also tend to impoverish the middle class and poor. First, because all of this money was created out of thin air, the transfer of wealth to the richest Wall Street financial institutions tend to decrease the value of currency and wealth held by everyone else. This happens because there are more dollars in the economy chasing the same goods.

Second, the Federal Reserve has suppressed interest rates, both through the purchase of federal securities through the other half of its QE program described above and through its Federal Funds discount window to member banks — a process that has been ongoing for decades. Artificially lowering interest rates tends to encourage spending and borrowing, while punishing savings. As a result, the savings rates of American workers are at historic lows, and are among the lowest in the industrialized world. Workers who save and put their money in the bank see their savings stolen through inflation, or they herd their funds into hard assets such as stocks, commodities, and real estate. This diverts and magnifies inflation to these sectors, which has in just the last 15 years created two economic bubbles and economic crashes.

In addition to the Fed’s “Quantitative Easing” program, the Fed engaged in a separate, secret lending program to insider Wall Street banks during the crisis of 2008-10. The super-rich Wall Street speculators who engaged in risky real estate loans, such as sub-prime loans or credit-default swaps, were simply bailed out by the Federal Reserve. Meanwhile, Main Street investors and homeowners had to file bankruptcy and faced a real risk of losses in the real estate crash.

The bank bailout program involved $16 trillion in loans, of which more than 85 percent went to the 20 largest banks in the world. While the loans were short-term, and rarely included outstanding cash loans of more than $1 billion at any particular time, the program amounted to a bailout for the richest financial institutions on the planet with taxpayer backing. A July 2011 Government Accountability Office report on the bailout noted, “We found that the Federal Reserve Board had not fully documented the reasons for extending credit on terms similar to those of PDCF [Primary Dealer Credit Facility] to U.S. and London-based affiliates of a few primary dealers — Goldman Sachs, Morgan Stanley, and Merrill Lynch.” In other words, the Fed didn’t even have a stated or valid reason for putting taxpayers at risk for bailing out their super-rich friends on Wall Street.

2. Multilateral Trade Agreements: NAFTA, WTO

Multilateral trade agreements such as NAFTA and the GATT/World Trade Organization have also had a downward influence on the labor market in the United States, leading to the outsourcing of some jobs while causing wage stagnation in other fields.

The seven rounds of the GATT (General Agreement on Tariffs and Trade) negotiations — which were replaced in 1995 by the World Trade Organization — progressively lowered import taxes (tariffs) and other export barriers around the world since the 1940s. The result of these agreements has been a global free market in labor. While most free trade economists would cheer the lowered tariffs created by the agreements (though perhaps not the international governmental bodies they created) as a net positive for global wealth, that increased wealth does not get spread equally among countries, or even equally among the people in a particular country.

Free market economics postulates that lowering a tariff and replacing it with nothing tends to increase aggregate trade and wealth. Of course, in the United States, the tariff wasn’t replaced by nothing; it was replaced by higher income taxes. Today, the tariff is at an all-time low and amounts to less than one percent of federal revenue, compared to 44 percent of federal revenue in 1913 — the year the income tax law was enacted. The tariff was the sole peacetime source of revenue for the U.S. federal government before the Civil War, and continued to remain the primary revenue source until it was gradually replaced by income and payroll taxes. Meanwhile, federal corporate subsidies have burgeoned and have become the primary source of economic protectionism, again to the benefit of the wealthy elites.

The rest of the world, however, is a different story. The new global labor market has produced dramatic results in pulling more people around the world out of absolute poverty than ever before. Back in 1990, the United Nations set Millennium Goals of reducing global absolute poverty (those living on less than $1.25 per day) by half before 2015. The goal was accomplished years early, even if the UN had zero role in its accomplishment. The World Bank website reports: “According to the most recent estimates, in 2011, 17 percent of people in the developing world lived at or below $1.25 a day. That’s down from 43 percent in 1990 and 52 percent in 1981.” The result of the World Trade Organization has been an historic lift out of poverty for many of the world’s most populous nations engaged in the global marketplace. For example, absolute poverty in:

• China was reduced from 60.2 percent in 1990 to less than 11.8 percent by 2009;

• India was reduced from 49.4 percent in 1994 to 32.7 percent in 2010;

• Indonesia was reduced from 54.3 percent in 1990 to 16.2 percent in 2011; and

• Pakistan was reduced from 64.7 percent in 1990 to 21 percent in 2008.

Moreover, NAFTA had a significant impact on Mexican poverty. Mexican absolute poverty fell from 7.9 percent of the population in 1996 — two years after the NAFTA agreement took force — to just 0.7 percent of the population by 2010. This alleviation of poverty has not universally taken root. Totalitarian regimes such as North Korea, Vietnam, some African and Eastern European dictatorships, and nations engaged in civil war saw little economic gain. But the transfer of Nike footwear factories to Indonesia, iPhone and automobile factories to China, and call centers to India and Pakistan — among other job transfers — has raised living standards in those countries.

International trade is not a zero-sum game. Both parties to a trade necessarily benefit, and it’s likely the world is better off for more trade under almost any circumstances. Yet there’s no doubt that American workers are paying a price for the free market in labor in the post-tariff world market. It may be that the price is worth paying to a Christian nation inclined to charity and general beneficence. But it’s likely that most Americans remain unaware they are paying that price.

The impact on American workers’ pay is a bit more difficult to measure macro-economically because of the many variables in the U.S. economy. American consumers have definitely benefited from more inexpensive foreign-made consumer goods, but they also unquestionably have lost the manufacturing jobs they would have had under the old tariff system (even if the tariff was low and designed for the sole purpose of raising tax revenue).

American workers’ wages have not equalized down to those of workers in Mexico or China, nor should anyone expect that to happen. Business decisions on where to locate a factory or other production facility depend upon a number of variables, including the skill level of the labor force, supply chain logistics, local infrastructure, domestic corporate tax rates, etc. The cost of labor is only one factor, and the United States has many advantages over other countries with respect to most of the other variables.

But there are also factors that contribute to the hemorrhaging of manufacturing jobs. The high U.S. corporate income tax rate (nearly 40 percent between combined state and federal corporate income taxes) is the highest among developed nations and has led to massive capital flight from the United States, and investment in job-creation abroad.

Corporate income tax rates are in a “race to the bottom,” according to Piketty, who suggests that “the recent rise of tax competition in a world of free-flowing capital has led many governments to exempt capital income from the progressive income tax.... The result is an endless race to the bottom, leading, for example, to cuts in corporate tax rates and to the exemption of interest, dividends, and other financial revenues from the taxes to which labor incomes are subject,” which, again, he sees as leaving less money for redistribution.

A bigger problem for the American middle class is that the United States is losing this race to the bottom, costing the country jobs. America’s high-end 35-percent federal corporate income tax has led to the off-shoring of massive amounts of corporate profits. Rather than declare a profit, be taxed, and invest the remainder in the United States, global giants such as Google and Apple simply reinvest their profits in factories abroad in nations with lower tax rates, instead of declaring the income in the United States. In a world where capital knows no patriotism, the U.S. Treasury has seen a lot of greenback Benedict Arnolds under the new global trade architecture.

3. Crony Capitalism: TARP, Ex-Im Bank, Green Energy Tax Credits, Farm Subsidies

Another major reason the rich are getting richer and the poor and middle class are mired in economic stasis is because of crony corporate bailouts provided by the likes of the 2008 TARP bill, the Export-Import Bank, the Overseas Private Investment Corporation (OPIC), and a host of federal government programs that guarantee profits to politically connected corporations that take casino-style risks with everyone else’s dollars.

Take, for instance, the fate of Lehman Brothers CEO Dick Fuld. (Lehman Brothers was a securities company specializing in investment banking, trading, and underwriting new issues of stocks and bonds.) Fuld was the first CEO of Lehman Brothers after American Express spun off its investment banking division and made it an independent company largely owned by American Express shareholders, and he had a hand in taking Lehman Brothers public on the New York Stock Exchange in 1994 as its first independent CEO. While Fuld drove the company into the ground with investments in ever-more-risky credit-default swaps, he took in nearly $500 million in salary and bonuses. Even when the housing industry bubble was blowing up, Fuld took credit for increased profits and demanded a higher salary from his board. He took a salary of $20 million in 2007, the year before the Wall Street behemoth declared bankruptcy. When the bubble popped and his 110-year-old firm went bankrupt, tens of thousands of stockholders lost their entire investment. In the aftermath, Fuld packed his bags for the $13.75 million mansion he had just sold to his wife for a mere $100 (in order to shelter his wealth from lawsuits).

In the end, Fuld was handsomely rewarded for driving his company into the ground. Meanwhile, pension funds and mutual funds across the nation that had invested in Lehman Brothers took a major hit.

And in the whole scheme of things on Wall Street, Fuld actually did suffer a little bit — at least comparatively — for being a scam artist. He actually lost some of his millions as his stock shares shrunk to zero; taxpayer bailouts didn’t come on line until after the Lehman bankruptcy. Most major financial institutions and their executives got off far easier thereafter. Immediately following Lehman’s bankruptcy, Congress passed the $700 billion TARP bailout bill. With TARP, corporate profits were privatized and losses were socialized. The bill bailed out the biggest Wall Street gamblers with taxpayer dollars, and later General Motors and Chrysler Corporation as well. The $80 billion given to General Motors — most of which will never be repaid to the U.S. Treasury — was yet another case of a giant, politically connected corporation being bailed out by taxpayers. The sum of the GM bailout was so great that it would have been cheaper for taxpayers to give every GM employee $200,000 to go out and find a new job rather than do a bailout.

It’s obviously no coincidence that most of the giant financial institutions bailed out through the TARP legislation were corporate members of the Council on Foreign Relations, an organization with a tiny membership of just a few thousand but which is a Washington-New York power axis of corporate executives, politicians, media, academia, and the military. For example, bailout recipients of TARP funds included then-CFR corporate members AIG (an insurance giant), Goldman Sachs, Bank of America/Merrill Lynch, JP MorganChase, and Citi. During the crisis, the CFR had the luxury to organize a conference call with Obama’s Treasury Secretary Tim Geithner (also a CFR member).

The federal government is also presently funding dozens of crony capitalist programs through longstanding agencies such as the Export-Import Bank, OPIC, and even the Marketing Promotion Program of the U.S. Department of Agriculture. The subsidies those entities provide must be added to the myriad “green energy” subsidies given to companies by the federal government. In general, the giant, politically connected corporations with the most lawyers, accountants, and lobbyists are the ones who win the biggest contracts through federal subsidy programs.

Though the government and the corporations involved would like taxpayers to believe that the middle class is actually benefiting from the payouts, the evidence shows otherwise.

The Ex-Im Bank, which provides loan guarantees for product sales in foreign countries (guaranteeing the U.S. companies against loss), claims to have supported 1.2 million U.S. jobs over the last five years, or about 250,000 in the last year. That’s about 800 jobs per “transaction.” The Wall Street Journal backed the claim, writing, “Nearly 90% of the bank’s deals last year, covering more than $5 billion in financing and insurance, directly served small companies.” But that 90-percent figure is based on counting “transactions,” not on the amount of money disseminated. In reality, more than three-quarters of the bank’s funding subsidized giant corporations. And the Ex-Im Bank, the Journal noted, “includes firms with as many as 1,500 workers or revenue of up to $21.5 million annually” as “small businesses.”

The largest corporate client of the Export-Import Bank is Boeing, the Seattle-based airplane manufacturer, and the giant deals made on behalf of Boeing have given the bank the nickname “Bank of Boeing.” CNSNews.com noted, “In the 17 years from 1997 to 2013, according to the bank’s annual reports, the bank issued 1,046 loan guarantees (worth $142,870,200,824). 426 of these — or 40.7 percent — went to organizations that were using their U.S.-government guaranteed loan to buy products from Boeing.” Essentially, the bank guarantees sale of airplanes to foreign airlines that compete for customers against U.S. airlines, allowing the foreign airlines to buy aircraft at undermarket rates. Delta Airlines claims that Ex-Im Bank has cost it some 7,500 jobs, because Ex-Im Bank subsidizes Delta’s foreign competitors.

Lost jobs aren’t the only way the American middle class loses in the deals. If the loans go bad, the taxpayers pony up to pay the losses. The bank recently approved a $694 million loan to Australia’s richest woman. According to Australia’s Sydney Morning Herald, “In return for the US government loan, Hancock Prospecting will purchase American mining and rail equipment from Caterpillar, General Electric and Atlas Copco. The Export-Import Bank says their involvement will ‘support’ 3400 US jobs.” But if the loan goes bad (and the Sydney Morning Herald reported in February that it was over-budget and behind schedule), U.S. taxpayers will pay out to ensure that the big corporations keep making profits.

OPIC, a quasi-private corporation chartered and funded by Congress to encourage U.S. companies to invest in emerging markets and boost America’s foreign policy efforts by providing “investors with financing, guarantees, political risk insurance, and support for private equity investment funds,” also favors giant corporations. For example, in 2013 alone, OPIC gave Citibank more than $115 million in loan guarantees. Wells Fargo received guarantees for $700 million during the same period. Though OPIC boasts of its small business loans, its loans often run at cross purposes with American jobs, and even national security. In 2004, OPIC even approved a loan to open a tannery in Mali so that the U.S. military could outsource the making of its leather gloves.

Under the guise of “green energy,” the federal government has given more billions of dollars in subsidies to the rich and well connected, often for failed corporations such as Solyndra ($535 million), Abound Solar ($469.2 million), and A123 Systems ($390 million). Probably the biggest “green” subsidy recipient has been Tesla Motors, which manufactures expensive battery-powered automobiles. National Review’s Phil Kerpen explained how the rich gain at the expense of the middle class in this case: “Every time a Tesla is sold, we witness a transfer of wealth to a rich hobbyist (most Teslas are their owners’ third or fourth car), while average Americans are on the hook for at least $30,000 in federal and state subsidies. Tesla is more a regulatory arbitrageur than an auto manufacturer.”

Ironically, the one industry that takes in very little in the form of taxpayer subsidies is the much-demonized oil industry. Last year, claims about big oil “subsidies” were phony. What were deemed “subsidies” for big oil were actually tax cuts, not cash subsidies or loans from taxpayers. Oil companies were given special depreciation rules for deducting genuine expenses from their tax bills. In fact, nearly all of the more than $3.4 billion the Department of Energy spent in 2013 provided cash and loans for renewable energy pet projects now in vogue with the political Left.

The list of corporate welfare goes on and on. The federal government has hundreds of different crony capitalist programs, subsidizing corporate giants such as McDonald’s and Blue Diamond, as well as giant industry associations such as the Cotton Council International and the U.S. Meat Export Federation. Isn’t it convenient that H&R Block — which spent a small fortune lobbying for passage of ObamaCare, the healthcare plan that is driving up health insurance premiums for the middle class — has just finished engaging in a tax season advertising campaign to cash in on the more complex income tax forms that must now be filed?

Who Will Close the Gap?

Senator Elizabeth Warren has made a name for herself with stirring speeches claiming she is standing up for the poor and middle class against the super-rich. On January 7, she told the AFL-CIO, “Pretty much the whole Republican Party — and, if we’re going to be honest, too many Democrats — talked about the evils of ‘big government’ and called for deregulation. It sounded good, but it was really about tying the hands of regulators and turning loose big banks and giant international corporations to do whatever they wanted to do — turning them loose to rig the markets and reduce competition, to outsource more jobs, to load up on more risks and hide behind taxpayer guarantees, to sell more mortgages and credit cards that cheated people.”

That sounds good, until you look at the record. It wasn’t a lack of government action in the form of reduced regulation that created the increasing income gap, but government inflation and cronyism. A majority of House Republicans opposed the TARP bailout, and every single House Republican supports a public audit of the Federal Reserve. Meanwhile, Warren’s Democrats were the margin of passage for TARP back in 2008. Republicans, however, are far more likely to back multilateral trade agreements such as NAFTA, the WTO, and the upcoming Trans-Pacific Partnership.

Moreover, Warren may be the very worst crony capitalist on Capitol Hill. She has voted to continue funding for the Export-Import Bank, and she openly backs “investing in clean energy technology” at the federal level. And she has publicly opposed a Federal Reserve audit, choosing instead to keep the operations of the central bank’s crony capitalism shrouded in mystery.

If there is any leadership on Capitol Hill to oppose crony capitalism, it won’t be found in pseudo-populists such as Elizabeth Warren, but rather in the handful of congressmen who are sponsoring bills to rein in the Federal Reserve Bank and abolish crony capitalism, i.e., members of the House Liberty Caucus. But the real leadership against cronyism and inflation has to come from an educated and engaged American people, not from Washington. Only when Americans rise up and demand a new direction from their leaders will policies crushing the poor and middle class cease.

This article is an example of the exclusive content that's available only by subscribing to our print magazine.