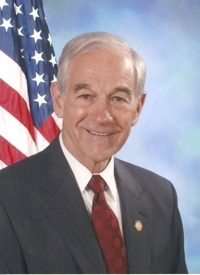

Will Tuesday be Ron Paul’s big day? Robert Wenzel of EconomicPolicyJournal.com thinks so, as does Paul confidant Lew Rockwell. On December 7 the Republican leadership in the House of Representatives is scheduled to announce the chairmen of various committees and subcommittees, including the Subcommittee for Domestic Monetary Policy and Technology, of which the Texas congressman is currently the ranking Republican member.

Rockwell points out that strictly on the basis of seniority, Paul should be made chairman of the entire Financial Services Committee; but there is no way the leadership is going to allow that. The question now is whether or not they will even permit Paul to assume chairmanship of the subcommittee. Thrice before the leadership has denied that post to Paul through chicanery, as the current Financial Services Committee chairman, Rep. Barney Frank (D-Mass.), has testified. Will they do it again this time? It’s certainly possible. Bloomberg Businessweek reported on December 2 that “five GOP leadership aides, speaking anonymously because a decision isn’t final, say incoming House Speaker John Boehner has discussed ways to prevent Paul from becoming chairman or to keep him on a tight leash if he does.”

{modulepos inner_text_ad}

Clearly the GOP leadership fears a Paul-led subcommittee, as Businessweek explains:

The prospect has Wall Street, Fed officials, and even Republican House leaders worried that Paul’s agenda could roil the markets and make a mockery of the U.S. financial system. This is a man, after all, who entered politics because President Richard Nixon bucked the gold standard in 1971, and now wants to make gold and silver legal tender….

Officials at several major banks have privately raised concerns with Republican leaders that, by allowing Paul to become a chairman, his radical views would gain legitimacy, according to three bank lobbyists.

It would appear that Businessweek writers haven’t been paying much attention the last few years. Have they not noticed that the markets are already roiled and that the U.S. financial system has made a mockery of itself? It is possible that the Federal Reserve’s policies have something to do with it? Paul certainly thinks so, as the magazine reports:

If he gets the subcommittee gavel, Paul says he plans a thorough review of Fed policy. Fear of inflation is what motivates him the most. Next to the doorway in his Washington office are six framed German bank notes dating from the 1920s hyperinflation era. The notes are sequentially dated “to show how quickly the zeroes were added onto the bills” as inflation skyrocketed, Paul says. The notes are arranged around a quote by one of Paul’s favorite Austrian School economists, the late Hans F. Sennholz, who Paul once met and calls “a tremendous influence on me.” Paul is a devotee of the Austrian School, which teaches that manipulating money supply and interest rates are responsible for history’s boom-and-bust cycles. “The Fed creates all of the bubbles and they create the inevitable bursting of all of the bubbles,” says Paul.

Then there’s that “radical” view that gold and silver, rather than worthless pieces of paper, should be legal tender. In fact, it’s so radical that it’s right there in Article I, Section 10 of the U.S. Constitution, which reads: “No State shall … make any Thing but gold and silver Coin a Tender in Payment of Debts.” The fear of a return to paper-money printing by state governments, which had had disastrous consequences during the Revolutionary War and postwar period, was so great, wrote Rick Lynch, that “it was paper money, far more than anything else, that prompted [the Framers] to convene the assembly that gave birth to the Constitution.”

With opinions like these, it’s no wonder Paul is anathema to the Washington establishment and the big banks. Indeed, as the congressman told Businessweek, “There has been a politically cozy relationship between Congress and the Federal Reserve” for decades, including, says the magazine, “past efforts to keep him from heading the subcommittee.”

Will they succeed this time either in denying him the gavel entirely or in keeping him “on a tight leash” as chairman? Wenzel thinks not:

If Boehner as much as takes away Paul’s bathroom privileges, there is likely going to be serious hell to pay. There is no way Ron Paul’s followers will take any messing around with Paul’s chairmanship or the power that now comes to the subcommittee. All they need is a cause to rally around, and messing with Ron Paul would be such a cause. Boehner would be a very wise man to move on and pick on somebody that isn’t principled and who doesn’t have a following many, many times greater than those who participated in the original Boston Tea Party.

Rockwell is even more optimistic about the outcome regardless of the leadership’s tactics:

But no matter what they choose — chairmanship, leash, or no chairmanship — the leadership will lose. Ron is already a far bigger figure than Boehner or [incoming House Majority Leader Eric] Cantor. Not in the power to threaten or use violence — a power Ron does not want, and does not believe in — but in the power to raise up a peaceful army for sound money and sound banking. If they try anything, Boehner-Cantor will only diminish themselves.

No matter what the House leadership decides to do, Tuesday will indeed be Ron Paul’s big day.