In July 2011, two of China’s vaunted new bullet trains collided in a spectacular wreck that killed 40 people and injured nearly 200 others. When one train stalled after being struck by lightning, a second train rammed it from behind, causing four train cars to plunge 60 feet off a bridge. The accident was the worst of a series of setbacks that have plagued China’s new high-speed rail project, a visionary plan to link major Chinese population centers that has become something of a symbol for China’s explosive growth over the past several decades.

But China’s foray into bullet-train technology has come with a steep price tag. Having spent an untold fortune on the construction of the rail system, China’s Ministry of Railways has clocked up trillions of yuan in debt (a figure equivalent to hundreds of billions of dollars), and continues to lose around $600 million per quarter. Add to this the steep interest rates that China now has to pay for new debt issues to fund the railway and very low passenger turnout because of the cost of tickets, and the Chinese high-speed rail project has all the hallmarks of a financial disaster in the making.

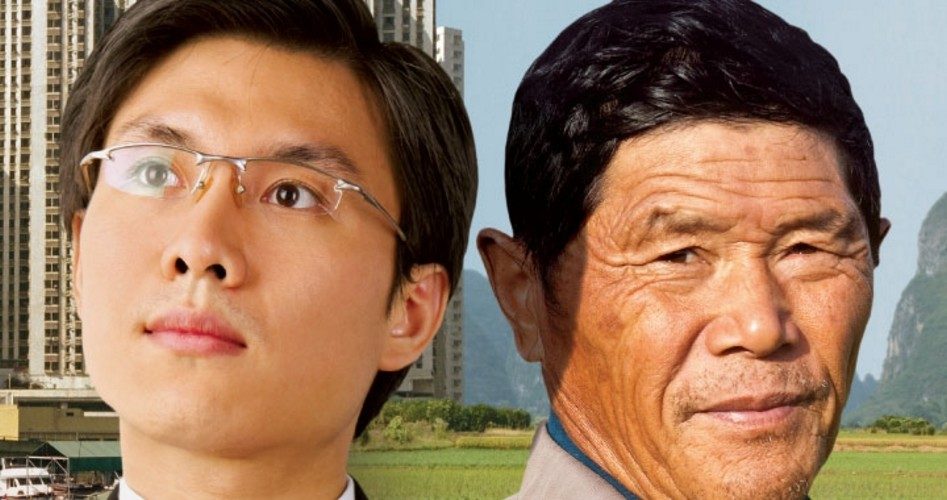

The high-speed rail project is only one of a myriad of state-directed enterprises in still-socialist China that are looking less and less like unstoppable engines of success driving the world’s most dynamic economy and more and more like train wrecks in the offing. For a generation now, and especially in the years since the great economic collapse in 2008, we have been informed by a range of economists, journalists, politicians, and international investors that so-called “red capitalism” has been and will remain a resounding success, that China’s manifest economic destiny is to eclipse the economies of the West within a few short years, and that such growth as the world economy has managed to eke out in recent years has been crucially dependent on China’s progress. In a word, the more free-enterprise-based system of the West appears to be in decline, while China’s oligarchic, managed economic system is held to be the wave of the future, representing a rational compromise between Western laissez-faire and Eastern central planning.

Can China Keep It Up?

But how sustainable is China’s growth? And does it really herald the arrival of a “Chinese century” and the terminal economic decline of the West?

First, the facts: There can be no doubt that China’s economic progress over the last 30 years has been impressive. China essentially launched a modern banking system from scratch and began liberalizing its economic laws in the late 1970s under the leadership of Deng Xiaoping, who pragmatically grasped that China needed to learn to harness the engines of economic progress in order for the communist state to sustain itself. Deng urged his fellow communists to accept that neither socialism nor capitalism could be “pure,” and that China would have to learn to live with both. For a few years, as Eastern Europe and the Soviet Union came unraveled in the late ’80s, it appeared that a similar pageant would play out in China. Events in 1989 in Beijing’s Tiananmen Square, however, dispelled any illusions that China’s economic progress would be paralleled by political liberalization. Government tanks slaughtered hundreds of innocent demonstrators, most of them university students, agitating for “democracy,” quelling any prospect of an overthrow of China’s communist oligarchy.

In the generation since Tiananmen Square, the Chinese economy has continued to charge forward, even as once-isolated China has thrown its doors open to the outside world. Nowadays, millions of foreigners — students, bankers, teachers, and businessmen — live and work in China. The media are filled with dazzling images of glittering new skyscrapers and nouveau-riche Chinese in BMWs and Ferraris, even as China’s space program progresses by leaps and bounds. Chinese factories hum day and night, manufacturing consumer goods that used to be made in the United States, and which wind up on the shelves of Walmart and other Western retailers. Measured against where it was three decades ago, China has indeed enjoyed extraordinary progress — probably the fastest and most dramatic economic growth episode the world has ever witnessed.

Much of this growth, however, has less to do with enlightened policymaking than with the character of the Chinese people themselves. Although China and Russia, the two former titans of totalitarian communism, may seem to have enjoyed parallel histories in the 20th century, they have very different cultures. Russia, when it first embarked upon its disastrous experiment with communism, was a feudal state with little inclination toward the commercial and financial enterprise that had propelled Western Europe to economic supremacy. After the breakup of the Soviet Union, the Russians have more or less reverted to form, with a sort of modern feudalism transforming the Russian economic landscape into a patchwork contest of entrenched oligarchies and partisan machinations. While the Russia of Stalin is thankfully gone, its departure has not ushered in an era of Western-style economic liberalization. Russia’s economy has grown, but not on the scale of China’s, Brazil’s, or those of a host of other newly competitive economies.

China, on the other hand, comes from a robust mercantile tradition, as famed investor Jim Rogers — long one of China’s most conspicuous Western proponents — has pointed out. “China,” Rogers wrote in 2004, “has had a vibrant merchant class throughout much of its history; many are still alive who remember what capitalism was like before Mao Zedong’s revolution.” Nor was the Chinese entrepreneurial spirit snuffed out by the communist revolution in 1949, Rogers pointed out:

Many of those Chinese capitalists went abroad to Hong Kong, Taiwan, and elsewhere to pursue their business interests. Before the Communist revolution, Shanghai had the largest stock market in Asia and between London and New York, and it will again. Even after a half-century of a strictly controlled Communist economy, the Chinese seem more culturally predisposed to capitalism than their Russian counterparts.

They also have the habits of ready-made capitalists: The Chinese save and invest upwards of 40 percent of their income (Americans save barely 2 percent), and they have an incredible work ethic. The Chinese work and work to get the job done. I saw men and women working on highways late at night under floodlights. They demonstrate the kind of productivity and ingenuity that are required to build good companies.

Of the Chinese work ethic and entrepreneurial spirit, this author can personally attest, having spent time in the 1980s teaching English in Taiwan. That beautiful subtropical island that served as a refuge for Chiang Kai-shek’s fleeing Chinese Nationalists fairly buzzed with activity. Many of my English students worked two or three jobs over an 80- or 90-hour work week and still managed to carve out time to study English for 10 to 20 hours a week, so determined were they to position themselves for competitive advantage in what was even then a global economy.

Much the same could be said of Hong Kong, Singapore, and other East Asian cities, like Kuala Lumpur, where the so-called “overseas Chinese” constitute a dominant class. Where Chinese merchants have gone, prosperity has followed.

Thus the Chinese — hard-working, thrifty, and entrepreneurial — enjoy a cultural profile that has allowed them to achieve such extraordinary progress.

Politics of Impoverishment

Politically, of course, China is a different story altogether. Since 1949, mainland China has been ruled by a single party, which was introduced by foreign agents and driven by a foreign ideology. The introduction of Russian-style Marxism in China was not the first time a foreign power has imposed its will on China, but it was destined to have devastating consequences. When Mao Tse-tung and his guerrilla army of communists swept into power in 1949 — with the help and connivance not only of the Soviets but also sympathetic Marxists in Western countries — China was plunged into a totalitarian nightmare, complete with one of the largest pogroms in world history. In contrast to the horrors of the Cultural Revolution, the lighter hand of communism introduced by Mao’s successor, Deng Xiaoping, must have seemed a blessed respite to China’s long-suffering masses. From the late 1970s to the present day, the Tiananmen massacre being a notable exception, the Chinese Communist Party has behaved more like a run-of-the-mill autocracy than a Stalinist dystopia, although crucial human rights generally acknowledged in the West continue to be denied or severely abridged in China.

One of these is the right to have children. China’s abominable “one child” policy, made explicit in 1979, has, as intended, sharply curbed China’s population growth, an outcome that has been met with strong approval among modern-day Malthusians and population-control fanatics, outside as well as inside China (in 1987, China had 26 million births; last year, only 15 million). It has also led to a campaign of forced abortions and other unspeakable treatment of women and couples who conceive children without government authorization.

And there has been an economic price to pay as well, a price that is poised to become much steeper over the next few decades: the loss of a rising generation. Thanks to strictly curbing childbirths for an entire generation, China’s demographics now skew heavily old and gray, and declines in productivity are already becoming evident as a result. “Each year, the number of new workers joining factories is smaller than the number of old workers who are retiring,” Zhang Zheng, an economist at Peking University, told the Telegraph’s Malcolm Moore last year. “The supply has dried up.” Zhang estimates that, out of a total Chinese workforce of 550 million, a mere 154 million are under 30, and the number is dropping with each passing year.

Such a trend spells serious trouble for an economy dependent on a sprawling manufacturing base and the millions of young people who keep its factories productive. China is not the world’s only major power with a graying demographic — the populations of Japan, Russia, and parts of Europe are also graying, as fewer and fewer children are born to couples more and more reluctant to raise families — but China is the only country whose government is directly responsible for the trend.

And China’s one-child edict is only one example of the lingering totalitarian impulses that still define the Chinese Communist Party. While foreign visitors in China are impressed with the bustle and progress, a surprising number of successful Chinese are trying to emigrate. As the Wall Street Journal’s Jeremy Page noted last November, more than half of China’s millionaires are planning to leave the country, according to a Bank of China survey. A whopping 40 percent wanted to relocate to the United States, and another 37 percent were looking to Canada as a refuge. Why? “Many Chinese who have profited most from the country’s growth,” Page observed, “also express increasing concerns in private about social issues such as China’s one-child policy, food safety, pollution, corruption, poor schooling, and a weak legal system.” Beneath its veneer of modernity and order, Chinese politics is still a graft-ridden spoils game and the Communist Party, with its secret police and laogai, is still autocratic and unaccountable. Given the choice between living and rearing such family as they are permitted to beget in a rising China on one hand, and moving to the West on the other, many successful Chinese are contemplating voting with their feet.

Currency Comeuppance

But bad government isn’t the only thing spooking China’s wealthiest. Concerns are rampant that the Chinese economic miracle is about to go sour. For one thing, much of China’s growth has been predicated on its ability to export cheap goods to Western consumers. Since 2008, however, buying has slowed dramatically with the global economic downturn. As household wealth in the United States and Europe has plummeted, so has demand for consumer items made in China. And that’s not all. Page notes that many of China’s wealthy are concerned that “China’s growth could be derailed by a raft of problems, including high inflation [and] a bubbly real-estate sector.” As in the West prior to 2008, China’s real estate sector has been flying high — too high, many analysts are now warning. And while China has refused to allow its currency, the yuan — officially called the renminbi — to float freely against other currencies, the Bank of China has been no less inclined than its Western counterparts, like the Federal Reserve, to pump up the economy by expanding the money supply.

China’s inflationary policies have had a single clear objective since the current 8:1 peg was instituted in July 2008: Keep the value of the renminbi low relative to the dollar, in order to ensure cheaply priced export goods. But any country wishing to maintain a currency peg must print sufficient money to purchase lots of the foreign currency in question; this is why the government of China holds so many dollar-denominated assets. Like other kinds of inflationary activity, fiat money created to support a currency peg in an international climate of floating, or non-pegged, currencies will create malinvestment and asset bubbles. Every major currency crisis in the last 20 years — the Mexican crisis of 1994 and the Asian crisis of 1997 are two prominent examples — was triggered by a breakdown in currency pegs. In those instances, however, the governments of Mexico, Thailand, and elsewhere got their comeuppance from trying to peg their currencies too high, leading eventually to catastrophic devaluation. China, by contrast, has deliberately pegged its currency too low; most estimates put the renminbi’s pegged value at anywhere from 25 to 40 percent below market value.

Printing enough renminbi to maintain the peg has resulted in fairly robust inflation domestically, but has allowed China to avoid the worst effects of the global downturn — for now. There can be little question that, as U.S. politicians frequently charge, China is taking advantage of the international banking and currency system, including the dollar’s status as the world’s reserve currency, to engage in a none-too-subtle form of protectionism, while insulating itself from much of the wild instability in global markets since 2008.

But what is really taking place is that the Chinese government (which is top-heavy with keen financial minds) has cynically discovered a clever means of turning a thoroughly rotten and immoral international monetary system to its own advantage. Prior to World War I, all major world currencies were pegged — to gold (and, in the case of certain regional powers with fewer assets, like China and Mexico, to silver). The gold standard meant that different currencies merely represented different amounts of the precious metal; there was no need for currency controls, currency speculators, and the like. The system regulated itself, and immediately punished any government or central bank that attempted any funny business, like printing more money than it had assets in gold to redeem.

The demise of the international gold standard has given rise to modern currency trading and to the intricate web of international banking and currency regulations we now have. It has also, since the early 1930s, when most of the world abandoned the gold standard, produced almost unremitting currency chaos, in which governments deliberately manipulate their respective currency supplies in order to maintain competitive advantage (or “beggar thy neighbor” policies, as they were once called). But efforts to peg all currencies to the dollar and the dollar in turn to gold, which emerged from the Bretton Woods agreement in 1944, came to naught when the United States under Nixon, having printed money to finance the Vietnam War, went off the gold standard in 1971.

Although the “Nixon shock” to global finance was immediate and long-lasting, the U.S. dollar remained the world’s reserve currency, allowing the United States to continue its inflationary policies at the expense of the rest of the world. In other words, thanks to the international demand for dollars, the United States for several decades was able to issue quantities of fiat money that would have long since overwhelmed any other economy with hyperinflation.

Many other countries with weak currencies — Argentina, Thailand, and Mexico among them — have tried to hitch their currency wagon to the U.S. dollar’s star, only to succumb to inflation and currency implosion after running the printing presses to maintain an artificial peg.

That China has succeeded at this game longer than most others is a testament in part to her avoidance of debt and to her seeking to artificially devalue rather than prop up the value of her currency. The first wave of the great global economic contraction that is still unfolding was triggered by the real estate asset bubble and (more recently) unsustainable levels of sovereign debt, especially in Europe.

But the hard reality (so to speak) of fiat money is that it always produces malinvestment, asset bubbles, and artificial booms that sooner or later end badly. Fiat money is socialized, i.e., centrally planned money, and like all other artifacts of centrally planned economics, always falls prey to the errors inherent in centrally planned economies. Authorities at the Federal Reserve and other central banks have no idea how much money is appropriate for any economy, any more than planning boards in the old communist bloc were ever capable of figuring out how many cars to manufacture or how much wheat to grow. Only the free market can make such determinations.

Therefore, China’s economy, sooner or later, will slip into recession as the inevitable need to correct the pernicious effects of inflation arrives on Chinese shores. There is considerable reason to believe that China, like the West a few years ago, is in the midst of a spectacular real estate bubble, as manifested in part by the binge of skyscraper construction that has transformed the skylines of many of China’s largest cities over the last few years.

Present Position

In the meantime, China has managed to avoid the worst effects of the global downturn by maintaining certain economic fundamentals a little better than the United States and Europe. China is a creditor, not a debtor nation, a distinct advantage at a time when debt is threatening to bring down Western civilization. In relative terms, China is much freer than was the case a few decades ago, engendering confidence on the part of her huge workforce that there will be no returning to the darkness of Maoism. The United States, on the other hand, is dramatically less free, particularly in economic terms, than was the case a generation ago. Our corporate taxes are the world’s highest, and the IRS is now poised to become a national healthcare gestapo on top of its already onerous powers. During the last three and a half years alone, the United States has virtually nationalized her entire financial sector and her insurance industry. Most of the rest of our economy is under the regulatory thumb of the federal government, from pharmaceuticals to automobile manufacturers to oil companies. What basis does the smart money have for expecting America to reverse course?

Not only that, many of our government’s own policies have created huge incentives for American corporations to relocate to China. From the aforementioned vertiginous corporate taxes to the gargantuan cost of compliance with Byzantine occupational, financial, and product regulations, America has become a very hostile environment for building and conducting business. This in contrast to the likes of China, which rolls out the red carpet for any foreign corporation willing to build its factories on Chinese soil and employ its willing workforce.

One piece of silver lining in the recent economic clouds, though, is the arrival of the shale gas industry, which bids fair for the United States where cheap energy is concerned, compared to the likes of China and Japan. As investment guru Antoine van Agtmael pointed out in Foreign Affairs, “The [shale gas] glut has made natural gas prices of $2 to $2.50 per 1 million BTU equivalent to oil at about $12 to $15 per barrel…. In contrast, China and Japan are now forced to import gas at much higher prices of $13 to $17 per 1 million BTU.” Van Agtmael forecast a rosy future for the American energy industry, thanks to the explosive growth of gas extraction via hydraulic fracturing:

In the future, gas will be king rather than oil. In a decade, gas prices may no longer be set by oil prices, but the other way round…. China has its own shale gas but the United States has a major head start in geology, technology, and pipelines. It will take China several years to catch up. India’s offshore gas production has been disappointing and slow. Thailand will run out of gas in ten years, though Myanmar will bring on line large new supplies.

But factors like these have failed to revive confidence in the long-term viability of the U.S. economy as against that of China, whose economy this year is poised to grow by a figure of “only” around seven percent — down from the double-digit growth rates of recent years but still a figure that American and European policymakers can only dream about.

That we have arrived at a state of affairs where an authoritarian regime like China’s looks good, economically and financially, in comparison with the United States speaks volumes about our dire predicament. With investors like Jim Rogers already proclaiming the arrival of a Chinese and Asian century, is there anything the United States can do?

First of all, much of the mess we’re in — the massive indebtedness, the expiring asset bubbles, and the Big Government that is inevitably created to remedy such ills — can be ascribed to a century-long diet of fiat money. In the long run, no nation — not even the frugal, industrious Chinese — can resist the siren song of easy credit and inflationary booms occasioned by fiat money. Over time, excessive debt and easy money become cultural expectations, and people become unaccustomed to thrift.

The only way to extricate ourselves from the culture of easy money is to return to the gold standard. Pegging all currencies to gold once again would put an end to currency wars and would eliminate inflation as long as governments honored their commitments. Under such conditions, no country’s currency would enjoy a competitive advantage over any other’s; if one country tried to print its way out of debt, its currency would self-correct.

The fiscal discipline that a gold standard imposes is, of course, the reason that American politicians and bankers are loath to consider it. Unfortunately, the market is now imposing a discipline of its own, and the inflationary dollar’s days are numbered.

The other step that we must take to avoid being swamped by young economies on the make, like China and Brazil, is to restore some semblance of a free-market economy. America must restore her economic preeminence by returning to her heritage of laissez-faire and getting rid of regulations and taxes that are destroying our economy. If we fail to do so, we will continue down Hayek’s dreary road to serfdom — and may someday soon pass the Chinese going the other way.

This article is an example of the exclusive content that’s only available by subscribing to our print magazine. Twice a month get in-depth features covering the political gamut: education, candidate profiles, immigration, healthcare, foreign policy, guns, etc. Digital as well as print options are available!