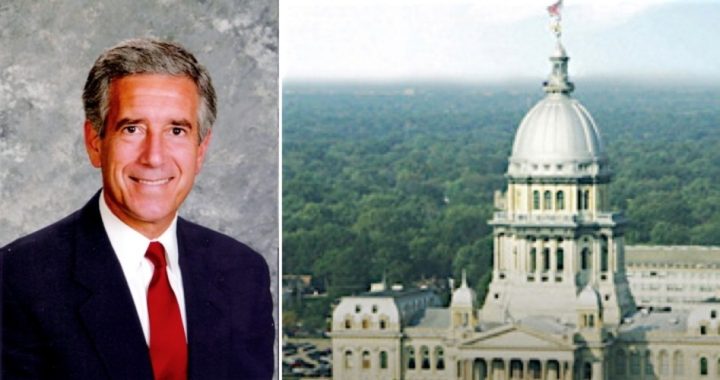

Illinois State Senator Chris Lauzen (pictured along with Illinois statehouse) made three simple suggestions to solving Illinois’ $83 billion unfunded pension liabilities: end abuses of the present system, raise the retirement age to 62, and limit cost-of-living-adjustments (COLAs) to 2 percent a year. What he failed to mention is how to get these changes implemented.

Lauzen has served in the Illinois state legislature beginning in 1992 when he ran on a promise to “work hard, stay honest, and use common sense.” Now that he is retiring he decided to spell out what was needed to bring order out of chaos in Illinois. He said that, if successful, his plan, “The Lauzen Plan,” could be applied to other states facing similar daunting challenges. And if it works there, it might even, he says, apply to Europe’s problems. First, Lauzen recognized the size of the problem. According to the American Enterprise Institute (AEI) the total unfunded liabilities of all the states is at least $3 trillion, possibly more.

Many states, according to AEI, are in denial about that number, relying on old and outdated methods and assumptions used to calculate those liabilities. The interest rate assumptions and proper valuing of the assets held to provide the future benefits may be off, perhaps way off. As noted in an article in The New American, liabilities could be as much as $5 trillion or even more.

Be that as it may, Lauzen is optimistic that, with a little tweaking, Illinois can make it work. First, there are some participants in Illinois’ plan who are “gaming” the system, taking advantage of using overtime in the last few years before retirement to enhance their benefits. This results, says Lauzen, in “a minority of government employees [retiring] at a preposterously young age with obscenely high pension benefits — sometimes well over $100,000 a year.” This has to stop, he says, as it undermines confidence in the system by those honest folks who are playing by the rules.

The next step is to raise the retirement age to 62. Under Illinois’ current plan this changes the liability characteristics of the plan significantly, requiring the state government to contribute much less. Lauzen is optimistic that the state won’t run into the same trouble Wisconsin Governor Scott Walker had when government unions forced him to face a recall election. According to Forbes, many state employees Lauzen has approached on this haven’t been thrilled with the idea but recognize it to be “an equitable calibration of unsustainable overpromises.” Lauzen also recommends a transition period and a grandfather clause to put off the pain for those nearing retirement.

Thirdly, Lauzen thinks the automatic three percent COLA should be reduced to two percent, figuring that that would be enough to close the gap and bring the plan into a currently funded position.

Ralph Benko, writing for Forbes, has his doubts. He thinks more will be required — much more if the current assumptions underlying the $83 billion shortfall don’t prove out. Illinois government workers might be persuaded to accept a defined contribution plan similar to the 401(k) plans used in the private sector. At present the state of Illinois guarantees a pension benefit based upon years of service and not on what’s in the plan. If the plan comes up short, Illinois taxpayers are on the hook. And Lauzen offers no comments about asking those plan participants to pay more for their benefits. Most government workers pay between five and eight percent of their wages into the plan, far less than the actual cost, with the taxpayer picking up the difference.

In light of current reality, potential union pushback, and political unwillingness to face the music especially in an election year, Lauzen’s plan is unrealistic. Those unfunded liabilities are going to have to get much worse before even modest changes such as these will even be seriously considered. It’s wise that State Senator Lauzen is getting out while the getting is good.