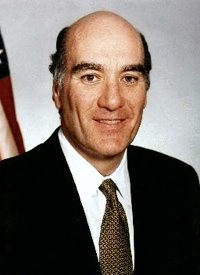

When William Daley, the new White House Chief of Staff said U.S. taxpayers should not pay for infrastructure improvements, it might have sounded to some like a good thing. But the statement he made to Bob Schieffer on Sunday’s Face the Nation on Jan. 30 deserves closer examination.

The Raw Story reported Daleys remarks that U.S. infrastructure investment should come from foreign and domestic private sources:

That’s a creative way to move forward. I dont think raising the taxes on the American people right now is the way to go at this point of our economy..Reality is, as certain people in the Republican Party have said, there’s no way they are going to look for revenue raising in any way, shape, or form. It obviously puts an enormous constraint on the budget and the deficit.

Daley echoed President Obama’s statement during his Jan. 25 State of the Union address. The President asserted:

We’ll put more Americans to work repairing crumbling roads and bridges. We’ll make sure this is fully paid for, attract private investment, and pick projects based [on] what’s best for the economy, not politicians.

But that struck fear into the hearts of those who understand the real meaning of attracting private investment and Daleys belief that funding should come from foreign and domestic sources.

Just ask Texans who revolted when the financial stripes of the Trans Texas Corridor were revealed in the last decade, as reported several times by The New American. When the public private partnership (PPP) that was to fund the NAFTA Superhighway was uncovered, it was found to be a secret deal struck between the State of Texas and Cintra, a private Spanish construction company. Requiring the construction of mandatory toll roads funded through illegal tolling methods, Texans learned that toll revenues were to be funneled to the Spanish company at taxpayer expense. The uproar that followed was heard round the nation.

The Trans Texas Corridor is not the only example of a PPP. While construction is continuing on a much smaller scale than before, and with a much lower profile, other PPPs around the nation have already been completed and public control of public projects has been lost to the private sector entities reaping the benefits. The Chicago Skyway and the Indiana Toll Road are both PPP projects also operated by Cintra.

Private investment in public infrastructure is a trendy new way to solve financing problems that state and local governments face when searching for infrastructure funds. At first sounding like a logical solution, taxpayers are learning they are anything but.

Daleys call for creative ways to finance infrastructure expenses reminded Texans of the Texas Department of Transportations innovative tolling solutions. Whatever they are called, whether innovative tolling solutions, or PPPs, they are usually connected with wording that proposes new ways to transport people and goods. Obama’s speech was no exception. In putting forward his idea, he said,

To attract new businesses to our shores, we need the fastest, most reliable ways to move people, goods, and information from high-speed rail to high-speed Internet.

To propose funding of infrastructure repairs by private investment in order to avoid raising taxes ignores the consequence that private funding usually involves mandatory tolling. While opponents of PPPs don’t oppose tolling, they believe it should be voluntary and that private toll roads are acceptable, as long as they are wholly private, and operate on a free market basis. To understand the differences is critical to solving today’s infrastructure problems.

So when Obama and Daley opine that the answer to infrastructure problems is to court private funds, the public is well served to investigate.

Earlier this month, Obama chose Daley, a former Wall Street executive, as his new Chief of staff, and Daley has been called the business connection at the White House.