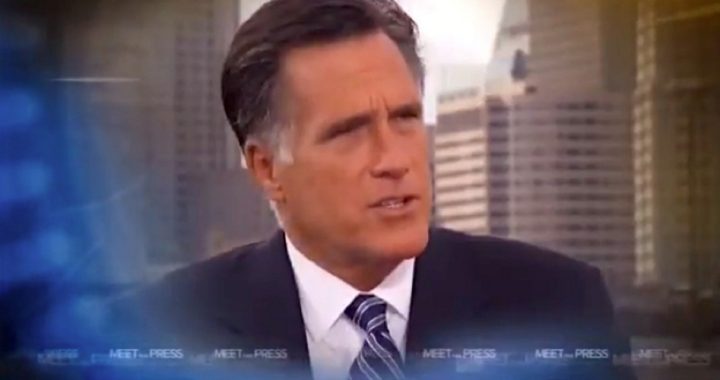

The Republican Party standard-bearer for President, Mitt Romney, edged up toward criticism of the Federal Reserve Bank’s “quantitative easing” in an interview for the October 7 edition of NBC’s Meet the Press.

In the interview, host David Gregory claimed that Obama’s economic agenda appears to be working because “the stock market is at the highest level since 2007,” and with the unexpected unemployment numbers that came out last Friday. Romney replied:

This is really a sign that people are having a hard time finding work, very, very troubling. And of course, the stock market does well, in part because the indication by the Fed that they’re going to print more money, pour more money into the system says we’re likely to have down the road high inflation. Where else are you going to go? If interest rates are going to be near zero, investors have to have some place to go.

Gregory pressed the former Massachusetts governor for a more pointed critique of the Federal Reserve’s third bout of “quantitative easing,” dubbed QE3: “You don’t think the Fed ought to be any more involved at this point?”

Romney backed away from his criticism, suggesting:

I don’t think that easing monetary policy is going to make a significant difference in the job market right now. I think that what the nation needs is a change in fiscal policy, a different structure to our economic positions. And if we take the right course, I believe you’re going to see this economy come roaring back.

Of course, at the time of the Federal Reserve QE3 announcement August 31, Federal Reserve Bank Chairman Ben Bernanke claimed that “Model simulations conducted at the Federal Reserve generally find that the securities purchase programs have provided significant help for the economy.” But the chairman of the Federal Reserve Bank’s Open Market Committee promised that “inflation (except for temporary deviations caused primarily by swings in commodity prices) has remained near the Committee’s 2 percent objective and inflation expectations have remained stable.”

Romney’s statement flatly contradicted Bernanke’s assessment.

Moreover, Federal Reserve Bank policies suppressing interest rates have shrunk the “national savings rate” to near-record lows. The consumer spending spree has been driven by low interest rates as well as easy credit under government guarantees through institutions such as Fannie Mae, Freddie Mac, and Ginnie Mae. This is significant because nations with lower savings rates generally experience lower economic growth rates.

Photo: Mitt Romney with David Gregory on Meet the Press back on September 9, 2012