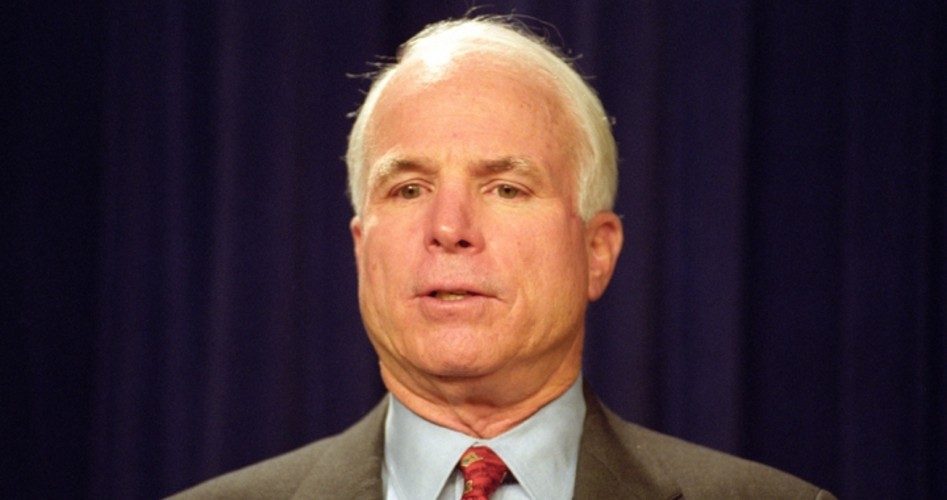

The political transparency watchdog group Judicial Watch announced that it has obtained internal IRS documents that reveal conversations between Henry Kerner, former staff director for Senator John McCain (shown) and chief counsel on the Senate Homeland Security Permanent Subcommittee, and IRS brass. The latter included then-director of exempt organizations Lois Lerner. Among the disclosures: Kerner urged Lerner to “audit so many that it becomes financially ruinous.”

Here’s the backstory to this bombshell breaking story as summarized in the Judicial Watch press release dated June 21:

The explosive exchange was contained in notes taken by IRS employees at an April 30, 2013, meeting between Kerner, Lerner, and other high-ranking IRS officials. Just ten days following the meeting, former IRS director of exempt organizations Lois Lerner admitted that the IRS had a policy of improperly and deliberately delaying applications for tax-exempt status from conservative non-profit groups.

The “marathon” meetings were held to discuss concerns that Senators McCain (R-Ariz.) and Carl Levin (D-Mich.) had that the IRS was not doing enough to rein in political action committees (PACs) and other advocacy organizations.

The Supreme Court’s decision in the Citizens United case effectively repealed one of McCain’s pet pieces of legislation, the McCain-Feingold Act.

In light of the court’s action, McCain was insistent that the IRS increase its pressure on those groups whose activities would now be under less federal scrutiny.

The notes of the April 30 meeting are remarkable for the zeal demonstrated by McCain’s staffer for using the IRS as the weapon for destroying organizations that McCain believed were violating the conditions of their tax-exempt status.

Here’s a small sample of the memo written about the meeting between Kerner and Lerner, again taken from the Judicial Watch statement:

Henry Kerner asked how to get to the abuse of organizations claiming section 501 (c)(4) but designed to be primarily political. Lois Lerner said the system works, but not in real time. Henry Kerner noted that these organizations don’t disclose donors. Lois Lerner said that if they don’t meet the requirements, we can come in and revoke, but it doesn’t happen timely. Nan Marks said if the concern is that organizations engaging in this activity don’t disclose donors, then the system doesn’t work. Henry Kerner said that maybe the solution is to audit so many that it is financially ruinous. Nikole noted that we have budget constraints. Elise Bean suggested using the list of organizations that made independent expenditures. Lois Lerner said that it is her job to oversee it all, not just political campaign activity.

You read that right. John McCain’s staff director and chief counsel for the Senate Homeland Security Permanent Subcommittee was pressing the IRS to come down so hard on tax-exempt organizations that the organizations would be forced to end their activities. Mind you, all activities would be terminated, not just those of an alleged political nature.

For his part, in 2015 Senator McCain has previously released statements denouncing the “false reports claiming that his office was somehow involved in IRS targeting of conservative groups.”

Lucky for Senator McCain, the parts of the documents that could have corroborated the suspicion of Judicial Watch and others that McCain’s office was, in fact, leaning on the IRS to target groups no longer under the watchful eye of McCain-Feingold were blacked out before being turned over to Judicial Watch.

Well, the Arizona octogenarian’s luck seems to have run out as the relevant notes showed up as part of another cache of documents recently released to Judicial Watch.

In May 2013, during a meeting of the American Bar Association (ABA) regarding whether conservative groups were “inappropriately” targeted for audit, Lerner, in response to a softball question (apparently planted), described the targeting scheme as “absolutely incorrect, insensitive, and inappropriate.”

Nor surprisingly, given the widespread political and moral corruption in Washington, D.C., Lerner was let off the hook. Bob Adelmann reported on her unconscionable exoneration in an October 2015 online article for The New American. “In a letter to the chairman and the ranking member of the House Committee on the Judiciary, Peter Kadzik, the assistant attorney general of the Justice Department, let Lois Lerner … off the hook,” Adelmann explained, before quoting the milquetoast letter:

We took special care to evaluate whether Ms. Lerner had criminal culpability.

The need for scrutiny of Ms. Lerner in particular was heightened by the discovery and publication of emails from her official IRS account that expressed her personal political views and, in one case, hostility towards conservative radio personalities.

We therefore specifically considered whether Ms. Lerner’s personal political views influenced her decisions, leadership, action, or failure to take action with respect to tax-exempt applications, or any other matter.

We found no such evidence.

Adelmann went on to explain:

Lerner, and others, were guilty of all manner of malfeasance, delays, obfuscation, stalling, dithering, and borderline obstruction, according to Kadzik, but nothing his department can prosecute her for. There were “mistakes” and “ill-advised selection criteria” used in targeting specific conservative groups seeking tax exemption, along with “delays” and “oversight and leadership lapses by senior managers and senior executive officials in Washington, D.C.” There was “substantial evidence of mismanagement, poor judgment and institutional inertia,” but nothing, according to Kadzik, warranting criminal prosecution. After all, wrote Kadzik, “poor management is not a crime.”

“The Obama IRS scandal is bipartisan — McCain and Democrats who wanted to regulate political speech lost at the Supreme Court, so they sought to use the IRS to harass innocent Americans,” said Judicial Watch President Tom Fitton. “The Obama IRS scandal is not over — as Judicial Watch continues to uncover smoking gun documents that raise questions about how the Obama administration weaponized the IRS, the FEC, FBI, and DOJ to target the First Amendment rights of Americans.”

Regardless of this charade of oversight, the bottom line is that there is now evidence that Senator McCain did, despite his vitriolic denials, take a leading role in the IRS’s scheme to single out conservative tax-exempt groups for harassment and persecution by the IRS.

Why would Senator McCain, a self-styled conservative, one who took an oath to “support and defend the Constitution,” use the influence and authority of his position to “financially ruin” fellow conservatives?

Perhaps 18th Century English Whig John Trenchard can help illuminate the issue. Describing the politically powerful, Trenchard wrote in 1721:

This, I can safely say, has been the constant principle and practice of every leading patriot, ever since I have been capable of observing public transactions; the primum mobile, the alpha and omega of all their actions: They all professed to have in view only the public good; yet every one showed he only meant his own.

Photo of Sen. John McCain: AP Images