The U.S. Supreme Court has given a thumbs-up to school choice, ruling in favor of an Arizona law that gives tax credits for contributions to groups providing funding for religious schools.

In a 5-4 decision (Arizona Christian School Tuition Organization v. Winn et al.) on April 4, the High Court ruled that a group of Arizona taxpayers who sued to block the tax break had no legal claim since the state program that allowed millions of dollars in contributions to go to the private schools was voluntary. The ruling reversed an earlier decision by the U.S. Ninth Circuit Court of Appeals, which had ruled that the tax break was unconstitutional because it violated the First Amendment’s supposed separation of church and state.

Under the Arizona law, which has been in place for over 13 years, citizens can contribute money to “school tuition organizations” (STOs), which in turn fund scholarships for students who attend private, mostly Christian, schools. Taxpayers can claim up to a $500 individual tax credit, or $1,000 for married couples. Since going into effect, the program has funneled some $350 million to more than 50 STOs in the state.

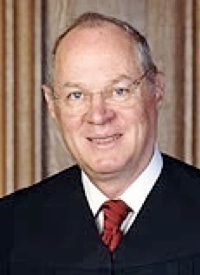

Writing for the majority, Justice Anthony Kennedy (picture, above) noted that tax credits are not the same as direct government funding, explaining that when Arizona taxpayers contribute to STOs, “they spend their own money, not money the state has collected from respondents or from other taxpayers….” Referring to those who filed suit against the law, Kennedy wrote that “respondents and other Arizona taxpayers remain free to pay their own tax bills, without contributing to an STO. Respondents are likewise able to contribute to an STO of their choice, either religious or secular.”

Kennedy was joined in the majority ruling by Chief Justice John Roberts, along with Justices Clarence Thomas, Antonin Scalia, and Samuel Alito.

In her first dissenting opinion since she was appointed to the Supreme Court by President Obama in August 2010, Justice Elena Kagan wrote that the decision “devastates taxpayer standing in Establishment Clause cases.” She argued that the ruling “offers a roadmap — more truly, just a one-step instruction — to any government that wishes to insulate its financing of religious activity from legal challenge…. No taxpayer will have standing to object. However blatantly the government may violate the Establishment Clause, taxpayers cannot gain access to the federal courts.”

Kagan was joined in the minority opinion by Justices Ruth Bader Ginsburg, Sonia Sotomayor, and Stephen Breyer.

Attorney David Cortman of the Alliance Defense Fund (ADF), which represented one of the STOs in the suit filed by the ACLU, applauded the High Court in its decision. “Parents should decide what schools their children attend and where their money goes,” said Cortman in an ADF press release. “The ACLU failed in its attempt to eliminate school choice for hundreds of thousands of students nationwide and also failed to demonstrate that it had any constitutional basis for its clients to file suit in the first place.”

Mathew Staver of Liberty Counsel, another conservative advocacy group which weighed in on the case with a legal brief, was quoted by Baptist Press News as saying that the tax break “gives parents the rights that everyone should enjoy. It is contrary to our history of liberty that parents should be forced to educate their children in government schools, particularly when some schools doom their children to failure. Parents know best about their children’s well-being and should be given every opportunity to provide a quality education of their choice.”