The March 15 Associated Press story was blunt: "For more than two decades, Social Security collected more money in payroll taxes than it paid out in benefits — billions more each year. Not anymore. This year, for the first time since the 1980s, when Congress last overhauled Social Security, the retirement program is projected to pay out more in benefits than it collects in taxes — nearly $29 billion more."

Despite the negative cash flow, on paper the Social Security Trust Fund is still officially in the black. The Social Security Administration is just cashing in a portion of the “interest” it supposedly earning from the federal government, about $2.5 trillion in Treasury bills that the federal government is supposedly paying the trust fund. But the budgetary reality is that one part of the federal government with no money is paying another part of the federal government with no money in more IOUs.

The federal government has not taken the Social Security trust fund money and invested it in the market, against which they could withdraw actual dividends. The government spent every penny, and is now cashing in its own IOUs. The “interest” is fictional; a mere mark on a piece of paper on a ledger.

The Associated Press story continues:

For the budget year that ends in September, Social Security is projected to collect $677 billion in taxes and spend $706 billion on benefits and expenses. Social Security will also collect about $120 billion in interest on the trust funds, according to the CBO projections, meaning its overall balance sheet will continue to grow. The interest, however, is paid by the government, adding even more to the budget deficit.

Part of the reason that Social Security and Medicare are running a negative cash flow is the current recession — high unemployment numbers mean fewer people are paying the 15.3 percent FICA payroll tax (7.65 percent each for employer and employee) that sustains the programs. When the economy recovers, the non-partisan Congressional Budget Office (CBO) projects that Social Security will run a slight cash flow surplus for a few years before running in the red again by 2016.

The net effect is that the federal government is developing a cash flow problem that will stress the federal budget for decades to come. In fact, several of the Social Security “trust fund” sub-units and other federal trust funds have been running in the red for years, even after accounting for all the fictional interest, and will be flat-out bankrupt within ten years. The CBO reported recently that “in the absence of legislative action, the Highway Trust Fund, the DI Trust Fund [Social Security’s disability fund], and the HI Trust Fund [Medicare] will exhaust their balances during [before 2020], CBO projects. The Highway Trust Fund required an infusion from the Treasury’s general fund of $7 billion in 2009.”

The Medicare trust fund draw-down is being driven by out-of-control cost increases as well as an aging national demographic. The CBO estimated that while “in 2009, Medicare had about 46 million beneficiaries; by 2020, that number is expected to climb to 61 million.”

The net result is that the Medicare program, touted by President Obama as a model to follow in pursuing a health care “public option” for all Americans, will be essentially bankrupt unless it is largely funded from general government tax revenues or more borrowing. The Social Security and Medicare Board of Trustees said in it’s most recent annual report: “Growing annual deficits are projected to exhaust HI reserves in 2017, after which the percentage of scheduled benefits payable from tax income would decline from 81 percent in 2017 to about 50 percent in 2035 and 30 percent in 2080.”

Social Security’s Old Age and Survivors fund (OASI) faces similar demographics from the maturation of America, even if it will not face the stress of increased health care cost. But it also faces eventual bankruptcy a few decades down the road.

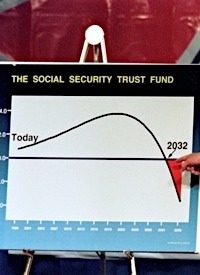

Photo: In 1998, Vice President Al Gore pointed to a graph representing decreasing Social Security revenues: AP Images