Thanks to how the Internal Revenue Service implemented President Barack Obama’s tax break last spring, more than 15 million taxpayers may owe the government either $250 or $400 more for their 2009 income tax. The tax break has decreased the amount of tax withheld for 95 percent of working families, but millions will find that they need to pay back the government for not withholding enough.

The tax credit was designed to pay individuals up to $400 and married couples up to $800. The problem occurs for individuals with more than one job, couples with both spouses working, students who are still dependents, and Social Security recipients who also have taxable wages. Individuals with two or more jobs and working couples may need to repay $400, while those who receive Social Security and job income may need to repay $250.

Taxpayers can go to the IRS website to find an appropriate withholding calculator. While a new W-4 may be filed with employers, there is very little time left in the year to make adjustments large enough to compensate. The IRS issued new tax withholding tables early in the year to reflect President Obama’s stimulus tax break, and most workers began seeing small increases in take-home pay in April.

Unfortunately, the withholding tables fail to consider some of the common taxpayer categories already mentioned, and taxpayers will literally pay the price for the IRS blunders. In the case of an individual with two jobs, each paycheck received a $400 boost, together equaling $800. But an individual is only supposed to get a straight $400 break, so half of the $800 total must be repaid.

The IRS somehow managed to recognize that married couples with both spouses working would suffer a similar fate, with couples eligible for a total of $800. But rather than limiting each spouse to $400 in lowered withholding, they decreased each spouse’s taxes by $600. The resulting total of $1,200 is $400 too high, and that difference must be paid back.

Lest anyone think this a small mistake on the part of the IRS, there were 33 million married couples in 2008 with both spouses working. By the reckoning of the U.S. Census Bureau, this represents no less than 55 percent of all married couples.

The stereotypically starving student with a part-time job was also supposed to get a $400 pay hike via lower withholding amounts, but only if he is no longer a dependent. If the student is claimed as a dependent on his parents’ tax return, this disqualifies him for the tax break and he will need to starve a little longer to pay back the $400.

Somewhere around 50 million Social Security recipients received $250 payments this past spring as part of the stimulus, but the payments were only supposed to go to those who didn’t qualify for the tax credit. Any retirees who received the $250 payment along with the credit for taxable income will need to return Uncle Sam’s $250 mistake.

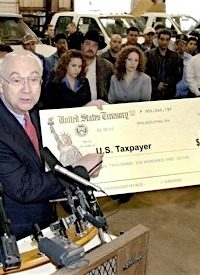

“More than 10 percent of all taxpayers who file individual tax returns for 2009 could owe additional taxes,” stated J. Russell George, the Treasury inspector general for tax administration. Senator Chuck Grassley (R-Iowa), the senior GOP member of the Senate Finance Committee, analyzed the tax credit problem as “another unfortunate example of what can happen when Congress and the White House rush through legislation like the stimulus without thinking through the consequences.”

It is also the unfortunate result of President Obama seeking brownie points with the electorate through temporarily tossing out the modern equivalent of “bread and circuses,” yet offering no long-term relief through permanent tax reductions or even the total elimination of the IRS. The fact that the agency responsible for collecting such a debilitating tax from U.S. citizens could be so incompetent speaks volumes about how richly it deserves to be abolished.

Photo: AP Images