Colt Defense, the once high-flying iconic manufacturer of the Colt .45 single action Army revolver known as the “Peacemaker” — the “gun that won the West” — and the 1911 semi-automatic pistol designed by John Moses Browning, ran out of airspeed and altitude on Sunday, and declared bankruptcy.

In his press release, Keith Maib, chief restructuring officer of Colt Defense, LLC, put the best face he could on a disaster that has been unfolding for years:

The plan we are announcing and have filed today will allow Colt to restructure its balance sheet while meeting all of its obligations to [its] customers, vendors, suppliers and employees [while] providing for maximum continuity in the Company’s current and future business operations….

[This restructuring] will enable us to continue to gain traction on a challenging but achievable turnaround in our business performance and competitive positioning in the international, U.S. government and consumer marketplaces.

Colt remains open for business.

Behind the press release, however, a far darker picture emerges. In order to pay its current bills, the West Hartford, Connecticut, company had to wrangle a $20-million short term loan from its lenders just to stay open for business until August. After that, if a buyer can’t be found, the company will be forced to liquidate.

Trouble surfaced last November when Colt had to borrow $70 million to make an interest payment on its $355 million of debt. Shortly thereafter certain “accounting issues” prevented the company from filing its financials in a timely fashion.

Then it went to its bondholders, asking them to exchange their debt for equity in the company. Less than 10 percent of them agreed to the deal, and the offer expired on June 12.

On June 15, the company had another interest payment due and no money to pay it. That explains the Sunday evening announcement.

The company’s strategy is simple. Because of its fragile financial condition, it has named its primary equity partner, Sciens Capital Management, which owns 85 percent of the company, to act as a “stalking horse” in obtaining bids from potential buyers. Sciens will set a purchase price that will act as a floor, thus hoping to avoid low-ball bids.

Sciens describes itself as an independent “alternative” investment management firm which focuses “on providing bespoke” investment strategies for companies that are in trouble and cannot obtain any additional regular financing for their operations. The drop-dead date for the company is August 3, after which it will be forced to liquidate.

Colt’s history dates back to the Mexican-American War of 1847 when it first began supplying small arms to the United States and other governments. Its last brush with profitability was in the 1990s and early 2000s when its highly regarded M4 and M16 military weapons were purchased in massive quantities primarily by the U.S. Defense Department.

But in 2013, it lost out in its bid to continue making the M4 and M16 to FN Herstal of Belgium. It failed to keep up with the changing handgun market as well, and the end of Colt was inevitable.

Perhaps the biggest blow to Colt was the accidental invention of a polymer-framed gun developed, almost on a lark, by Gaston Glock in a bid for Austria’s handgun business in 1980. The government was seeking a replacement for its famous but aged Walther P38 9mm semi-automatic pistol that dated back to before WWII. It listed 17 criteria for the tenders to follow, and Mr. Glock, whose company made curtain rods and knives for the Austrian government, was unencumbered by a past that demanded that things be done a certain way.

When his tender was accepted, Glock continued to refine the firearm, and its 17th iteration became the world’s most popular handgun, the Glock 17.

Of interest is the fact that Glock’s design competed successfully against eight different pistols from five other established manufacturers, including Heckler and Koch of Germany, SIG Sauer also of Germany, Beretta of Italy, FN Herstal of Belgium, and Steyr Mannlicher of Austria. Missing from the competition was any company from the United States, especially Colt. Colt apparently was too busy focusing on military weaponry to notice the revolution taking place in Austria.

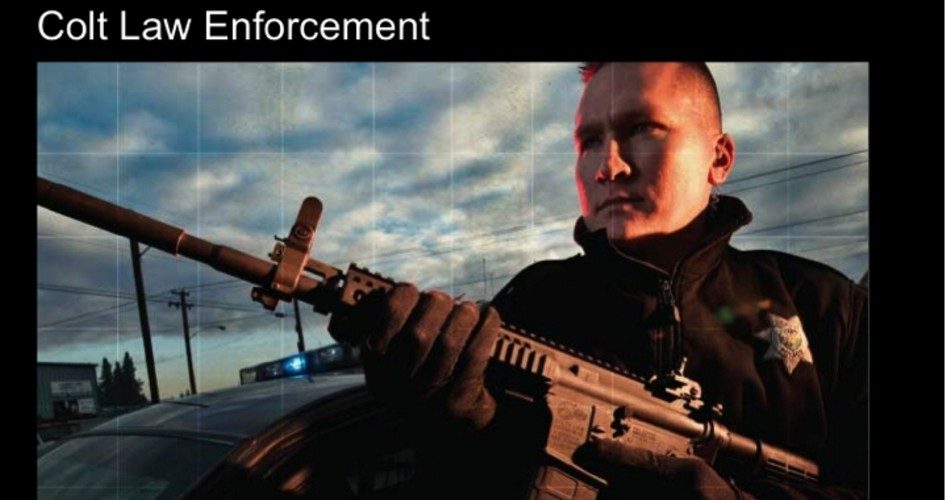

By the time Colt began losing market share to Glock — some estimate that 70 percent of law-enforcement officers in the United States now carry a Glock — it was too late. When it lost its bid to FN Herstal for the M4 and M16 contracts, from then on it was just a matter of time.

What’s remarkable is that Colt’s disintegration took place during the “Obama bull market” in gun sales. Background checks — a prerequisite for gun purchases — jumped from nine million in 2005 to almost 21 million in 2014. By the time Colt realized that it was missing an opportunity, there was no way for the company to catch up.

Even if a buyer is found in time to avoid liquidation, there is serious doubt that Colt would or could ever become profitable again. Opportunity, competition, and innovation have passed them by.

A graduate of an Ivy League school and a former investment advisor, Bob is a regular contributor to The New American magazine and blogs frequently at www.LightFromTheRight.com, primarily on economics and politics.