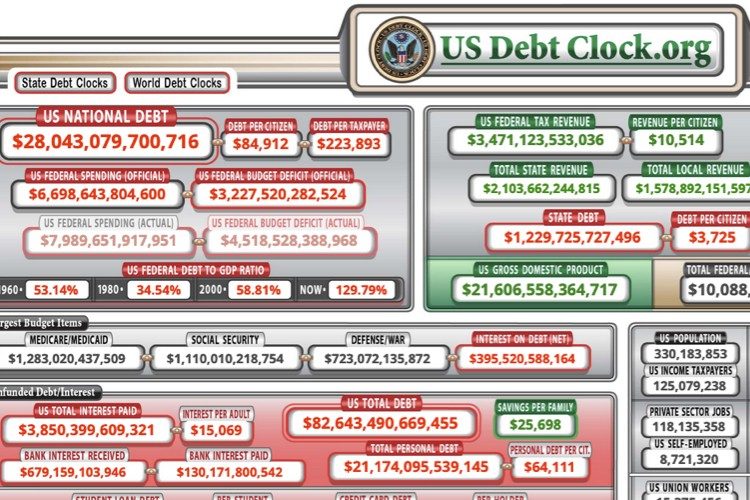

President Biden has signed the $1.9 trillion American Rescue Plan that will bring the national debt well beyond the $28 trillion it is now.

Americans who qualify for “stimulus payments” will start receiving payments as early as this weekend, but the bill does more than send out cash. The bill includes a cornucopia of other goodies, such as more money for leftist federal grant makers, that will push its 10-year cost beyond $4 trillion.

Whatever Americans get from all that money now, they’ll pay for it later. Or maybe sooner.

Biden Speaks

Though Biden hasn’t held a press conference since he was inaugurated, he did come to life long enough yesterday to say a few words after he signed the bill. “An overwhelming percentage of the American people — Democrats, independents, our Republican friends — have made it clear — the people out there have made it clear they strongly support the American Rescue Plan,” Biden said:

Yesterday, with the final passage of the plan in the House of Representatives, their voices were heard and reflected in everything we have in this bill. And I believe this is — and most people, I think, do as well — this historic legislation is about rebuilding the backbone of this country and giving people in this nation — working people and middle-class folks, the people who built the country — a fighting chance. That’s what the essence of it is.

Actually, neither Biden nor his leftist party colleagues care much for the “people who built the country.” If they did, they wouldn’t be importing Latin Americans at a rate of more than 3,500 every day.

That aside, the bill contains, again, more than just a big check for Americans earning under $75,000 annually.

Other Goodies

Among the other goodies are these, NBC reported:

- A $300 weekly federal bonus added to unemployment and a 15 percent boost in food stamps through September 6;

- The child tax credit goes to $3,600 for Americans with kids under 6 years old, and $3,000 for kids between 6 and 17;

- $40 billion in Federal Emergency Management relief and $14 billion to administer vaccines against the coronavirus; and

- $22 billion to help pay rent, $10 billion to help pay mortgages, and $5 billion for the homeless.

But at least those payments are, in some sense, directed at people who need help.

Other money isn’t. Thus does the list of handouts includes these wasteful items that have nothing to do with “virus relief:”

- $86 billion to bail out pensions;

- $1.7 billion for Amtrak;

- $270 million for the hard left National Endowments for the arts and humanities;

- $175 million for the leftist Corporation for Public Broadcasting; and

- $125 billion for the nation’s failing public schools.

The Committee for a Responsible Budget put the plan’s 10-year cost at $4.1 trillion because of tax-credit and economic relief extensions and interest on the debt that will cost $2.2 trillion.

America’s Debt Clock spins faster and faster.

Would It Pay Not to Work?

Such is the munificence of the rescue plan, John Carney wrote at Breitbart yesterday, that it might pay one not to work.

Carney calculated that a family with two jobless parents and three kids could net more than $92,000 if they exploit all the plan’s many subsidies.

The $300 unemployment bonus, he wrote, is a major income multiplier. “In New Jersey, the average state unemployment insurance payment is $419 per week,” he wrote. “So that’s $719 per week for each parent or $1,438 per household. That is the equivalent of earning $74,776.”

Even better, the first $10,200 of those benefits won’t be taxed.

Though “the enhancements are not scheduled to last the full year and neither are the extensions of benefits,” Carney explained, “Congress has repeatedly extended the length of time a jobless American can collect benefits and kept federal enhancement in place long after it was set to expire. The current enhancement is set to sunset in September but only time will tell.”

Added to that are three $3,600 child tax credits totaling $10,800, which would boost family income to $85,576. Even if the family only takes $3,000 credits for older kids, the income is still quite high: $83,776.

And, of course, each family member will snag a $1,400 stimulus payment. Total for a family of five: $7,000.

Total package: $92,576

That figure would vary depending on a state’s unemployment benefits, and, again, the number of children and their ages.