If all the advocates of a world fiat currency (a currency not backed by a precious commodity like gold) were to scream at once, workers in world capitals, business centers, colleges, and news media may be deafened. And if global financial elites have their way, America will move quickly toward accepting a planetary fiat currency issued by a world central bank.

Calls for a new global monetary regime are nothing new. After World War II left the world’s financial system in disarray, political leaders and financial gurus met at Bretton Woods, New Hampshire, from July 1-22, 1944, to plan the post-war economic order. Economist John Maynard Keynes and the British government proposed the creation of a world currency called the “bancor,” and the U.S. government proposed a world currency to be known as “unitas.” But for a lot of reasons, mostly American reluctance, the schemes never took off. Instead, the Bretton Woods agreement resulted in the U.S. dollar — its value at the time tied to gold — being crowned “the” world reserve currency. But the dollar’s place as the unchallenged world currency began being displaced with the dollar’s decoupling from gold in 1971. A new system emerged: The dollar retained its position as the world’s reserve currency, but now it was backed not by gold, but only by trust and the fact that oil and other commodities were traded around the world in dollars. Since then, the U.S. government has been growing itself and its power through creating money via the inflationary power of the Federal Reserve, thus making the dollar increasingly less stable, prompting vigorous calls for a world currency to stabilize world financial markets. That has especially been true as markets have imploded.

Leading the Charge

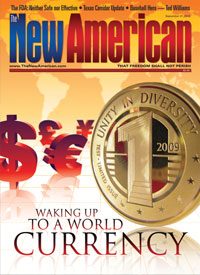

Naturally, prominent globalist leaders and central bankers have been at the forefront of promoting world-currency schemes. And they are confident that the groundwork has been sufficiently laid to achieve the goal. Russian President Dmitry Medvedev has been among the most vocal supporters. At the G-8 meeting last year, he actually pulled a “united future world currency” coin out of his pocket bearing the words “unity in diversity.” Then, he explained to the audience that it “means they’re getting ready. I think it’s a good sign that we understand how interdependent we are.” In June of this year, he was at it again. “We are making plans for the future. We are talking about creating other reserve currencies, and we are counting on other countries to understand this,” Medvedev told an economic forum in St. Petersburg, Russia.

At the same forum, French President Nicolas Sarkozy concurred, saying world powers “should think together about a new international currency system” at the upcoming G-20 summit. He also said the world’s financial system was “outdated” and should be replaced. “We all need to think about the foundations for a new international financial system,” he urged. “We’ve been based on the Bretton Woods institutions of 1945, when our American friends were the only superpower. My question is: Are we still in 1945? The answer here is, ‘no.’”

Numerous other prominent national leaders have jumped on the international fiat-currency bandwagon as well — too many to list in a short article. But perhaps more importantly, powerful central bankers around the world are also pushing the issue. Former Fed boss and current chairman of Obama’s “Economic Recovery Advisory Board” Paul Volcker, for example, has long been a strong proponent of a global fiat currency and a global central bank. He is widely reported to have said, “A global economy needs a global currency.” And he has repeatedly called for such a system, hoping to see it emerge during his lifetime.

In China, the “people’s” central-bank boss Zhou Xiaochuan has also frequently called for a new reserve currency. In a 2009 report published on the central bank’s website entitled “Reform the International Monetary System,” Xiaochuan explained that “the desirable goal of reforming the international monetary system, therefore, is to create an international reserve currency that is disconnected from individual nations and is able to remain stable in the long run, thus removing the inherent deficiencies caused by using credit-based national currencies.”

When asked about the communist-Chinese regime’s idea at a Council on Foreign Relations event, tax-dodging U.S. Treasury Secretary Timothy Geithner, a regular proponent of global regulation, after acknowledging that he had not read it yet, said, “We’re actually quite open to that.” The dollar immediately plunged. And while Geithner promptly backtracked on his statement, as the saying goes, the cat was already out of the bag.

At a separate Council on Foreign Relations event earlier this year, European Central Bank boss Jean-Claude Trichet gave a speech entitled “Global Governance Today.” While different in important respects from calls to empower the International Monetary Fund as the world central bank, which seems to be the consensus view on how to quickly achieve a world currency, Trichet offered a vision that would ultimately lead to the same end. “We need a set of rules, institutions, informal groupings and cooperation mechanisms that we call ‘global governance,’” he said, praising the progress that has already been made in “strengthening the mandate of existing international institutions” but noting that “no market can survive without a set of rules. This is particularly true at the international level.”

In terms of the international monetary system, he applauded the fact that central banks around the world were already “able to take quick, decisive and coordinated action at short notice.” But “the crisis also showed that gaps in the system of global governance — in terms of both efficiency and legitimacy — have to be filled,” he explained, pointing out that the process was already ongoing.

“Overall, the system is moving decisively towards genuine global governance that is much more inclusive,” Trichet said. “The significant transformation of global governance that we are engineering today is illustrated by three examples. First, the emergence of the G20 as the prime group for global economic governance at the level of ministers, governors and heads of state or government. Second, the establishment of the Global Economy Meeting of central bank governors under the auspices of the [Bank for International Settlements (BIS)] as the prime group for the governance of central bank cooperation. And third, the extension of Financial Stability Board membership to include all the systemic emerging market economies.” In other words, the BIS, the central bank of central banks (which was almost disbanded for supporting the Nazis), is becoming increasingly powerful, along with global financial regulatory institutions. And for Trichet, this is a positive development.

He added, “Global governance is of the essence to improve decisively the resilience of the global financial system,” and concluded by saying, “The crisis has driven an historic change in the framework of global governance. In my view this transformation was overdue.” And indeed, the economic crisis has given a major boost to advocates of a world financial and monetary regime.

Global Institutions

With the onset of the global financial crisis, which interestingly enough was largely brought on by an asset bubble caused via currency manipulation by the United States’ version of a central bank — the Federal Reserve — international authorities have become increasingly vocal about the supposed need for a world fiat currency controlled by a single world central bank. The United Nations and the International Monetary Fund are the most prominent among them. And both of these quasi-governmental institutions have recently issued reports blasting the dollar and calling for a world fiat currency.

“A new global reserve system could be created, one that no longer relies on the United States dollar as the single major reserve currency,” said the UN’s World Economic and Social Survey for 2010. “The dollar has proved not to be a stable store of value, which is a requisite for a stable reserve currency.” The new UN report said that the IMF should be given the authority to print its own fiat currency, claiming that the new system “must not be based on a single currency or even multiple national currencies but instead, should permit the emission of international liquidity — such as [Special Drawing Rights] — to create a more stable global financial system.” SDRs are “assets” issued by the IMF with a value currently based on multiple national fiat currencies.

Late last year, another UN report from a different arm of the institution offered similar analyses and suggestions. “In the discussion about necessary reforms of the international monetary and financial system, the problem of the United States dollar serving as the main international reserve asset has received renewed attention,” said the report, published by the UN Conference on Trade and Development. The paper also pointed to SDRs as the potential international reserve currency.

Earlier in 2009, another UN panel also called for talks on setting up a new international monetary system and moving away from the dollar. And the calls are only becoming more frequent and respected as time goes on.

Then there is the International Monetary Fund, a likely candidate for the position of global central banker, which in some ways has already taken on the role. Like other figures within the organization, IMF boss Dominique Strauss-Kahn — an avowed socialist — has repeatedly called for global regulation and a world currency controlled by the “Fund.”

“One day, the fund might even be called upon to provide a globally issued reserve asset, similar to — but in important respects different from — the SDR,” he explained in a speech earlier this year, saying it would be “intellectually healthy to explore” the creation of a new IMF-backed world reserve currency before it is “needed.” A few months later, he told the High-Level Conference on the International Monetary System that “crisis is an opportunity” and “a new global currency issued by a global central bank, with robust governance and institutional features, could provide a nominal anchor and risk-free asset for the system.”

And it’s not just Strauss-Kahn. In a barely noticed paper published in April of this year, the Fund went even further than the UN or Strauss-Kahn. It outlined the future global fiat currency, to be run by a transformed and newly empowered IMF.

The paper, published by the IMF’s Strategy, Policy, and Review Department and entitled “Reserve Accumulation and International Monetary Stability,” offers very specific proposals which — not surprisingly — would involve handing it massive new powers over the global economy and “making the special drawing right (SDR) the principal reserve asset in the [International Monetary System].” And this is merely the short-term policy; the IMF wants to go further, with the creation of a global currency called the bancor.

Of course, even the IMF says its schemes will not likely come about quickly or easily. “It is understood that some of the ideas discussed are unlikely to materialize in the foreseeable future absent a dramatic shift in appetite for international cooperation,” it says in the report. Some analysts have suggested a war with Iran or a crash of China’s economy could trigger such a shift.

Trend Toward Monetary Unions

Monetary unions, where a collection of national governments surrender their power over money to international institutions, are popping up around the world. In recent decades, there has been a declining number of currencies as more countries abandon their own currencies to use a multinational currency, such as the euro.

Africa already contains a patchwork of regional supranational currencies, including one in West Africa, another in Central Africa, and a group of countries that use the South African Rand. A plan to introduce a continental currency — sometimes referred to as the “afro” — controlled by the already existing African Union’s African Central Bank is set for completion in less than two decades. In Asia, calls for a regional monetary union are growing stronger. Arabian nations, through the Gulf Cooperation Council, are planning their own common currency right now.

In closer proximity to the United States, a group of Caribbean nations formed the Eastern Caribbean Currency Union. All use the East Caribbean dollar. More recently, a number of leftist Latin American regimes created the SUCRE under the leadership of socialist despot Hugo Chavez. And a South American currency is currently in the works. Significant numbers of nations have also unilaterally abandoned their own currencies and switched to the dollar, such as Ecuador and El Salvador. In Europe, while not officially joining the Eurozone, numerous small countries have also switched to the euro. And this is exactly what many proponents of a global fiat currency are promoting as a means to that end. Once there are fewer currencies and the principal of supranational currency is established, such as has already occurred with the euro, it becomes easier to simply merge them.

A 2007 article for the Council on Foreign Relations’ magazine Foreign Affairs entitled “The End of National Currency” offered some insight into the strategy being pursued. Benn Steil, the powerful group’s director of international economics, suggests a very specific proposal: “Governments should replace national currencies with the dollar or the euro or, in the case of Asia, collaborate to produce a new multinational currency over a comparably large and economically diversified area…. Most of the world’s smaller and poorer countries would clearly be best off unilaterally adopting the dollar or the euro, which would enable their safe and rapid integration into global financial markets. Latin American countries should dollarize; eastern European countries and Turkey, euroize.”

And that is precisely the argument of the most prominent global currency enthusiasts. Columbia economics Professor Robert Mundell, who could not be reached by press time, is one of them. He is a Nobel-prize winner, a key advisor to the communist Chinese regime, and also known as the “father” of the euro. And he argues that the world should move toward a new global currency system called the “DEY” — a “basket” of dollars, euros, and yen controlled and issued by a global central bank, possibly a newly empowered IMF. Eventually, the architecture would lead to a truly global fiat currency.

“My approach is rather to start out with arrangements for stabilizing exchange rates, and move from there to a global currency. It would start off from the situation as it is at present and gradually move it toward the desired solution. We could start off with the three big currencies in the world, the dollar, euro, and yen, and with specified weights, make a basket of them into a unit that could be called the DEY,” Mundell explained in a 2005 speech called “The case for a world currency.” “The DEY could then become the platform on which to build a global currency, which I shall call the INTOR.”

His “basic plan” for the world currency would be implemented in three stages, he said. First, stabilization of exchange rates. Next, a monetary union under the DEY consisting of most of the world’s economy. And finally, the creation of the INTOR. While Mundell acknowledged that it might be difficult, he expressed optimism about the currency’s prospects, saying, “The next big crisis might be the occasion for a reconvening of a Bretton Woods type conference to establish the conditions for a new international monetary system.” With the United States looking at a likely second round of economic turmoil and its dollar becoming increasingly unstable as interest payments on the national debt take up an ever larger part of all taxes collected, such a “crisis” is probably closer than Americans would like to imagine.

Other prominent advocates agree with the Mundell strategy for achieving a world currency managed by a global central bank. “We’ll probably get there by the merger of monetary unions,” explained Morrison Bonpasse, founder and president of the Single Global Currency Association and author of The Single Global Currency: Common Cents for the World, in an interview with The New American. “But there are several possible routes. One is to continue the current regionalization of currencies, to include North America, and creation, expansion and merger of monetary unions; and then combine those currencies into one. Another is for smaller countries to continue to ‘ize’ their nations’ legal tender, as in ‘dollarize’ and ‘euroize.’ … Once the ‘tipping point’ is reached where one currency supports approximately 40-50 percent of the world’s GDP, the movement will accelerate to anoint that currency as the single global currency.” The organization’s target date: 2024.

Clearly, the move toward regional currencies is picking up traction, especially during this decade.

Already Emerging

Some argue that the global central bank and all that it entails are already taking solid form or, worse, already here.

“What the IMF is doing is, they’ve positioned themselves and are actually beginning the process of issuing debt for the first time,” explained James Rickards, senior managing director for market intelligence and co-head of threat finance and market intelligence at Omnis, a leading consulting firm. “So what that means is the IMF is acting like a central bank because it’s leveraging its balance sheet,” he told The New American, saying SDRs could replace the dollar and become the international reserve currency in two to five years. And it’s already going on. “In terms of paper currency, a leveraged balance sheet, and the creation of liquidity out of thin air, the IMF is clearly the way they’re going because, as I said, they’ve already done it…. It’s not speculation, it’s actually happening,” he said, noting that the shift away from dollars has already started and would accelerate.

The IMF has indeed taken some extraordinary steps recently. Last year, for example, for the first time in the Fund’s history, it issued bonds denominated in SDRs. The Chinese regime promptly gobbled up $50 billion worth, with the IMF saying in a statement that the sale “offers China a safe investment instrument” and that it was part of a broader plan to “boost the Fund’s capacity to help its membership — particularly the developing and emerging market countries — weather the global financial crisis, and facilitate an early recovery of the global economy.” And of course, there’s still more.

“The other thing the IMF has done — not for the first time, really for the second time, but the first time in quite a large size — is to issue SDRs,” explained Rickards. “The IMF is issuing its own paper currency,” and, like all fiat currencies, it’s backed by nothing, Rickards said. “I view all of these as pilot programs. In other words, they’re kind of testing the plumbing…. Now the IMF is positioned to — in effect, and I think this is the plan — to become a global central bank which can issue its own currency called SDRs, leverage its balance sheet through borrowing, and then create assets by making loans and investing in securities, all under the auspices of the IMF executive committee, which is basically the same set of people as the G20.”

At recent G20 confabs, the centralization of the world’s monetary system has indeed been a hot topic. Headlines around the world announced — boldly and with good cause — the imminent arrival of a “new world order,” a global currency, a world central bank, and a planetary monetary-policy regime. The early 2009 G20 declaration, for example, said, “We have agreed to support a general SDR allocation which will inject $250 billion into the world economy and increase global liquidity.” In simpler terms, printing international fiat money.

Now, the regulatory regime is going global, too. And fast. The same G20 meeting also led to the Financial Stability Forum being transformed into the Financial Stability Board, usurping financial regulatory authority traditionally held by national central banks around the world. The new “board” is rapidly becoming a global financial regulator as its mandate expands to include overseeing action to address vulnerabilities in the financial system, setting guidelines, and even managing “contingency planning for cross-border crisis management.”

Media Support

No strategy for dramatic, unpopular change would be complete without a public media campaign. So, of course, among the prominent voices throwing their weight behind a global fiat currency and a global central bank are some of the most influential media outlets in the world. Already in 1988, The Economist wrote an article predicting a global currency within 30 years, saying, “This means a big loss of economic sovereignty, but the trends that make the [new hypothetical global currency] so appealing are taking that sovereignty away in any case.”

A decade later, the New York Times took up the issue with a piece from prominent CFR insider and global central bank promoter Jeffrey Garten calling for a “global Fed.” After praising the development of various unconstitutional institutions in the United States, most notably the Federal Reserve, Garten wrote, “The world needs an institution that has a hand on the economic rudder when the seas become stormy. It needs a global central bank.” Ten years after that, Garten penned a piece for the Financial Times, once again advocating “the establishment of a Global Monetary Authority.”

In a 2008 Newsweek article entitled “We Need a Bank of the World,” Garten claimed, “The financial crisis is global, and only an international central bank can deal with it.” The piece called for world leaders to “begin laying the groundwork for establishing a global central bank” because “the Fed no longer has the capability to lead singlehandedly.”

The year after that article, Garten was at it again, this time in Businessweek. “If critics could suspend the hyperventilating for a few minutes, they’d realize a global central bank is becoming a necessity in today’s complex, interconnected world economy,” he wrote. The piece also cites Tim “TurboTax” Geithner, who said, “We need a common global solution to these markets, not separate regional solutions.”

Meanwhile, the Washington Post ran a 2009 story praising the International Monetary Fund’s transformation into a bank of the world. “Bowing to a new economic world order, the IMF would grant fresh powers to the likes of China, India and Brazil. It would have vastly expanded authority to act as a global banker to governments rich and poor,” wrote Post staff writer Anthony Faiola. “And with more flexibility to effectively print its own money, it would have the ability to inject liquidity into global markets in a way once limited to major central banks.” The article also mentioned “the IMF’s transformation into a veritable United Nations for the global economy” and quoted various experts praising the developments.

Even the supposedly more free-market-friendly press in the United States has also backed the scheme. “World money, with a world central bank, seems a next logical step,” wrote Wall Street Journal editor emeritus Robert Bartley in a 2003 opinion piece for the newspaper. “A world money would be an extraordinary boon to international stability.” He was writing from Mundell’s monetary conference at his castle in Italy.

The world elite is on a mission. Its plan to impose a global fiat monetary regime on humanity is well under way. And if serious resistance is not mounted soon, the new world monetary order could be just around the corner.

Related article: