When John Hussman, in his Weekly Market Comment, noted that the Economic Cycle Research Institute’s (ECRI) Index “has slumped to the lowest level in 44 weeks and has now gone to a negative reading,” he was confirming other recent signals that the economy was giving off, notably here and here, that the possibility of a double dip recession continues to increase.

ECRI has studied “cycles in economic growth, employment and inflation” for years and has “uncovered reliable sequences of events … [that] help us to predict cyclical turning points …we have refined the scope and accuracy of cyclical forecasting tools to the point where ECRI can reliably predict the timing of cyclical turns.

Their Weekly U.S. Leading Index was at 132 in January 2008, just before swooning to 104 a year later, accurately predicting the start of the Great Recession. That Index has moved higher since last summer but after peaking in April, it has declined significantly. Hussman believes that the U.S. economy is now in a “cliff-hanger” situation because it suggests the real possibility of the economy rolling over into a second recession. He goes on to say

Wall Street seems to have no concept at all that every bit of growth we’ve observed over the past year can be traced to government deficit spending, with zero private sector expansion when those deficits are factored out. As I noted last week, if one removes the impact of deficit spending, "the economy has recovered to the point where the year-over-year growth rate since early 2009 now matches the worst performance of any of the 50 years preceding the recent downturn." In effect, Wall Street’s is seeing "legs" where the economy is in fact walking on nothing but crutches.

Hussman concludes that “For all intents and purposes, unless the credit spreads, the S&P 500, or the yield curve [change direction], a further decline in the Purchasing Managers Index to 54 or below would be sufficient to confirm a ‘double-dip’ recession."

David Rosenberg, chief economist at Gluskin Sheff, agrees, arguing that only once since 1987 has the ECRI Index failed to signal a recession: “[the decline in the index] accurately signaled a recession in the lead-up to all of the past seven downturns … Right now the choice is really either a 2002-style growth relapse or an outright double-dip recession — pick your poison … If memory serves us correctly, the S&P 500 went on to … make new lows before [that] year was out.” In 2002, the S&P 500 declined from 1150 to 880, a decline in the stock market approaching 25 percent.

Chartered Financial Analyst Rom Badilla in his client newsletter said that the ECRI’s index has been steadily declining since the end of April, losing more than 6 percent in the past twelve weeks, “which is the largest decline in the weeks prior to all [previous economic downturns].” Even Rasmussen has been tracking the decline through its daily Consumer and Investor Indexes, both of which are showing falling numbers. Their Consumer Index, which measures the economic confidence of consumers,” fell to its lowest level since April 11th … and is just five points shy of the lowest level recorded so far this year.” Their Investor Index, a measure of the economic confidence of investors, has also declined to the lowest level since March 19th, and is just three points above the lowest level recorded so far this year.

With the combination of the Dow Theory signaling in May "a major crash" ahead, the national debt reaching a "tipping point" in June, and ECRI reporting its highly reliable index pointing downward, only the cheerleaders on the Potomac, in the mainstream media, and at the Federal Reserve, are continuing to claim the economy is on the mend.

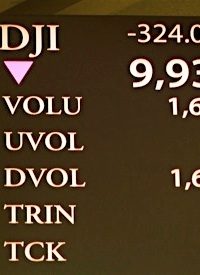

Photo: A scoreboard at the New York Stock Exchange shows the closing Dow Jones industrial average numbers at the end of the day, June 4, 2010, in New York. The Dow dropped 323 points, its third worst slide of the year: AP Images