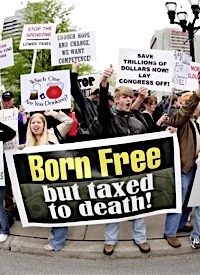

April 15th is the day when American taxpayers must file their income tax returns, and Tea Partiers are protesting those taxes all across the country. One question not being raised is: If these citizens are sovereign over their government, who can explain the income tax? How did this happen? Are the citizens not sovereign after all?

When Thomas Jefferson wrote the Declaration of Independence, he clearly relied on the thinking of his mentors, especially including John Locke. According to Jim Powell, writing for The Freeman, Locke “expressed the radical view [at the time] that government was morally obligated to serve people, namely by protecting life, liberty, and property. He explained the principle of checks and balances to limit government power. He favored representative government and a rule of law.”

Locke published two treatises on government in 1689 in which he said:

Reason…teaches all Mankind… that being all equal and independent, no one ought to harm another in his Life, Health, Liberty, or Possessions…

Every Man has a Property in his own Person. This nobody has any right to but himself. The Labour of his body, and the Work of his Hands, we may say, are properly his. The great and chief end therefore, of Men uniting into Commonwealths, and putting themselves under Government, is the Preservation of their Property….

[Government] can never have a power to take themselves the whole or any part of the subjects’ property, without their own consent. For this would be in effect to leave them no property at all…[rulers] must not raise taxes on the property of the people, without the consent of the people, given by themselves, or their deputies….

Wherever the power that is put in any hands for the government of the people…is applied to other ends, and made use of to impoverish, harass, or subdue them to the arbitrary and irregular commands of those who have it: There it presently becomes Tyranny, whether those that thus use it are one or many.

[end indent]

And so that is the background for one of the most famous and stirring of all statements of the proper role of government in all of human history, Jefferson’s penning of the Declaration of Independence:

We hold these truths to be self-evident, that all Men are created equal, that they are endowed by their Creator with certain unalienable rights, that among these are Life, Liberty, and the Pursuit of Happiness.

There are some who claim that the “inversion of sovereignty” took place in 1913 with the passage of the 16th Amendment, whereby “The Congress [was given the] power to lay and collect taxes on incomes, from whatever source derived…” Jacob Hornberger, writing for The Future of Freedom Foundation, said that “Prior to the enactment of the income tax, the relationship between the citizen and the government was one of master and servant. The citizen, who was free to accumulate unlimited amounts of wealth, was sovereign because there was nothing the government could do to interfere with that process. The government was the servant.” But with the enactment of the 16th Amendment, Hornberger claims that “the nature of that relationship fundamentally changed…With the enactment of the income tax, the citizen became the servant and the federal government became his master [because] the income tax effectively nationalized people’s income…By having that power, the amount of income that the government permits people to keep effectively becomes akin to an allowance that a parent permits his children to have.”

When Pastor Chuck Baldwin was the presidential nominee for the Constitution Party in 2008, he was the featured speaker at the 50th Anniversary Celebration of The John Birch Society. In his address, Baldwin said a Baldwin presidency would work to “dismantle the Internal Revenue Service and the Federal Reserve System and to repeal the 16th Amendment.”

And when the CEO of the John Birch Society, Art Thompson, was interviewed for The New American magazine a year ago, he was asked “What is your take on the income tax?” Thompson responded, “Our Founding Fathers wrote the Constitution so that the federal government could not impose direct taxes — like the income tax — on the people. Nevertheless, a federal income tax was imposed for the first time during the Civil War and attempted again later on, but each time [it] was declared unconstitutional. This all changed with the adoption of the 16th Amendment, which made legal, if not legitimate, the heavy progressive income tax America is saddled with today… If we want to fix our economy, then we need to end the income tax.”

Article 1, Section 8, Clauses 1, 3, and 4 are relevant: “The Congress shall have power to lay and collect taxes, duties, imposts and excises…but all duties, imposts and excises shall be uniform through the United States…” “Direct taxes shall be apportioned among the several states…” “No capitation, or other direct, tax shall be laid…”

This was the design called federalism whereby the sovereign citizens and sovereign states bequeathed cautiously and deliberately extremely limited powers to the central government, including the power to tax. That power was only to be levied on the states proportionately, and not on the citizens directly. The founders had no intention whatever of allowing the central government to tax individual citizens directly.

This power to tax is one of the severely limited powers granted to the federal government by the states in Article 1. That grant was based squarely on the concept of divided sovereignty. Thomas DiLorenzo, in his book Lincoln Unmasked, explains: “The citizens of the states were to have an equal voice in constitutional matters.” The concept is more popularly known as federalism, or states’ rights. Johns Hopkins University professor Gottfried Dietz put it this way: “Federalism, instituted to enable the federal government to check oppressions by the government of the states, and vice versa, appears to be a supreme principle of the Constitution.” Before the Civil War, Dietz wrote, “The nature of American federalism was still a subject of debate. The outcome of the Civil War ended that debate. The Nationalists emerged as victors.”

John C. Calhoun put it this way: “At first they [the strict constructionists] might command some respect, and do something to stay the encroachment, but they would, in the progress of the contest, be regarded as mere abstractionists … [indulging] in the folly of supposing that the party in possession of the ballot box … could be successfully resisted by an appeal to reason, truth, justice, or the obligations imposed by the constitution … the end of the contest would be the subversion of the constitution.”

It is useful, therefore, to discover that early attempts to impose an income tax on the sovereign citizens failed. To pay for the War of 1812, during which the federal government had incurred a staggering $100 million of debt, excise taxes were imposed on goods and commodities, and taxes levied on housing, slaves and land. When the war ended in 1816, those taxes were repealed after the debt was paid, and any notion of an income tax was successfully rebuffed. Tariffs were used to fund the North’s attempt to prevent the secession of the Confederacy, but were insufficient to meet the huge and increasing costs of the war. In March, 1862, Congress passed an income tax which President Lincoln signed into law in July. This tax was enforced through the concept of “withholding” and was applied to interest and dividends as well as incomes. The level of taxation was increased in 1863 and again in 1864 and, for the first time, taxpayers had to vouch for the accuracy and veracity of their tax returns. After the conclusion of the war, the progressive nature of the income tax was replaced by a flat tax. That law expired in 1870 but was replaced with another tax which then finally expired in 1872.

Even though the country was without an income tax for the next two decades (during which the economy grew enormously), in the 20 years between 1874 and 1894 sixty-eight bills to re-establish an income tax were introduced in Congress.

The Panic of 1893 led to the creation of an income tax which was ruled, in 1895, unconstitutional on the basis that the tax amounted to a direct tax, prohibited by the Constitution.

The Democrat Party endorsed an income tax in its party platforms in 1896 and again in 1908. Progressive Theodore Roosevelt endorsed both an income tax and an inheritance tax and in 1909 an income tax amendment was passed by the Congress and sent to the states for ratification. Delaware was the 36th state to ratify the 16th Amendment which became effective on February 13th, 1913. What the 16th Amendment did was to allow the direct taxation of the citizens, thus “working around” the limitations placed initially on that power by the founders.

Frank Chodorov was a strong critic of the income tax, saying “Whichever way you turn this amendment, you come up with the fact that it gives the government a prior lien on all the property produced by its subjects…[the United States government] unashamedly proclaims the doctrine of collectivized wealth. That which it does not take is a concession [to the taxpayer].”

The question remains: When did the citizens of the United States lose their sovereignty? Was it in 1913, with the passage of the 16th Amendment? Or were the seeds sown with the end of federalism after the Civil War? History shows that the gradual wearing down of the limits on the central government, enhanced from time to time by emergencies, panics and wars, and by the lack of understanding of those limits by students attending government schools, all have contributed to the loss of sovereignty. The upcoming elections will be a reflection of the ability of the citizens to understand what they have lost, and to attempt to regain and recover their precious sovereign rights once again.

Photo: People take part in a tax day protest in Nashville, Tenn., Wednesday, April 15, 2009.: AP Images