President Donald Trump’s proposed budget has generated hysteria among the American left. Prominent progressives have accused the president and his allies of wanting to kill children, senior citizens, and other vulnerable Americans. The reaction of the president’s allies — including some conservatives who should know better — is equally detached from reality as they hail Trump for launching a major assault on the welfare state and making the hard choices necessary to balance the budget.

President Trump’s budget does eliminate some unnecessary and unconstitutional programs such as the Overseas Private Investment Corporation, and the National Endowment for the Arts. However, it largely leaves the welfare-warfare state intact. In fact, this so-called “radical” budget does not even cut domestic spending! Instead, it plays the old DC game of reducing “the projected rate of growth.” For example, under Trump’s budget, Medicaid spending increases from $378 billion this year to $525 billion in 2027. Only in the bizzaro world of Washington, DC can a 38 percent increase be considered a cut.

President Trump’s budget combines phony cuts in domestic spending with real increases in military spending. Specifically, the budget increases the military budget by $23 billion over the next ten years. Trump claims that the increase is necessary to reverse the damage done to our military by sequestration. But, despite the claims of the military-industrial complex and its defenders in Congress, on K Street, and in the media, military spending has increased over the past several years, especially when the “off-budget” Overseas Contingency Operations funding is added to the “official” budget.

The restrained American Frist policy promoted by candidate Trump does not require a large and expansive military that literally spans the globe. This budget is the latest indication that President Trump is embracing the neocon foreign policy that candidate Trump correctly denounced.

The budget also relies on rosy scenario economic projections of three percent growth without even a mild economic recession to justify the claim that the federal budget will achieve balance in a decade. This claim bears little or no resemblance to reality.

It certainly is true that some of Trump’s proposed tax and regulatory reforms can increase economic growth. However, the benefits of these pro-liberty policies will not offset the continued drag on the economy caused by the continued growth of federal spending, and the resulting monetization of debt by the Federal Reserve. Far from bringing about endless prosperity, Trump’s big-spending budget increases the odds that Americans will face a Greece-style crisis in the next few years, while the Federal Reserve’s inflation tax evaporates the benefits of any tax reductions passed as part of tax reform.

Some of President Trump’s apologists claim his proposed $1 trillion infrastructure spending plan will help create jobs and grow the economy. But government spending programs do not create real wealth; they only redistribute resources from the private sector to the (much more inefficient) government sector. Therefore, any short-term gains from these programs are illusionary and outweighed by the long-term damage the expansion of government inflicts on the economy. Trump’s proposed new parental leave mandate will also hurt the economy, as well as the job prospects of the new entitlement’s supposed beneficiaries.

Far from presenting a radial challenge to the status quo, President Trump’s budget grows the welfare-warfare state, albeit with more emphasis on the warfare. This budget is thus more evidence that, for a pro-liberty political revolution to succeed, it must be preceded by an intellectual revolution that reignites the people’s desire and demand for liberty.

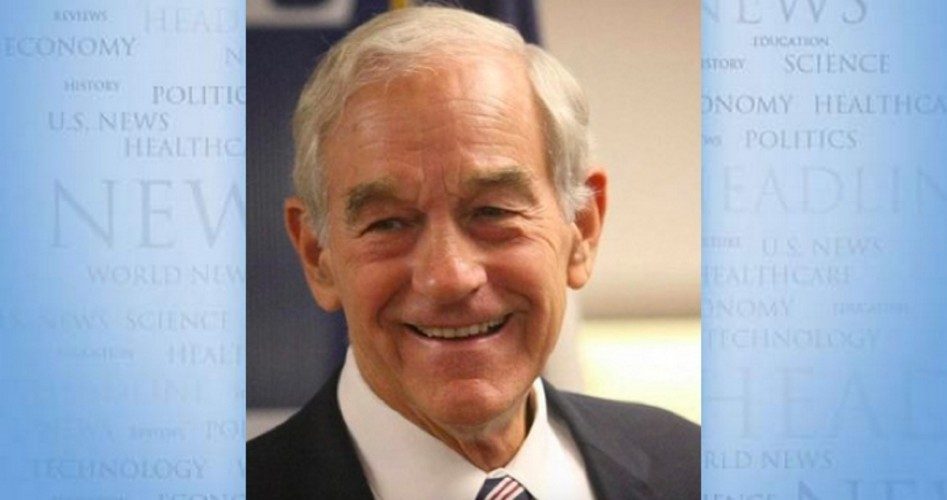

Ron Paul is a former U.S. congressman from Texas. This article originally appeared at the Ron Paul Institute for Peace and Prosperity and is reprinted here with permission.