“Why so much fighting about economics?,” asked a friend recently. “Economics is just logic.”

Well, not exactly. The basics are logical, as in reasonable or to be expected. But things get very tricky and political when it comes to applications.

With the basics, for instance, drops in supply can be expected to raise prices. A freeze in Florida’s orange groves will generally reduce supplies and hike prices.

And decreases in demand can be expected to drop prices. Christmas cards are cheap on December 26.

But get past the basics and things get a lot more arguable — and less logical.

In the current fight about taxes, spending, and “fairness,” there are no clear answers in an Introduction to Economics book about what’s “fair.”

Some might say it’s not “fair” that the Obama administration defines “rich” as someone making $250,000 in Manhattan and $250,000 in Bonaparte, Iowa.

President Obama regularly admonishes “the rich” for not paying their “fair share” of taxes.

Peter Schiff, American investment broker, author, financial commentator, and CEO and chief global strategist of Euro Pacific Capital, holds a different view.

“After the tax hikes go into effect, more than half of my total income is going to the government,” said Schiff recently. “Now you tell me, what’s ‘fair’ about that? I don’t care what the majority voted to do. They don’t have a right to steal our money just because they voted for it.”

Schiff characterizes the November election as an “auction on the sale of stolen goods.”

Obama doesn’t see it as theft via the ballot. “There are a lot of wealthy, successful Americans,” he says, “who agree with me because they want to give something back.”

Conversely, there are “a lot of wealthy, successful Americans” who think they already give back more than their “fair share.”

Internal Revenue Service data for 2010, as reported by the Tax Foundation, show America’s top 1 percent of income earners receiving 18.9 percent of the nation’s adjusted gross income and paying 37.4 percent of all federal income taxes — about double their share of total income.

Similarly, the top 5 percent of income earners received 33.8 percent of the nation’s adjusted gross income in 2010 and paid well over half the total federal income tax bill — 59.1 percent.

Both groups might argue, contrary to Mr. Obama’s censure, that they already “give something back.”

In the same way, the top 10 percent of America’s income earners received 45.2 percent of the nation’s adjusted gross income in 2010 and paid 70.6 percent of all federal income taxes.

In all, the top half of income earners in the U.S. in 2010 received 88.3 percent of all income and paid 97.6 percent of all federal income taxes, while the bottom half of earners received 11.7 percent of total income and paid 2.4 percent of total federal income taxes.

Regarding percentages of income paid in taxes, Internal Revenue Service data for 2010 show the top 1 percent of income earners paying an average federal income tax rate of 23.4 percent, about double the 11.8 percent average federal income tax collected in 2010 on all income from all taxpayers.

The 23.4 percent tax rate doesn’t count income taxes at the state level – 11 percent in Oregon and Hawaii on incomes over $250,000 and $200,000, respectively, 10.5 percent on high incomes in California, etc.

So, what’s “fair?” What’s “fair” about sticking the next generation with $16 trillion in debt, and adding $1 trillion in red ink a year? What’s “fair” about means-testing Social Security when that wasn’t the deal?

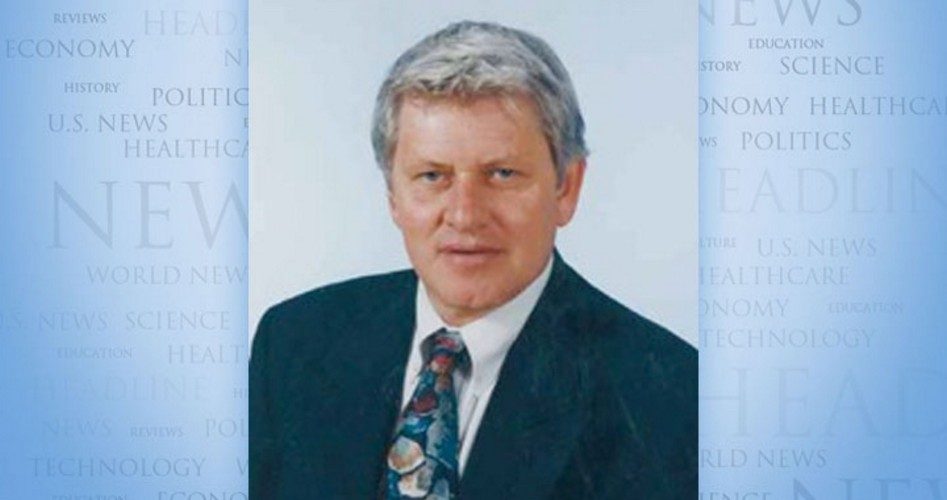

Ralph R. Reiland is an associate professor of economics and the B. Kenneth Simon professor of free enterprise at Robert Morris University in Pittsburgh.