Shutting down the Department of Education and returning control of the education dollar to the American people is the key to improving education. The best way to put the people in charge of education is by shutting down all unconstitutional bureaucracies, repealing the Sixteenth Amendment, and ending the Federal Reserve’s money monopoly.

Since Congress is unlikely to restore constitutional, limited government in the near future, supporters of quality education must advance policies aimed at giving Americans control over the education dollar so they can seek alternatives to the federally-controlled system. This is why I have always supported education tax credits and deductions.

When I was in Congress, I introduced legislation providing tax credits for contributions to education scholarship funds. These funds provide K-12 scholarships to low-income-family students whose parents cannot afford private schools. These scholarship funds allow these children to escape government schools that have been ruined by federal “reforms” like No Child Left Behind and Common Core, as well as mandates such as the ones dictating what can be served in school cafeterias.

Including education scholarship tax credits in the tax reform bill currently before Congress would be a major step toward creating a free market in education. In a free market, parents could select the type of education that best suits the unique needs of their children, instead of the demands of politicians and bureaucrats. Schools could compete on the basis of academics, extracurricular activities, and even lunch menus. Those with unique and innovative education ideas would be free to establish schools and prove their models’ superiority.

Moving to a free-market education system would increase the amount of money spent on educating children. This is because in a free market resources would not be siphoned away from the classroom to support a bloated federal bureaucracy and schools would not be force to waste valuable resources proving they are complying with federal regulations.

By increasing competition, education scholarship tax credits encourage government-run schools to improve. The threat of losing more students may even cause local school boards and state boards of education to resist federal mandates. Thus, education scholarship tax credits can improve the education of all children.

Some libertarians oppose education scholarship tax credits on the grounds that they are a form of government “subsidy.” Since education tax credits allow people to use their own money to support education, this claim only makes sense if one believes that all income is owned by the government, so any income not taxed away is a gift from government. This is a strange position for a libertarian to take!

Other critics say that tax breaks for education (or any other item) distort the market. They also claim that these tax breaks cause income taxes to be higher than they would be without these credits. These critics may have a point, but the answer is to force Congress to cut spending and reduce or eliminate all taxes, not to take away existing tax breaks.

Almost all Americans agree that education should be generously funded. The only question is who should control the education dollar — the federal government or the people. Anyone looking for the answer need only consider how American education has declined as the federal government’s role has increased. Education scholarship tax credits are an important step toward restoring control of education to the American people and providing a quality education to children from low-income families. Congress should help American children and include education scholarship tax credits in the tax reform bill.

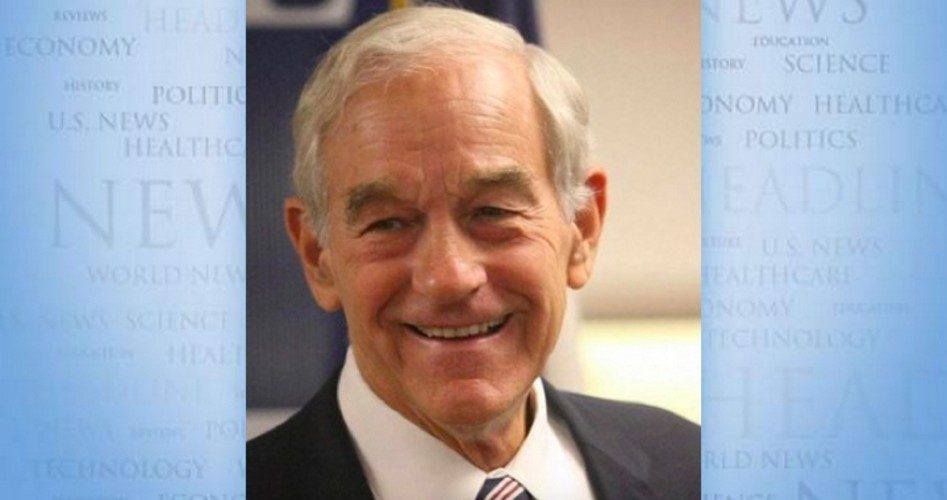

Ron Paul is a former U.S. congressman from Texas. This article originally appeared at the Ron Paul Institute for Peace and Prosperity and is reprinted here with permission.