“It’s kind of a Peter Pan thing. I want to stay a kid. But I guess you have to grow up someday. Everybody does.” — Kodi Smit-McPhee

One would think the comments by the X-Men: Apocalypse star would ring true for an economy still being force-fed a diet of easy money and low interest rates nearly 10 years after the Federal Reserve began its historic onslaught of loose monetary policy. Alas, despite the long, tepid economic recovery, interest rates are still hovering near historic lows, with the Fed literally caught in a trap of its own devises.

If the Federal Reserve Bank — the central bank charged with managing the U.S. economy — cannot effectively do the job, why does it still exist?

The Federal Reserve’s Stated Purposes

The Fed details its four key objectives on its website:

• Conducting the nation’s monetary policy by influencing money and credit conditions in the economy in pursuit of full employment and stable prices.

• Supervising and regulating banks and other important financial institutions to ensure the safety and soundness of the nation’s banking and financial system and to protect the credit rights of consumers.

• Maintaining the stability of the financial system and containing systemic risk that may arise in financial markets.

• Providing certain financial services to the U.S. government, U.S. financial institutions, and foreign official institutions, and playing a major role in operating and overseeing the nation’s payments systems.

The first and third bullet points are the macroeconomic elements of the Fed’s stated objectives. Although it has a number of tools at its disposal to influence the economy, the most common methods utilized are injecting liquidity and lowering interest rates. The Fed deployed both in historic fashion over the past decade in a largely-futile effort to combat the slowing economy and subsequent economic downturn.

The Constitutionality of the Fed

The U.S. Constitution is specific regarding the powers vested to the federal government. Per Investopedia:

Article I, Section 8 of the U.S. Constitution lists most of what are commonly referred to as the Enumerated Powers of Congress. Among them are the power to borrow money on behalf of the United States and the power to coin money, establish currency and determine its value. Critics of the Federal Reserve point out that the Constitution makes no reference to a centralized bank to carry out these actions. The 10th Amendment also states the federal government is only to have those powers expressly granted to it. Therefore, it is argued the creation of the Federal Reserve itself was a violation of the Constitution.

Others believe the Federal Reserve has been previously affirmed as constitutional. They cite Osborn v. Bank of the United States, in which the Supreme Court ruled the Second Bank of the United States (the central bank of the time) provides necessary support in the power to tax, borrow money and regulating trade, along with Nixon v. Individual Head of St. Joseph Mortgage Company, in which the Supreme Court upheld Federal Reserve notes as legal tender.

The “Peter Pan” Economy

Putting aside the debate over its constitutionality, there is little question that the Fed has failed to achieved its stated objectives.

The official unemployment (U3) rate in the United States is currently 4.7 percent, but the calculation leaves out a large swath of people who desire employment but are no longer actively looking for work. If U6 unemployment is considered — which includes discouraged and marginally attached workers along with part-time workers who cannot find full-time employment — the unemployment rate is actually 9.7 percent.

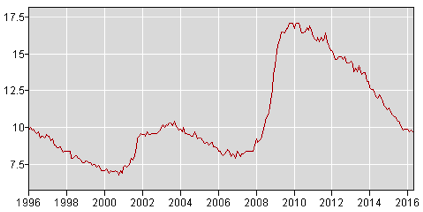

U6 Unemployment Rate (Source: Bureaus of Labor Statistics)

Although the U6 unemployment rate has declined significantly over the past six years, it is still high by historical standards. Other than during the Great Recession and its lingering aftermath, U6 unemployment has generally hovered between seven and nine percent over the past 20 years. Despite the narratives coming out of Washington D.C. regarding the strength of the labor market, the notion of the economy approaching full employment is pure fantasy.

And yet, the Fed has added trillions to the money supply and driven interest rates to historic lows to generate sub-par employment results. These outcomes don’t even consider the slow-growth economy over the past seven years and the burgeoning national debt.

Michael Contopoulos, Bank of America-Merrill Lynch Global Research’s head of high yield and relative value strategy, called the current situation a “Peter Pan” economy:

A Peter Pan economy is an economy that just doesn’t want to grow up. The central bankers of the U.S., Japan and Europe are like three nannies managing the economies. If you think about it, [the central bank’s] job is to spur inflation and growth. It’s to baby the economies forward. It’s just not happening though.

Contopoulos was pessimistic that interest rates would normalize anytime soon.

I think rates could go lower. You have ten trillion of negative yielding assets globally. Treasuries, U.S. investment grade and U.S. high-yield are virtually some of the only assets available right now with a positive yield. Fundamentals are weak.

What Should Be Done?

In the short term, interest rates must be allowed to normalize. Whether or not a deleterious effect impacts GDP growth or employment is of secondary concern, as the training wheels have to come off the economy. The U.S. simply cannot continue to repeat the mistakes Japan made during its “Lost Decade” of the 1990s without facing the prospect of deflation, negative interest rates, an out-of-control national debt, and the prospects of continued slow growth.

The long-term solution is clear. Due to its dubious constitutionality, murky accountability, blatant interventionism, and poor economic record over the past 20 years, the Fed should be abolished. Doing so would likely achieve the following objectives:

• The elimination of fiat currency

• Rational government spending

• Long-term global economic stability

• The end of costly and ineffective Keynesian stimuli

• Market-based interest rates

• A return to normal business cycles

The U.S. economy is literally drowning in cash without a life jacket in sight. As P.J. O’Rourke once wrote, “A U.S. dollar is an IOU from the Federal Reserve Bank. It’s a promissory note that doesn’t actually promise anything.”