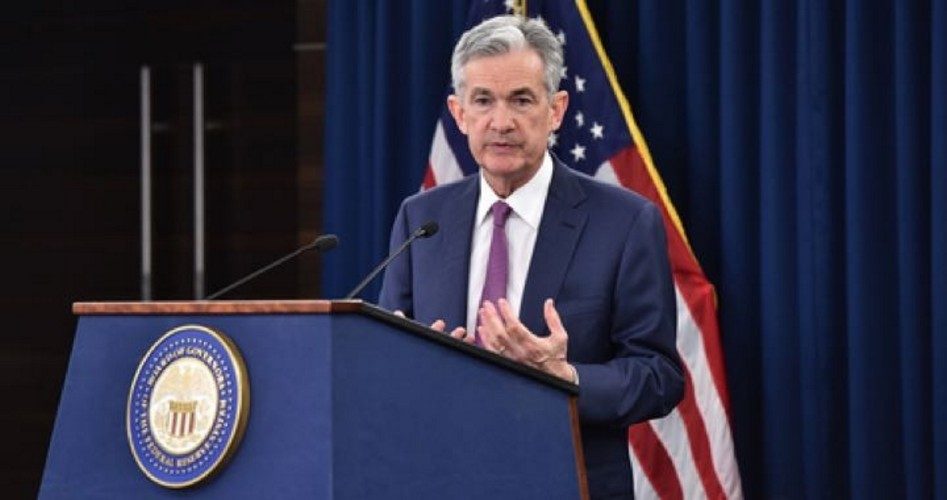

Following the announcement that the Board of Governors decided to raise its inter-bank lending rate — the “overnight” rate that banks are allowed to charge each other for lending them reserves to keep them in compliance with Fed rules — Federal Reserve Chairman Jerome Powell (shown) was, for him, borderline ecstatic:

The main takeaway is that the economy is doing very well. Most people who want to find jobs are finding them, and unemployment and inflation are low….

I think overall we have a really solid economy on our hands here….

The decision [by the Board] you see today is another sign that the U.S. economy is in great shape. Growth is strong. Labor markets are strong. Inflation is close to target.

And then he let the cat out of the bag: He hasn’t the slightest idea of where the economy is likely to be as a result of the Fed’s continued interference by arbitrarily raising interest rates:

As the economy has strengthened and as we’ve gradually raised interest rates, the question comes into view: how much longer will [we] need to be accommodative [with low interest rates] and how will [we] know?

We’ll be guided by incoming data on the economy.

This is like driving an automobile by using the rear-view mirror: There could be bumps, storms, traffic jams, and roadside detritus in front but Powell will never know it until his vehicle runs into them.

It gets worse. According to Fed mantra, the Phillips Curve remains a primary tool to inform Fed policy. It’s a theory of William Phillips, a New Zealand economist not intimately familiar with American free market economics, who developed it back in 1958. It posits the “historical inverse relationship” between the level of unemployment and wages: When unemployment drops, wages employers pay to obtain workers from a shrinking pool of unemployed workers goes up. Or so it should.

But that was in 1958, 60 years ago, long before the Internet, robots, and demands for minimum-wage laws to pay workers $15 an hour, even if they aren’t worth it.

Powell tried to answer his own rhetorical question:

I would emphasize we are learning about the real location of the natural rate of unemployment [in today’s economy] as we go. [Emphasis added.]

We can’t be too attached to these unobservable variables.

Translation: We’re not sure about the future, but we’re learning as we go. Or: We’re not sure exactly where we are headed, but we’re making great progress.

Establishment economist Greg Ip, the Wall Street Journal’s chief economic commentator, tried to help clear up the confusion: Powell’s “unobservable variables” relate to the fact that “the natural rate [of unemployment] can’t be measured, but rather only inferred from how the economy and inflation behave.”

This sounds a lot like Nancy Pelosi’s infamous claim that Congress needed to pass the bill in order to find out what’s in it. Put another way: How would an individual suffering from an unexplained illness feel about undergoing surgery by 1) a surgeon who didn’t know what he was doing; 2) didn’t know what he was looking for; and 3) didn’t know what he was going to do when he found it? Especially when the unexplained illness was just heartburn?

Perhaps that’s why the statement from Powell and his followers in the media use obfuscatory terms such as “overheating” and “inflation creeping higher.” And why it ever seeks to put interest rates in a “neutral” position, while keeping unemployment at its “natural” level, without being able to define those terms. Perhaps that’s why Powell finally owned up the fact that wages aren’t rising as much as they should according to the Phillips Curve estimate: It’s a “bit of a puzzle” said the man in charge of the Federal Reserve’s Board of Governors, the group of worthies tasked with interfering in the economy in order to help it reach full employment without inducing inflation.

Image of Jerome Powell: Screenshot from federalreserve.gov

An Ivy League graduate and former investment advisor, Bob is a regular contributor to The New American magazine and blogs frequently at LightFromTheRight.com, primarily on economics and politics. He can be reached at [email protected].