It does this not just through direct taxation but also through borrowed money that is created out of thin air by the Federal Reserve. The latter approach has become increasingly popular in Washington, since it enables big-spending politicians to spend more money without raising taxes.

But unbeknownst to most Americans, the Fed’s expansion of the money supply is in effect a hidden tax: the injection of more money into the economy diminishes the purchasing power of the dollars already in circulation and causes the price of goods and services to rise in terms of dollars. Put simply, this money expansion is inflation and one of its effects is rising prices — though there is a lag between the time inflation occurs and its effects.

If the government really could jump-start the economy by creating new money and pumping it into the economy, then the path to economic recovery would be simple enough to follow: the government would merely need to create unprecedented amounts of money through the Federal Reserve and then give the money to the American people. After all, there’s no reason why the Fed could not create enough new money to make every American citizen a millionaire or a billionaire many times over. And instead of printing checks and waiting for the Postal Service to deliver them, the federal government could even have the money dropped from airplanes or helicopters in order to get it into the hands of cash-starved Americans as quickly as possible.

Of course, common sense tells us that an inflation of this magnitude would render the dollar worthless. But such common sense is not only lacking in Washington in the advent of the new Obama administration, it has been lacking in that city for a long time. For many years now, the federal government and the Federal Reserve have been operating as if deficits do not matter, and consequently the annual federal shortfalls have exploded in size and this year’s federal deficit is expected to be a trillion dollars.

The Federal Reserve’s newly created money is not just injected into the economy through federal programs. The Fed has also artificially lowered interest rates in order to increase the flow of newly created money into the economy through the banking system. This "easy money" policy has resulted not only in more inflation but also in malinvestments that have resulted in many Americans taking on debt they could not afford. The devastating consequences of these malinvestments include the bursting of the housing bubble.

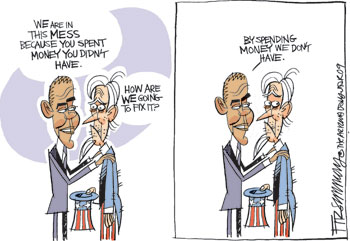

The spending, debt, and money creation have been devastating to the economy, as we have seen. So what does the new administration propose to do to solve the problem? More spending, more debt, and more money creation! For example, the Obama administration successfully lobbied for the release of the second half of the $700 billion TARP (Troubled Asset Relief Program) funding for bailing out major financial institutions. The administration has also championed a $825 billion "stimulus" bill ("trimmed" to $819 billion in the House-passed version), two-thirds of which is for new spending.

When President Barack Obama’s chief economic adviser Lawrence Summers was asked about the economic stimulus plan on NBC’s Meet the Press on January 25, one would think that he would have been forced to explain how the government spending money it does not have would contribute to economic recovery. Instead, moderator David Gregory asked Summers: "Why a stimulus plan that’s only $825 billion?" — indicating that newsmen too can lack common sense when it comes to basic economic principles. (Emphasis added.) Summers argued that the plan was not too small by pointing out that "this is the largest stimulus plan in the country’s history" and also by explaining that "it is only one phase of the approach that the president is taking."

That is, the president intends to spend even more money. Summers continued: "The president has made clear that there will be strong action to address the terrible problems in our housing sector, that he will be using additional funds for a substantial financial recovery plan to get the flow of credit going."

Later in the program, Summers was asked if more than the already authorized $700 billion would be needed to bail out the financial institutions. He indicated that the president is "prepared to do what is necessary" and that it’s possible "in the context of trust." But common sense dictates that we should not "trust" Washington to spend our way out of recession, but should instead demand that Washington get out of the way so that the free market can get our economy going again.