“We are ready, and we will act, if the economy does not continue to improve, if we don’t see the kinds of improvements in the labor market that we hope for,” Bernanke told the House Financial Services Committee on July 22, suggesting continued "stimulus." Among the ideas the Fed is considering: telling markets that interest rates will remain close to zero for even longer than projected, lowering the rates it pays to commercial banks with money parked at the Fed, or, as predicted by analysts, continuing to print money to buy everything from municipal bonds to mortgages.

The day before, Bernake told the Senate Banking Committee that economic conditions “are likely to warrant exceptionally low levels of the federal funds rate for an extended period,” but beyond that, the central bank did not have any immediate plans to “support” the economy. However, there are still “options,” he claimed.

“I think we do still have options, but they’re not going to be the conventional options,” he said in response to a question by Senator Richard Shelby, without making the meaning of that clear.

Regarding the prospect of deflation (despite the trillions the Fed has printed recently), Bernanke said he thought it was unlikely, but if it did happen, “we would be very assiduous” in fighting it. Some economists have raised the alarm about deflationary pressures because the velocity of all of the new money remains low — banks are not lending (except to government) and consumers and businesses are not borrowing.

He also said it would take a “significant amount of time” to lower unemployment and regain the more than eight million jobs lost in recent years, predicting that unemployment would remain well above seven percent until at least the end of 2012.

But, Bernanke insisted, it isn’t all the Fed’s fault. The Fed has been trying to “fix” it. In addition to keeping interest rates “very low,” it has “provided monetary policy stimulus through large-scale purchases of longer-term Treasury debt, federal agency debt, and agency mortgage-backed securities,” Bernanke said. That “stimulus” runs into the trillions of dollars — all appropriated by the Fed, not Congress — and used to purchase all sorts of debt and manipulate markets across the board.

The process will likely continue, at least in some respects. “The proceeds from maturing Treasury securities are being reinvested in new issues of Treasury securities with similar maturities,” Bernanke said. He did note that, for now, repayments of agency and mortgage debts were not being “reinvested.” But, also noteworthy is the fact that the Fed provided most of the credit for new mortgages last year — it printed over a trillion dollars to lend to U.S. home buyers. Obviously, it can’t continue forever.

Despite the circumstances, however, Bernanke tried to paint a reasonably rosy picture of the economic situation. The alleged “recovery” is proceeding at a “moderate” pace, he claimed, saying the Fed predicted annual growth of around three percent this year. He also said inflation was below “target” levels.

But Republican Congressman Ron Paul, who correctly predicted all of what has happened during the economic crisis while Bernanke was claiming everything was fine, recently explained that the situation was far worse than the Fed and the government were letting on. Unemployment is actually closer to 22 percent and inflation is around six percent, he said, citing free-market economists tracking the measure.

“There‘s a lot of deception, and the people sense this,” he said during a July 14 Congressional meeting of the Joint Economic Committee, criticizing the use of borrowed and newly printed money to create a false appearance of economic growth.

He explained that the supposed growth in America’s Gross Domestic Product was due to flawed calculation methodology. “You know, if we spend a billion dollars on a missile and we blow it up, that counts as an increase in the GDP,” he explained. “It didn’t give us a house, it didn’t give us healthcare or education — so there’s a big difference.” Including government spending as a measure of GDP has been controversial among some economists, since the state doesn’t actually produce any wealth.

“If you measure the GDP that goes up because of borrowing, inflating, and spending — and look at that with a better perspective — I would say that maybe the real GDP isn’t going up, and maybe that’s why we’re not having real growth,” Paul explained. He also criticized the prevailing mythology that government is somehow exempt from economic laws.

Bernanke has been proven unbelievably wrong — over and over again. Austrian-school economists, like Ron Paul, have been proven right. The Fed’s threats to step into “new areas” and consider new “tools” should be considered a grave concern, since every area the central bank steps into ends up a disaster (except for insiders). The more it expands its operations, the worse off the country and the economy will be.

The banking cartel has painted itself into a corner. Its statements about using even more of the same type of policies that brought the American economy to its knees must be rejected. No amount of Fed “tools” will fix the problem its “tools” created in the first place. The real solution is to abolish the cartel, repeal legal tender laws, and introduce sound money. And with the next crisis possibly just around the corner, the time for a new monetary system is way overdue.

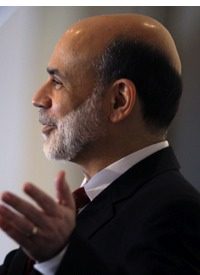

Photo of Federal Reserve Chairman Ben Bernanke: AP Images