The 1978 Humphrey-Hawkins Act requires the Federal Reserve to “promote” stable prices and full employment. Of course, the Fed’s steady erosion of the dollar’s purchasing power has made prices anything but stable, while the boom-and-bust cycle created by the Fed ensures that periods of low unemployment will not last for long. Despite the difficulties the Fed faces fulfilling its “dual mandate,” Federal Reserve Chairman Jerome Powell recently announced a new Fed mandate: to protect the financial system from being destabilized by climate change.

Powell appears to have bought into the propaganda that “the science is settled” regarding the existence, causes, and effects of climate change. But the statement “the science is settled” is itself unscientific. Science is rarely settled as today’s new discoveries disprove yesterday’s consensus. In the case of climate change, many scientists dispute the claim that absent massive expansion of government power a climate apocalypse will soon be at hand.

So far, the Fed’s actions regarding climate change include holding a conference and Chairman Powell indicating the Fed is likely to join the Network for Greening the Financial System. This network is composed in part of central banks from around the world that are attempting to work together to assess the risks of, and plan possible responses to, climate change.

While Powell has not given details regarding other actions the Fed might take to protect the financial system from climate change, there are a number of actions that the Fed could take. For starters, Powell could signal that the Fed would be willing to increase its purchase of government debt if Congress passes Representative Alexandria Ocasio-Cortez’s Green New Deal. The Fed, since its creation, has been monetizing federal debt, and thus enabling the growth of the welfare-warfare state.

The Fed could implement “Green Quantitative Easing” by purchasing bonds of green energy and other companies whose products fit the environmentalist agenda. The Fed could also use its monetary and regulatory authority to “encourage” financial institutions to support “environmentally-friendly” businesses.

Whatever policies the Fed adopts to protect the financial system from climate change, the result will be further erosion of the dollar’s purchasing power, increased government control over the economy, lower economic growth, increased crony capitalism, and a reduction in liberty and prosperity.

Ironically, the Fed’s plans to address climate change will harm the environment. History shows that the most effective way to protect the environment is via a system of private property rights and free markets. Private property owners are better stewards of the environment than are government bureaucrats because private property owners have greater incentives to maintain the value of their property. This is why the greatest pollution in history was in the communist countries of the 20th century.

The Fed’s failure to provide any details on how it will carry out its self-imposed climate change mandate is another reason why Congress must rein in the secretive, rogue central bank. A step in restoring a monetary policy that truly promotes prosperity is to pass the Audit the Fed bill so Congress and the people can at last learn the full truth about the Federal Reserve.

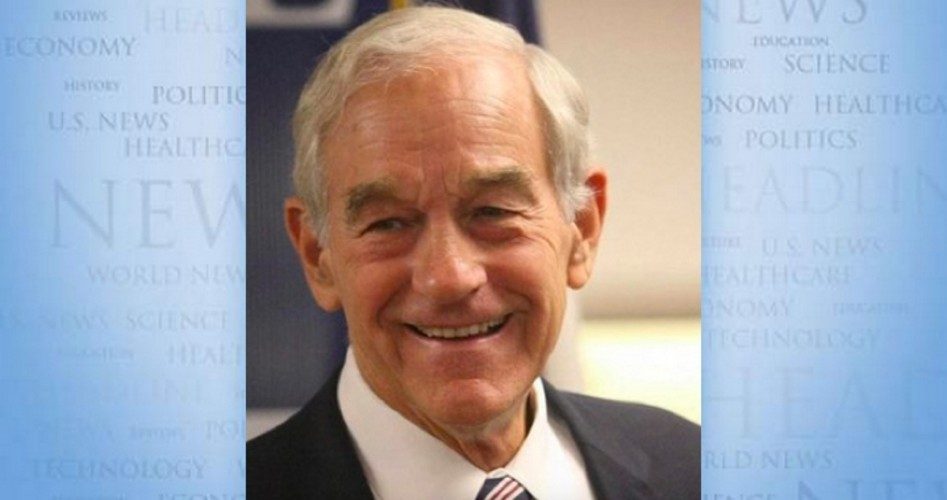

Ron Paul is a former U.S. congressman from Texas. This article originally appeared at the Ron Paul Institute for Peace and Prosperity and is reprinted here with permission.