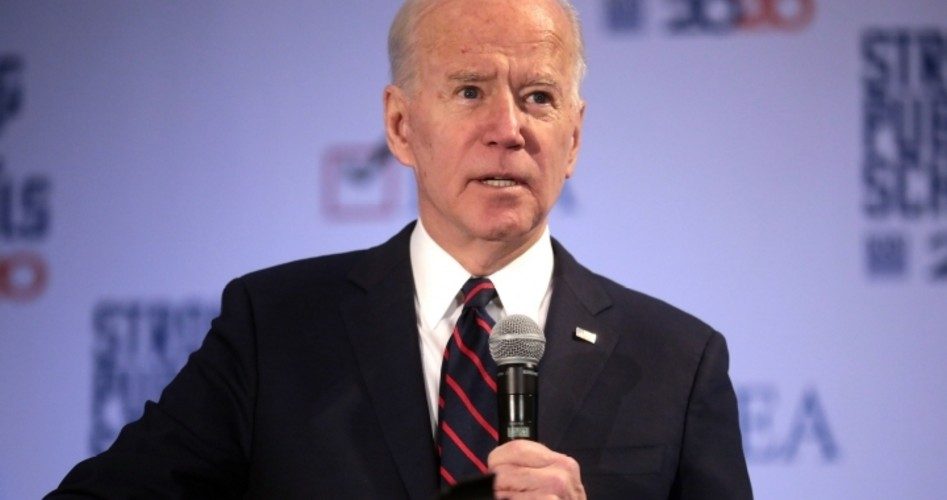

Democrat presidential candidate Joe Biden said it again, and he’ll probably keep saying until November 3: I’m going to raise your taxes.

Biden’s been threatening Americans with a tax hike since he began this third run for the White House, and during a virtual fundraiser on Monday, he vowed again to wage financial war against the American middle class.

If Biden wins and hikes taxes, Americans who can least afford it will get hit at the worst possible time — as the economy emerges from the Chinese Virus Pandemic shutdown.

Tough Luck, Suckers

A Wall Street Journal reporter divulged the remarks, CNBC reported.

“Folks, this is going to be really hard work and Donald Trump has made it much harder to foot the bill,” Biden said, blaming the U.S. budget deficit on the tax cuts. The “irresponsible sugar-high tax cuts had already pushed us into a trillion-dollar deficit,” the gaffe-prone candidate said.

Then Biden loaded and cocked his piece: “I’m going to get rid of the bulk of Trump’s $2 trillion tax cut and a lot of you may not like that but I’m going to close loopholes like capital gains and stepped-up basis.”

Biden also said he would raise the corporate tax rate to 28%, which he said would raise an estimated $1.3 trillion over the next decade. The Trump tax cuts had shrunk corporate taxes to 21% from 35%.

“We have to think as big as the challenge we face. But this is America, there is nothing we cannot do if we do it together,” Biden said. “But I think the country is ready.”

What the Tax Hike Would Do

Of course, Biden and his wealthy family, not least son Hunter — the beneficiary of his father’s influence-peddling in Ukraine — are ready. They can afford it.

Other Americans can’t, as Americans for Tax Reform noted last year when Biden threatened to deep-six the tax cuts for the eighth time.

If Biden and the socialists he will hire to run the country repeal the tax cuts, ATR reported, average Americans, not Biden’s leftist pals who run Big Tech and the major Wall Street investment firms, will get clobbered:

• A family of four earning the median income of $73,000 would see a $2,000 tax increase.

• A single parent (with one child) making $41,000 would see a $1,300 tax increase.

• Millions of low and middle-income households would be stuck paying the Obamacare individual mandate tax.

• Utility bills would go up in all 50 states as a direct result of the corporate income tax increase.

• Small employers will face a tax increase due to the repeal of the 20% deduction for small business income.

• The USA would have the highest corporate income tax rate in the developed world.

• Taxes would rise in every state and every congressional district.

• The Death Tax would ensnare more families and businesses.

• The [Alternative Minimum Tax] would snap back to hit millions of households.

• Millions of households would see their child tax credit cut in half.

• Millions of households would see their standard deduction cut in half, adding to their tax complexity as they are forced to itemize their deductions and deal with the shoebox full of receipts on top of the refrigerator.

The Big Lie About the Cuts

Part of Biden’s appeal has been the lie, also peddled by most Democrats, that the tax cuts mostly benefited the rich.

Senator Kamala Harris — the leading contender to be Biden’s running mate — put it this way during her ill-fated run: “On day one, we gonna repeal that tax bill that benefited the top one percent and the biggest corporations in this country.”

The Washington Post’s fact-checker, Glenn Kessler, dismantled the one-percent lie in May 2019.

“Any broad-based tax cut is going to mostly benefit the wealthy because they already pay a large share of income taxes,” he observed:

According to Treasury Department data, the top 20 percent of income earners paid 95.2 percent of individual income taxes in 2017. The top 10 percent paid 81 percent. The top 0.1 percent paid an astonishing 24.1 percent of taxes….

If the wealthy end up with more money because they pay more in taxes, that’s not necessarily a fair way to look at tax legislation. The top 1 percent in 2014 earned 20 percent of adjusted gross income and paid nearly 40 percent of federal taxes, according to the Tax Foundation. The Tax Policy Center estimates that in 2018, the top 1 percent would get 20.5 percent of the tax cuts.

Meanwhile, citing data from H&R Block for 2018, Kessler reported that middle-income taxpayers enjoyed a 25-percent decrease in tax liability, about $1,200. “Tax refunds were mostly flat, however, as the Internal Revenue Service changed the withholding tables so people would see more in their paychecks,” he reported. “So that worked out to about $25 extra every week — or $3.50 a day — starting in March.”

Image: Gage Skidmore/Wikimedia Commons

R. Cort Kirkwood is a long-time contributor to The New American and a former newspaper editor.