There can be little doubt that governmental shutdowns of businesses, clinics, schools, etc., in reaction to the COVID-19 pandemic has drastically changed the financial situation of tens of millions of Americans this year. While these shutdowns have been devastating, they, along with poor financial planning, are only part of the reason millions are now living paycheck to paycheck. NPR recently ran an article explaining another, yet perhaps more important, reason why Americans are struggling to make ends meet:

For decades, US wages have failed to keep pace with the rising costs of what many perceive as essential ingredients for a successful American life: good education and health care, a home, and a family. Student loans are a yoke around young people the minute they graduate and keep many parents from retiring. Medical bills can set people back for years…. A home mortgage and utilities can bite off half of a monthly income, especially in big cities.

An unexpected bill like that is what separates millions of Americans from financial disaster. In fact, survey after survey for years has found that most people in the US live paycheck to paycheck.

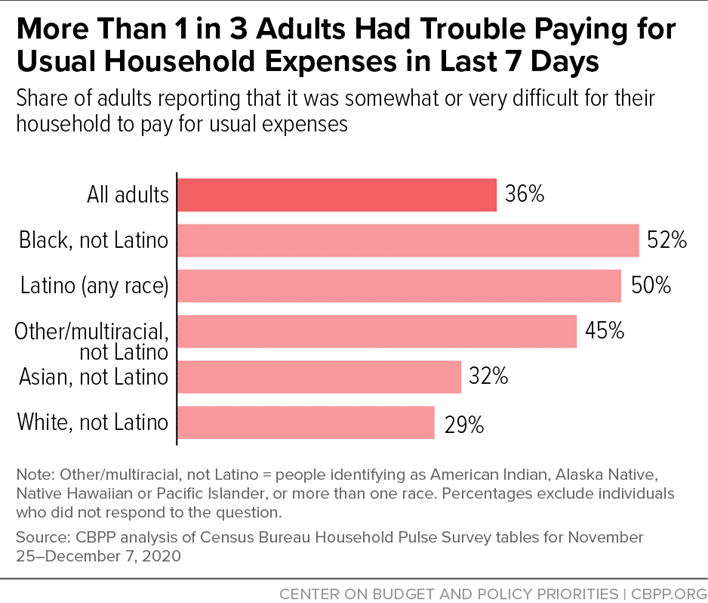

Today, amid the pandemic, a third of US adults say they are having difficulty covering everyday costs such as food, rent, or car payments. While people with the lowest incomes face the biggest challenges, even some households making above $200,000 are straining to pay basic expenses.

For many families, walking the tightrope of financial stress with little to no savings is hardly a pandemic-specific condition. Over a year ago, more than a third of Americans said they could not cover an unexpected $400 home repair or hospital bill without going into debt — or at all.

While NPR hit the nail on the head by stating that “US wages have failed to keep pace with the rising costs,” they failed to mention that the government is essentially covering this fact up. Since 1983, the Bureau of Labor Statistics (BLS) has falsified true inflation under the Consumer Price Index (CPI) as a means to curb the increase in Social Security and federal pension payments. The Chapwood Index, a group of financial experts, explains this fraud:

The change affected more than entitlements. Because increases in corporate salaries and retirement benefits have traditionally been tied to the CPI, the change affected everything. And now, 30 years later, everyone knows the long-term results. Ask anyone who relies on a salary or Social Security or a pension, and he’ll tell you his annual increase in income doesn’t come close to his increase in expenses. What comes in is less than what goes out — a situation that spells disaster for average Americans.

Activist Post posted this graph to show the increased costs of major ticket items in the United States in comparison to the increase in wages:

The BLS is reporting U.S. inflation for November 2020 as 0.2 percent. Chapwood says of its index:

“The myth that the CPI represents the increase in our cost of living is why the Chapwood Index was created. What differentiates it from the CPI is simple, but critically important.”

The Chapwood Index:

– Reports the actual price increase of the 500 items on which most Americans spend their after-tax money.

– No gimmicks, no alterations, no seasonal adjustments, just real prices.

– Shines a spotlight on the inaccuracy of the CPI, which is destroying the economic and emotional fiber of our country.

– Shows how our dependence on the CPI is killing our middle class and why citizens increasingly are depending upon government entitlement programs to bail them out.

– Claims to persuade Americans to become better-educated consumers and to take control of their spending habits and personal finances.

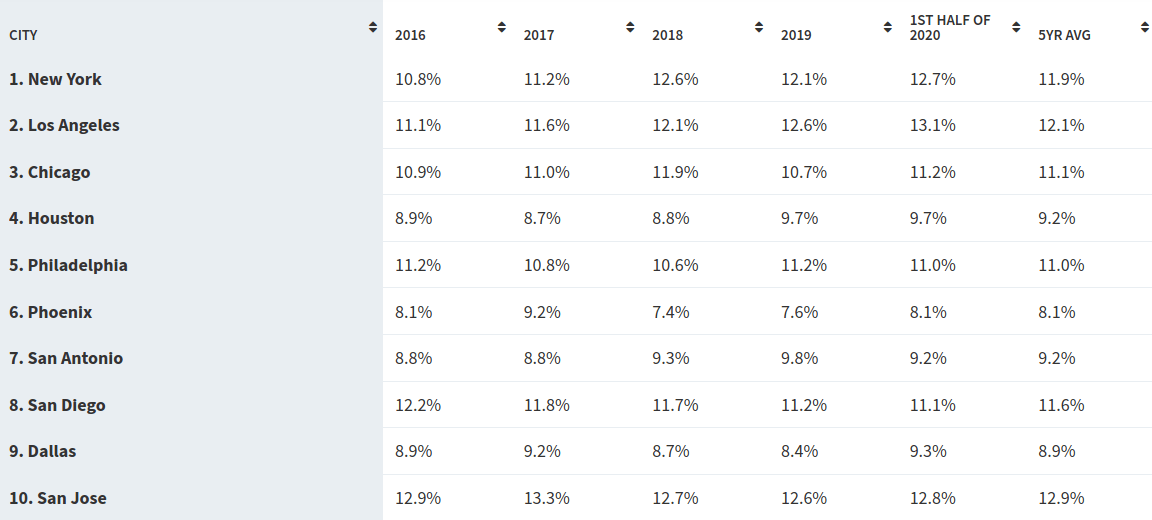

This is the Chapwood cost of living index for the ten top US cities:

So, while the cost of TVs, cellphone services, and toys have fallen, the price of the essential items has significantly outpaced wages, causing a growing crisis in America not seen since the Great Depression.

According to a recent Washington Post article,

The US poverty rate has surged over the past five months, with 7.8 million Americans falling into poverty, the latest indication of how deeply many are struggling after government aid dwindled.

The poverty rate jumped to 11.7 percent in November, up 2.4 percentage points since June, according to new data released Wednesday by researchers at the University of Chicago and the University of Notre Dame.

While overall poverty levels are low by historical standards, the increase in poverty this year has been swift. It is the biggest jump in a single year since the government began tracking poverty 60 years ago.

This spike in poverty has had a corresponding increase in food insecurity across the United States and the globe. According to Feeding America, the nation’s largest domestic hunger-relief organization, “due to the effects of the coronavirus pandemic, more than 50 million people may experience food insecurity in 2020, including a potential 17 million children.”

In addition to the miles-long food lines appearing across the country, another sign our society is heading for trouble is the increase of people stealing food to live. According to the Washington Post:

Shoplifting is up markedly since the pandemic began in the spring and at higher levels than in past economic downturns, according to interviews with more than a dozen retailers, security experts, and police departments across the country. But what’s distinctive about this trend, experts say, is what’s being taken — more staples like bread, pasta, and baby formula.

“We’re seeing an increase in low-impact crimes,” said Jeff Zisner, chief executive of workplace security firm Aegis. “It’s not a whole lot of people going in, grabbing TVs and running out the front door. It’s a very different kind of crime — it’s people stealing consumables and items associated with children and babies.”…

Though shoplifting tends to spike during national crises — it jumped 16 percent after the Sept. 11, 2001, attacks and 34 percent after the 2008 recession, according to the National Association for Shoplifting Prevention, which tracks data from US courts — the current trend line is skewing even higher, according to Read Hayes, a criminologist at the University of Florida and the director of the Loss Prevention Research Council.

Hayes has been tracking theft since the coronavirus began sweeping across the United States in March and has phone calls with the leaders of 60 major retail chains every other week to help them prevent losses. Most reports of retail theft have been anecdotal, he said, and even 10 months into the pandemic, it’s too early to know the full scope.

“We believe there is some increase in people who, because of covid-19, are not able to pay for the items,” Hayes said. “It’s sort of maintained that there may be a slight uptick in need-based stuff, but it’s really difficult to tease that out.”

With the deadline passed for Congress to extend unemployment payments for 12 million unemployed Americans, our economic stability could further teeter on the brink of disaster. Getting one’s financial house in order and preparing for the uncertain times ahead could be the best move you make for yourself and your family.